Industry Focus: LPG sector poised for sustainable fuel transformation

Like virtually all industries, the liquified petroleum gas (LPG) sector was challenged by the COVID-19 pandemic throughout 2020. Healthcare workers relied on propane-fueled heaters as they performed COVID-19 tests on motorists in parking lots. Restaurants relied on propane-fueled patio heaters to keep diners fed and employees working after restrictions on indoor dining compelled them to serve meals outdoors. Millions counted on propane to keep homes comfortable and businesses running.

However, owing to its role as an essential commodity for residential cooking, a dramatic increase in outdoor living, and as a petrochemical feedstock, the LPG industry was less affected by the pandemic than many other energy commodities. As a result, global supply continued its upward trend and demand continued to grow.

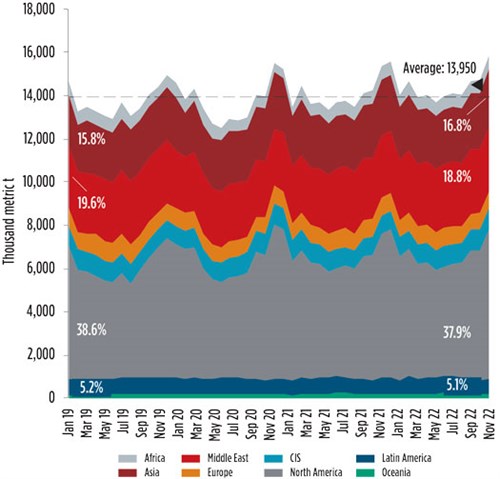

Supply boosts from U.S., Mideast. Estimated global supply in 2019, the latest year of reporting, was 331 metric MMt. The U.S. accounted for nearly 85 metric MMt of LPG production, which represents more than a 10% increase over the previous year (FIG. 1). U.S. total production was more than twice that of its nearest rival, China. LPG production from Canada and Australia also grew in 2019; however, Saudi Arabia saw short-lived declines in output due to attacks on production facilities.

|

|

FIG. 1. Global propane demand by region, 2019–2022. |

Economic and political tensions, such as the ongoing U.S.–China trade war, have provided an opportunity for upswings in production and supply in the Middle East as prime exports to Asian markets.

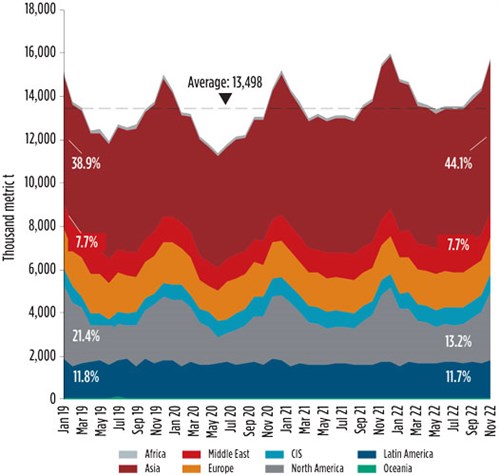

Demand gains in Asia-Pacific. Global demand in 2019 stood at nearly 325 metric MMt, a near-3% increase from the 2018 level. Demand is dominated by the residential sector, accounting for 44%, which is centered around the heating and cooking sectors. The petrochemical sector made up 28% of demand in 2019, followed by industrial (11%), refinery (8%), transportation (8%) and agriculture (1%). Asia-Pacific countries, and especially China and India, accounted for a significant portion of gains in demand, in both the residential and petrochemical market sectors (FIG. 2).

|

|

FIG. 2. Global propane supply by region, 2019–2022. |

In the transportation sector, autogas demand grew by 1% globally in 2019, continuing a decade-long pattern of growth. South Korea, Turkey and Russia remain the largest markets with consumption of 3 metric MMtpy each, but eastern Europe continues to see nominal demand growth as autogas rises in popularity as an economically attractive transport fuel. The Netherlands, Japan and Australia—some of the oldest and most reliable autogas markets—saw declines in demand averaging 10%.

LPG shipping. While 2020 figures are still being collected, 2019 saw a breakthrough in freight rates. Spot rates on the very large gas carrier (VLGC) benchmark Mideast Gulf–Japan route averaged $58/metric t compared with around $30/metric t in the last 3 yr. Time charter rates for the 12-mos period were also higher in all sectors. Amid high freight rates, favorable arbitrage conditions meant that there was some maneuvering room for those lifting from the U.S. Gulf Coast and delivering to Asia-Pacific.

The LPG fleet capacity increased further in 2019 and stood at 35 MMm³ at the end of the year. The semi-refrigerated sector accounted for most of the rise. Around 18 VLGCs entered the fleet in the past 2 yr, following 46 in 2017 and 69 in 2016—an indication that the freight market is rebalancing—as reflected on stronger freight rates. This took the LPG fleet to 1,494 vessels.

The International Maritime Organization (IMO) regulation on bunker fuels went into effect on January 1, 2020, effectively increasing operating costs in the form of higher bunkering costs for low-sulfur fuels. Shipowners were well-prepared for this change, and the impact on freight rates was largely shrugged off.

Climate change considerations. The past 24 mos have provided an opportunity for the LPG industry to review and reposition itself in the present and future role of climate change. Industry-wide efforts to adapt, innovate and engage in mitigation practices have proven positive, both internal to the industry and externally. Innovations like bio-LPG (or renewable propane, as it is known in the U.S.), have kicked off discussions in key markets like Europe and North America.

As a byproduct of renewable diesel and jet fuel production, renewable propane chemical and physical properties are identical to propane produced from traditional sources; however, it is carbon neutral. Additionally, renewable propane producers are eligible for subsidies through California’s Low Carbon Fuel Standard and the U.S.’s federal Environmental Protection Agency (EPA) Renewable Fuel Standard (RFS) program.

Beyond renewable propane, the LPG industry is investing in technology and product development toward a net zero future. This includes research and development efforts in the transportation and industrial engine market sectors, such as advanced spark-ignited engine technology, propane hybrid drive systems and advanced exhaust catalyst systems.

Similarly, LPG projects and products are beginning to play a role in providing resiliency to the electric grid through primary, backup and hybrid systems to support other renewables like solar and wind installations. Distributed power generation, grid-free and microgrid systems powered by LPG are proving highly versatile and sustainable in areas where the electric grid is overtaxed by current demand. These systems not only build in some level of resiliency to the grid, but also serve to improve energy and environmental equity.

Today, much of the developing world does not have access to clean cooking fuel. Black carbon emissions, such as those emitted from the burning of firewood, dung and charcoal, continue to be a major issue for residential air quality in many developing countries. As proposed by the World LPG Association, LPG could save millions of lives and support sustainable transformation of the household sector by becoming the go-to residential cooking fuel source.

Sector outlook. Mid-term LPG market forecasts suggest strong supply and continued growth worldwide. Global LPG production is expected to exceed 370 metric MMtpy by 2030, roughly a 14% increase from 2019 global production. Trade flows will continue to expand; however, they will likely become more complex with continued geopolitical and geoeconomics issues among the key market movers. Significant trade routes, like the Mideast Gulf to Asia-Pacific, U.S. to Asia-Pacific, and U.S. to Europe, are likely to make up a significant portion of global movements in LPG.

Continued demand in traditional residential heating and cooking segments is expected. Market projections suggest 15% growth from 2019–2030, culminating in more than 150 metric MMtpy of global demand. The cooking sector in Asia-Pacific will see the largest gain in incremental LPG demand. Alongside India, growth is forecast in several smaller markets in the region, including Bangladesh, Vietnam and the Philippines.

Continued expansion of the natural gas grid, rising energy efficiency and legislative pushes toward renewables and “carbon-free” sources will continue to impact the North American market. Similar impacts will be felt in northwest Europe and northeast Asia, based on current projections. Demand in South America, however, will continue to grow and be a consistent source for U.S. LPG exports.

Similar demand growth is expected in the global petrochemical market, primarily coming from Asia-Pacific markets, as well. Construction of new propane dehydrogenation plants will see global demand for LPG as a petrochemical feedstock.

Recently published global scenarios include the newest International Energy Agency (IEA) roadmap for the global energy sector.1 Such studies tell much the same story: The focus of government and business leaders must be on those solutions already in hand today, rather than on technology breakthroughs that may not come in time, or that may never come.

As centralized energy systems become more brittle and system upgrades become more expensive, LPG is increasingly seen as a key distributed energy resource made attractive by its wide availability, lower relative cost and small carbon footprint. GP

LITERATURE CITED

- International Energy Agency, “Net zero by 2050: A roadmap for the global energy sector,” May 2021, online: https://www.iea.org/reports/net-zero-by-2050

|

GORDON FELLER has been writing about energy, particularly oil and gas, since his first magazine article was published in 1978, and he has been published in more than 50 industry magazines. He has undertaken numerous research and writing projects for large institutions, including the World Economic Forum, the World Bank, and the governments of Germany, the UAE (Abu Dhabi), Japan and Canada. He has also won more than two dozen competitive fellowships. Mr. Feller graduated with a master’s degree from Columbia University in New York City, New York.

Comments