Regional Focus: North American NGL to boom alongside petrochemicals

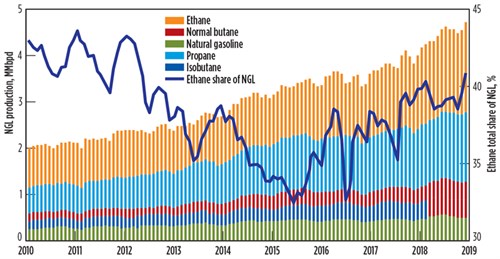

Strong natural gas production and rapidly rising demand from petrochemicals makers have resulted in record-high production of natural gas plant liquids in North America, particularly in the U.S. This growth has been led by ethane. While production of propane, normal butane, isobutane and natural gasoline are closely tied to volumes of raw natural gas processed at gas processing plants, ethane recovery is influenced by both the volume and quality of natural gas processed and by ethane supply/demand fundamentals.

In both the US and Canada, expanding petrochemicals production capacity is correlated with increases in NGL demand over the near term and several decades into the future.

U.S. NGL market movements. Between 2010 and mid-2015, industrial capacity to consume ethane as a feedstock remained fairly static. As a result, even as natural gas production and recovery of propane and butane at natural gas processing plants grew, ethane recovery remained relatively flat. During this period, the ethane share of the NGL barrel decreased from more than 40% to approximately 33%.

However, recent growth in the petrochemical sector’s ability to consume more ethane as a feedstock has caused the U.S. ethane market to expand, and ethane exports have supported additional demand growth. Consequently, ethane production and ethane’s share of the NGL barrel have increased to meet this rising demand.

The U.S. Energy Information Administration (EIA) estimates that domestic demand for ethane expanded by 360,000 bpd in the past 2 yr as a result of new ethylene crackers and expansions of existing facilities. Several new crackers and a major expansion were expected to come online in 2019, representing at least 260,000 bpd of additional ethane demand. In turn, U.S. ethane exports are increasing.

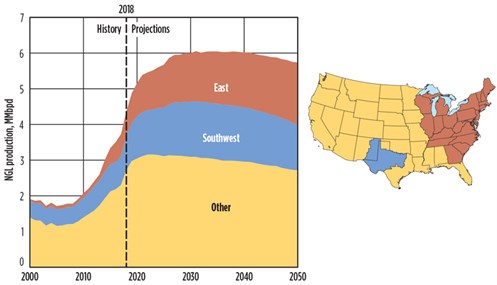

In its 2019 “Annual energy outlook” (AEO 2019), the EIA projects this growth in NGL production to continue as a result of increasing domestic natural gas production and expanding NGL demand.1 The EIA expected NGL production in the U.S. to grow from 2 MMbpd in 2010 to 4.5 MMbpd in 2019 (Fig. 1). Furthermore, the EIA expects NGL production to exceed 6 MMbpd in 2030 in its AEO 2019 reference case—40% higher than the 2018 level—before gradually dropping to 5.75 MMbpd at the end of the projection period in 2050.

|

| Fig. 1. Production of NGL in the U.S., 2010–2019. Source: U.S. EIA. |

Longer-term projections. The U.S. NGL market is set to surpass consumption of 3 MMbpd by 2025, propelled by rapid development in the shale gas industry and low prices for NGL. Increased investment in the domestic petrochemical industry, along with the ongoing expansion of centralized heating systems (particularly across Tier 2 and Tier 3 cities) will augment the NGL market.

Expanding demand for polypropylene, polyethylene and synthetic rubber for manufacturing plastics, tires and other products will propel petrochemical industry growth for NGL demand. Declining costs for space heating, decreasing emissions from the industrial sector, lower electricity costs and reduced reliance on foreign countries for energy imports are among the most instrumental factors driving U.S. NGL market growth.

As a result of this anticipated growth in the petrochemical industry, the EIA expects ethane to contribute significantly to future NGL production growth, with its share of total NGL production increasing from 40% in 2018 to 43% of all NGL produced in 2050. The Eastern U.S., encompassing the Appalachian Basin, is projected to account for the largest share of U.S. NGL output—30% of the national total—and for 35% of all ethane produced in the U.S. in 2050.

In the AEO 2019 reference case, NGL production will grow by 32% between 2018 and 2050 to 5.8 MMbpd. Most of the increase in production is seen in the Eastern U.S., along with the Southwest, specifically the Permian basin. Producers are expected to focus on liquids-rich plays, where NGL-to-gas ratios are highest. Additionally, increased petrochemical feedstock demand will spur higher ethane recovery (Fig. 2).

|

| Fig. 2. Production of NGL in the U.S., 2010–2050. Source: U.S. EIA. |

Canada’s petchem producers to benefit from NGL bump. Canada’s National Energy Board (NEB) expects its total NGL production to level off in the near term as natural gas production slightly declines. However, the volume of NGL per unit of natural gas produced is anticipated to increase as producers target areas rich with NGL, such as the Duvernay shale and Montney tight gas play.

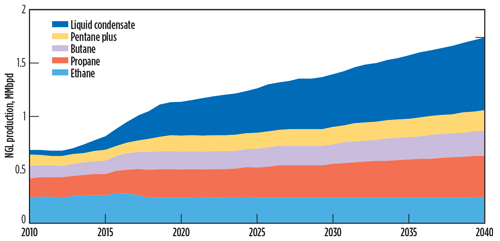

NGL production is expected to steadily increase throughout the NEB’s forecast period to 2040 as natural gas production increases.2 Aggregate NGL production is anticipated to expand by 75% from 2018–2040, to 1.7 MMbpd. Fig. 3 shows NGL production in Canada from 2010–2040 in the NEB’s reference case.

|

|

Fig. 3. NGL production in Canada, 2010–2040. Source: Canada NEB. |

Ethane, the majority of which is extracted at large natural gas processing facilities located along major natural gas pipelines in Alberta and British Columbia, made up 26% (262,000 bpd) of NGL production in 2017. Ethane production in the NEB’s reference case is anticipated to increase slowly over the projection period, to 237,000 bpd in 2040. Ethane recovery is seen increasing alongside expanding petrochemical production capacity in Alberta. The remainder of the ethane is reinjected back into the gas stream and sold as natural gas.

Propane production in the NEB’s reference case follows projections for overall natural gas production. As natural gas output increases, propane production steadily rises, reaching 397,000 bpd by 2040—63% higher than the 2017 level of 244,000 bpd.

Butane production follows a similar pattern to natural gas production. In 2040, it is expected to be 49% higher than in 2017, increasing from 161,000 bpd to 239,000 bpd. Production of pentanes plus is expected to jump by 79% over the forecast period, from 104,000 bpd in 2017 to 186,000 bpd in 2040.

Demand for gas condensate, which is produced at the wellhead, is growing as oilsands production continues to expand. Condensate demand has influenced gas drillers to focus on NGL-rich plays. Condensate production increased by more than 265% from 2013–2017. Of all the natural gas liquids, condensate will see the largest increase in production (205%) over the forecast period, jumping from 226,000 bpd in 2017 to an estimated 689,000 bpd in 2040. GP

Literature cited

- U.S. Energy Information Administration, U.S. Department of Energy, “Annual energy outlook 2019,” January 24, 2019, online: https://www.eia.gov/outlooks/aeo/

- Canada National Energy Board, “Canada’s energy future 2018: An energy market assessment,” October 2018, online: https://www.cer-rec.gc.ca/nrg/ntgrtd/ftr/2018/2018nrgftr-eng.pdf

|

Eugene Khartukov is a Professor of International Relations at Moscow State University in Russia. He is also Head of the Center for Petroleum Business Studies and the World Energy Analyses and Forecasting Group, as well as Vice President of the FSU division of Petro-Logistics. He is the author of more than 330 publications and a speaker at more than 170 international energy and economic conferences. Mr. Khartukov is a post-PhD in economics and earned his PhD, doctor of sciences degree, and professor certification at Moscow State University.

Comments