EWAnalysis: Impact of technology on gas processing plants

The gas processing industry has modernized and embraced technology throughout boom and bust cycles. As with refining and petrochemicals, gas processing has migrated from analog control to digital control, and from paper-chart recorders to process historians. Improvements in the ability to view information across a plant have enabled operations staff to achieve better insights into upsets, efficiency and troubleshooting. However, gas processing operations differ in that there is no site storage, except for natural gas liquids (NGL) and condensate. Short-term gas storage options include packing transmission pipeline or recoverable injection underground. The compounds in NGL are increasingly sought after as higher-value petrochemical feedstock. In real time, the gas plant and its associated compressor stations must respond promptly to demand for more, or less, treated gas from the gas transmission network, or respond to supply disruptions from gathering field well sources. Advances in telecommunications, networks, sensors and wireless technology have enabled gas plant operations to receive earlier warning of imminent disruptions from the gathering systems. How supply and demand are best managed and optimized is the topic of this column.

|

|

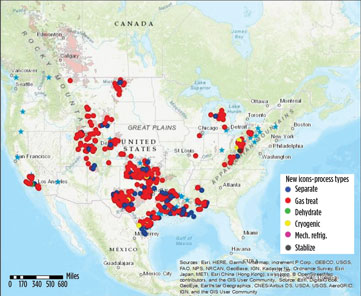

FIG. 1. The US natural gas transmission network has grown to include more states in the continental US, with more plants planned. |

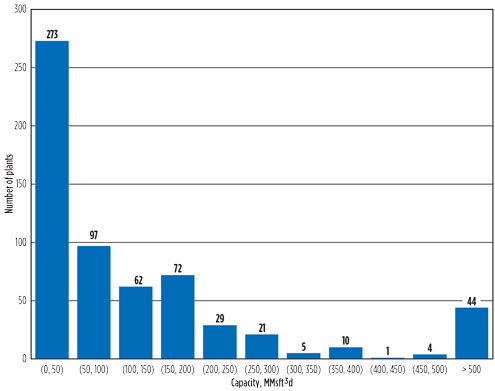

The natural gas transmission network has grown to include many more states in the continental US, with more planned (Fig. 1). States that used to only have truck-delivered LPG or fuel oil as fossil energy options have seen natural gas distribution networks developed. Data from Energy Web Atlas is used to show the number of plants per state (Fig. 2) and the range of gas processing capacities (Fig. 3). Energy Web Atlas is a web-based map application focused on visualizing energy data.

|

|

FIG. 2. Numbers of gas processing plants by US state. |

|

|

FIG. 3. US gas plant capacity, as of 2017. |

Treatment technology. The minimal treatment requirements are set by gas transmission system requirements: treatment must bring gas below the dewpoint to avoid condensation of water or hydrocarbons, and to meet the heating value. At the consumer level in the US, natural gas is lean—almost entirely methane. Some smaller gas plants do produce a richer gas, but this does not reach residential customers. In addition, acid gases, like carbon dioxide (CO2) and sulfur compounds, should be removed for corrosion and safety reasons. Earlier technologies used solid absorbents, but these do not scale up well and have problems with contaminated solids disposal.

Dehydration is achieved with solid desiccants and membranes in swing vessels. Larger-capacity plants may use regenerable glycol systems optimized for water removal. Acid gas removal is dominated by amine systems, which are offered by licensors with process guarantees and technical support. The choice of which amines depends upon the acid gas species to be removed.

Cryogenic technology. To meet the Btu content requirements for rich gas, operators can choose to dilute with nitrogen; more commonly in the US, however, the gas is cooled to condense out NGL. This can be as simple as expansion across a Joule-Thomson valve, most commonly at gas field gathering sites. Within a processing plant, if the gas pressure is high enough, turboexpanders are used to cryogenically cool and condense NGL. At lower pressures, mechanical refrigeration can be used.

Analyzer technology. Process analysis is key to operating close to target composition, which can be changed depending on the operating envelope set by market economics. Traditionally, high-quality analysis has been done by laboratory technicians. Improvements in sample conditioning, analyzer manufacturing and conditioned analyzer shelters have enabled continuous process analyzers to be more robust and reliable, with occasional calibration and self-cleaning cycles. The adoption of communication protocols to control systems and remote operations centers supports real-time diagnosis and exception flagging.

Operations technology. Materials engineering has enabled longer life of plant components in severe situations, such as erosion, corrosion or vibration. Three-dimensional manufacturing is enabling new control valve internals using sintered metal or ceramic components in new geometries. Turbine manufacturers have combined CAE, CAD and CAM to optimize blade designs that have resulted in larger machines with longer reliability.

One of the best improvements in operations technology has been enabling personnel with different roles to obtain real-time views of critical elements. The development of the distributed control system (DCS) enabled the control of all units in a plant through a single control room. Plant historian systems, which sample the DCS data with increasingly high fidelity, enable process engineers and instrument technicians to diagnose on a parallel network, impacting control integrity. Suppliers have developed increasingly useful tools to analyze plant historian data, which allows them to observe the impacts of changed throughputs on process performance.

Integrity technology. The next development was to integrate process monitoring with equipment condition monitoring, aided by new sensor types that help calculate declines or deviations. Monitoring of asset health indicators and the development of equipment-level baseline performance have enabled proactive intervention, packaged as asset management systems.

Multisite operations. Increased reliability of process plant operations has enabled operating companies to layer direct control on the local plant from an operations center that is also responsible for monitoring gathering fields, compressor stations and pipeline operations. This opportunity has seen a flourishing of offerings from major control system vendors of wall-size dashboards that provide an overview of each asset and allow for quick response to timely opportunities.

Resources: learn more. Readers wishing to learn more in-depth information on the aspects discussed in this overview can find it in the articles published by Gulf Energy Information’s publications, as well as networking with industry peers at Gulf Energy Information events. We also recommend signing up to receive publications from the GPA Midstream Association, and monitoring useful reports from the US Energy Information Association.

Also, watch for future midstream industry reports by Gulf Energy Information on different regional topics. These reports will provide coordinated coverage across the value chain of production, processing and delivery. The series will cover exploration and production, processing, logistics, storage, feedstocks and downstream operations. They will be available in digital article and on-demand webinar formats. GP

|

Bob Andrew is Senior Data Analyst in the Data Services Division of Gulf Energy Information, where he coordinates all research into content for the Construction Boxscore Database. He analyzes the quality of major datasets before they are added to Gulf Energy Information’s Energy Web Atlas. He also serves in a downstream and midstream technical advisory role for Gas Processing & LNG, Hydrocarbon Processing, Petroleum Economist and Pipeline and Gas Journal.

Comments