EWAnalysis: Impact of technology on gas transmission management—Part 2

B. Andrew, Senior Data Analyst

This article is the second in our “Impact of Technology” series; the first was “Impact of technology in gas processing plants—Part 1,” which appeared in the October/November 2018 issue of Gas Processing & LNG. The focus of this article is how technology has impacted the management and optimization of demand and supply of natural gas in transmission networks.

|

|

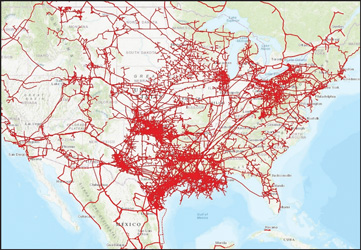

FIG. 4. US gas transmission lines. Map courtesy of Energy Web Atlas. |

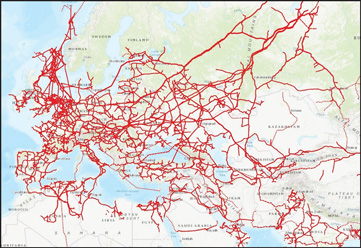

To see how extensively such networks have grown, see Fig. 4 and Fig. 5, which show gas pipeline networks for the US and Europe. The maps are created by the “world pipelines” application within Energy Web Atlas™ at: http://energywebatlas.com/pipelines.html.

|

|

FIG. 5. European gas transmission lines. Map courtesy of Energy Web Atlas. |

Gas compression equipment. Once natural gas has been processed to the dewpoint, impurity and heating value specifications of national transmission networks, gas compressors must ensure that gas supply volumes match the demands of power plants and city distribution networks, each with varying demand profiles.

For many decades, banks of reciprocal compressors were the workhorses at compressor stations. These devices are inherently fixed-volume equipment. Technology improvements in volume delivery include the ability to unload each cylinder from compressing gas, as well as variable speed drivers (typically gas-fired engines).

Centrifugal compressors now dominate large-capacity gas plants with their ability to deliver high flow capacity per unit of installed space and weight and good reliability. They also require significantly less maintenance than reciprocating compressors. With centrifugal compressors, control of capacity is achieved by speed variation, suction throttling or variable inlet guide vanes, while avoiding operation in damaging surge conditions.

Compressor station operation. The advent of SCADA systems that can send signals over hundreds or thousands of miles, plus high-reliability machinery and process control systems, have enabled gas compressor stations to be remotely operated from regional operations centers. However, the basics of load control—bringing on or taking offline gas compressors, changing compressor speed and other control parameters—remain largely the same.

Virtual storage hubs. One significant change is more sophistication in using the pipeline network itself as a “virtual storage hub.” For any demand cycle that peaks at predictable times, smart pipeline operators can operate the lines at different pressures, thereby building up stored volume to the design pressure limit during lower demand periods.

One advantage is enabling the gas processing plant to maintain steady operation, closer to a rate that is optimally energy efficient. A few traditional gas storage caverns are still being built in areas with very cold winters, to store an entire season of peak gas demand.

Pipeline network operations. Many operators work together to supply treated gas feeders into major transmission gas networks. The use of wall-size dashboards to monitor and share the health of all assets, including the status of each gas processing plant and compressor from each operator in the entire network, have been made possible by significant improvements in information technology. This also makes supply more robust by identifying, in real time, any local supply outage and requesting additional supply from another operating plant. A number of companies are offering excellent modeling and simulation offerings, as well as plant and network control systems.

Pipeline condition monitoring. The advent of “smart pigs” has enabled operators to measure the condition of pipe walls and welds without having to dig up lines. Miniaturized storage devices enable gigabytes of data to be captured during the travel of the pig. Cameras with multiple LED lights enable visual inspection for detailed analysis of pipe conditions and lining.

Optical fiber systems allow regular survey of coating and cathodic protection systems, with remote, optically powered amplification enabling inspection of several hundred km from a single location (Fig. 6). Developments of sensor technologies that have crossed over from other parts of the industry, such as downhole drilling, enable a wide variety of measurements to be conducted.

|

|

FIG. 6. The penetration of gas transmission systems in western Europe includes large cross-country transmission lines, with smaller branch lines to municipalities along the way. |

Residential vs. industrial vs. power plant demand. With increased availability of natural gas, use of gas-fired appliances has become an option for builders who have previously built all-electric houses. Direct gas use as heat is fairly predictable, driven principally by weather.

Within factories, the flexibility of electricity vs. steam made electricity the motive source of choice. Plants with fuel gas from feedstock, such as refineries, may still use large steam turbines to drive equipment.

Electrical power plants provide a wider set of choices. Traditionally, base power generation has been provided by coal-fired or nuclear plants, with fast-starting gas-fired power generation used for peak loads only. However, natural gas has the advantage of a lower carbon footprint, and the growth of shale gas has kept gas prices competitive with coal.

Another wrinkle for gas pipeline operators is rapid growth in the use of natural gas to power electricity generation in conjunction with renewables—e.g., during nighttime as a complement to daytime solar power, or when wind is calm to supplement wind turbine-generated power.

Power and gas demand management. The complexity of today’s power generation options has caused state regulators to take a closer look at reliability in a patchwork of vertically integrated operators, public utility commission-enforced extra capacity construction, traditional regulated utilities with the ability to pass on costs, and market-deregulated power generation.

Fortunately, from an operational viewpoint, the management and control systems of experienced gas system operators can keep up with such market fluctuations, although it takes more time to get new pipelines approved. Objections have been raised more frequently than in recent decades, in part due to concerns about the safety of aging pipelines.

From an information systems perspective, the complexity and interconnected nature of electricity and gas systems have also made them a target for cyber hackers. Governments and industries are working across the globe to strengthen their plants, power supplies and networks against cyber intrusion and attack.

Cybersecurity vulnerabilities could occur from hacking any smart device directly connected to a natural gas pipeline management system, particularly those devices with a role in control settings or safety shutdown logic. Advisory-only hacked devices cannot directly cause a shutdown, but they can mislead an operator.

The US Department of Energy and the Department of Homeland Security launched the Pipeline Security Initiative (PSI) to leverage federal government expertise with industry knowledge to address growing threats to the nation’s energy system. This initiative has broad industry support.

“Protecting America’s energy infrastructure from cyber-attacks is a major priority for the natural gas and oil industry, and a common goal that we share with the DHS [Department of Homeland Security], the DOE [Department of Energy] and the TSA [Transportation Security Administration],” said American Petroleum Institute’s Midstream Group Director, Robin Rorick. “Our natural gas and oil pipeline systems have been purpose-built to be highly resilient because the production, gathering, processing, refining, transmission, distribution and storage are flexible, with multiple fail-safes, redundancies, and backups. We applaud the Pipeline Security Initiative, which recognizes that as cyber-threats continue to evolve and become more sophisticated, so too must our energy infrastructure. This is a complicated and continually changing issue, and it will be best managed through a coordinated approach between industry and the federal government.”

Resources—learn more. Readers wishing to learn more in-depth information on any of the aspects discussed in this overview can find it in the magazine articles we publish at Gulf Energy Information, or by networking with industry peers at our annual events. Other recommendations are to sign up to receive publications from GPA Midstream and monitor useful reports of the US Energy Information Association. GP

|

Bob Andrew is Senior Data Analyst in the Data Services Division of Gulf Energy Information, where he coordinates all research into content for the Construction Boxscore Database. He analyzes the quality of major datasets before they are added to Gulf Energy Information’s Energy Web Atlas. He also serves in a downstream and midstream technical advisory role for Gas Processing & LNG, Hydrocarbon Processing, Petroleum Economist and Pipeline and Gas Journal.

Comments