Regional Focus

Mozambique and Tanzania hold an estimated 180 Tft3 and 57 Tft3 of proven natural gas reserves, respectively. Although the countries are two of Africa’s biggest holders of proven natural gas reserves, they are grappling with uncertainties surrounding hydrocarbon industry regulations and a prolonged cycle of low oil and gas prices. These circumstances have forced Mozambique and Tanzania to postpone key natural gas monetization projects.

Mozambique instated its New Petroleum Law in 2015 to replace regulations established in 2004 and updated in 2008; however, many specifics of the law are still unclear. In a similar scenario, Tanzania’s recently approved oil and gas laws provide no clear roadmap on production, commercial processing, liquefaction, transportation, storage or distribution of its natural gas resources.

Tanzania’s regulations also pose a threat to new investment, as the government insists that the laws be applied retroactively. This would give the government the power to renegotiate already-signed contracts, and even to throw out those contracts not favoring national interests.

LNG plans face challenges. The implementation of the new laws comes at a time when international oil and gas companies operating in the two countries are at different stages of developing two separate gas liquefaction export projects worth a collective $37 B.

A late-2016 report on Tanzania’s hydrocarbon sector by industry research firm Business Monitor International stated, “Several key fiscal and regulatory uncertainties remain, including those relating to taxation, domestic supply obligations and local content requirements … Further clarification will be needed before a final investment decision can be taken [on an LNG project].”

A consortium of ExxonMobil, Statoil, Ophir, Shell and Tanzania Petroleum Development Corp. has agreed to develop a 10-metric-MMtpy onshore LNG export facility valued at $30 B. The facility would be built near the coastal city of Lindi in southeastern Tanzania. The consortium signed a draft agreement on the development of the project in early 2017, although the estimated completion and startup dates have been moved several times.

Under the initial proposal, the project was to be commenced in 1Q 2017 and completed in 2024, but it is unlikely that this deadline will be met. Analysts believe it will take at least 5 yr for the project to reach a final investment decision, and another 5 yr to build the multibillion-dollar LNG terminal.

Gas gains in the power sector. Tanzania is scaling up consumption of domestic natural gas by expanding its gas-fired electricity generation capacity. The country plans to develop 2,000 MW of new, gas-fired power plants by 2018.

However, compared to its neighbor, Mozambique, development of Tanzania’s natural gas resources is still in its nascent phase, despite the modest progress achieved in the sector. Mozambique holds an estimated 180 Tft3 of recoverable natural gas resources, mostly in the northern Rovuma basin.

Since 2015, Mozambique has provided a clearer regulatory framework for its natural gas development program, with the introduction of new petroleum laws that apply to new concessions, new investors and international oil companies keen to expand their operations in the country.

Project development plans submitted by international oil companies for government approval must have a clause that commits to the allocation of 25% of the oil or gas produced for domestic consumption. Unlike in Tanzania, Mozambique’s new petroleum laws do not apply to previous contracts or concessions. As an example, this is why South African petrochemical giant Sasol—the sole natural gas producer in Mozambique at present, with production capacity of 135 Bft3 of natural gas at the Pande and Temane onshore fields—can allocate only 18 Bft3 (approximately 13%) of its total yield for domestic consumption. Sasol exports the rest to South Africa through an 862-km pipeline.

In addition, Mozambique’s government has explained the procedures for the sale of associated and nonassociated gas, and what will happen if a concession holder decides not to carry out the sale. The law also creates a decommissioning fund, and explains how interest in a concession can be transferred and how a concession is managed.

Upstream endeavors. Two international exploration and production (E&P) companies—Italy’s Eni SpA and Texas-based Anadarko Petroleum Corp.—have announced major discoveries in offshore Blocks 1 and 4. After oil and gas prices stabilize, it is expected that more international oil and gas companies will be encouraged to seek E&P opportunities in Mozambique, especially with the more oil and gas investment-friendly regulations.

Even with the old petroleum laws, a conducive environment has existed for mergers and acquisitions in Mozambique’s upstream sector. For example, the laws accommodated the entry of leading Asian national oil companies, such as Petronas of Malaysia, Mitsui of Japan, CNPC of China, ONGC Videsh of India and PTTEP of Thailand. Other partners in Mozambique’s Rovuma basin concession areas include Bharat Petroleum Resources Ventures, Tullow, Wentworth Resources and Maurel & Prom.

|

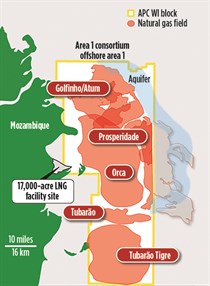

| Fig. 1. Location of the Anadarko-led consortium’s proposed Mozambique LNG terminal. Source: Mozambique LNG. |

Anadarko, the operator of offshore Block 1 (26.5% working interest) has made modest progress. It announced in July 2017 that it had signed an agreement with Mozambique’s government for the design, building and operation of marine facilities for its proposed, two-train LNG project (Fig. 1).

The US oil and gas E&P company, which has partnered in Block 1 with Empresa Nacional de Hidrocarbonetos EP, Mitsui E&P Mozambique Area 1 Ltd., ONGC Videsh Ltd., Bharat PetroResources Ltd., PTT Exploration & Production Plc. and Oil India Ltd., is developing the first onshore LNG plant with a capacity of 12 metric MMtpy.

FLNG in Mozambique. Italy’s Eni, the operator of Area 4, has made substantial progress in the commercialization of Mozambique’s natural gas resources.

In September 2017, Eni picked RINA Services as the preferred certification authority for the design and fabrication of subsea structures and equipment for its $7-B Coral South FLNG unit, which is part of Eni’s Coral South Development Project. RINA will also provide technological validation services for the project. The 3.4-metric-MMtpy FLNG unit, the first in Africa and the third globally, will be installed in the south part of Area 4 offshore Mozambique, in the deep waters of the Rovuma basin.

In June 2017, Eni said that the FLNG project will be financed through a project finance structure that will cover approximately 60% ($4.7 B) of its cost, making it the first FLNG unit to be financed in this way. At least 15 major international banks and five export credit agencies have subscribed to the financing agreement. GP

|

Shem Oirere is a freelance journalist based in Nairobi, Kenya. He has spent more than 10 yr covering various sectors of Africa’s economy, and has had numerous articles published in several international publications and websites. Previously, Mr. Oirere worked for Kenyan national newspapers, including the Daily Nation, Kenya Times and People Daily, where he served in various capacities as correspondent, business reporter and sub-editor. He earned a higher degree in journalism from the London School of Journalism, and is also a member of the Association of Business Executives (ABE).

Comments