Business trends

Adrienne Blume, Editor

The small-scale GTL (SSGTL) and small-scale LNG (SSLNG) sectors are gaining ground, providing alternative sources of power generation and transportation fuel in remote regions and areas not connected to major gas pipeline routes. According to the International Gas Union (IGU), as of 2015, global SSLNG installed production capacity was approximately 20 MMtpy, spread among more than 100 SSLNG facilities.1 The IGU defines SSLNG facilities as those producing less than 1 MMtpy of LNG.

A number of economic, geopolitical and environmental factors combine to make SSGTL and SSLNG viable solutions for specific demand and supply scenarios. Natural gas is widely touted as a relatively inexpensive and environmentally friendly source of fuel. Compared to other fossil fuels, natural gas emits significantly smaller quantities of CO2, SOx, NOx and particulate matter (PM) when burned as fuel.

However, a problem exists in the widespread flaring of associated gas by oil producers around the world. Several initiatives, standards and regulations have been established by international partnerships and individual governments to reduce gas flaring, but more solutions are needed. SSGTL and SSLNG are being touted as two ways of monetizing associated gas while also cutting down on flaring.

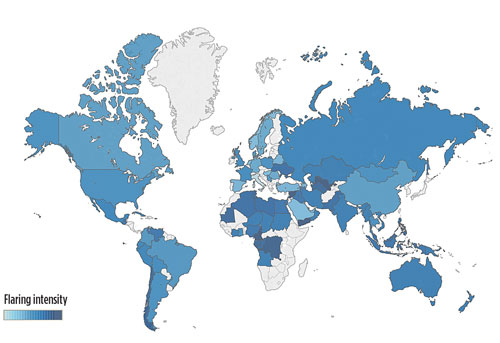

Drivers to reduce associated gas flaring. According to The World Bank’s Global Gas Flaring Reduction (GGFR) private-public partnership, established at the World Summit on Sustainable Development in 2002, an estimated 140 Bm3/yr of gas is flared around the world. This volume equates to more than 360 MMt of CO2 emitted into the atmosphere (Fig. 1). The regions with the largest volumes of gas flared are Russia and the Caspian Sea region (approximately 50 Bm3/yr–60 Bm3/yr), Africa (more than 30 Bm3/yr) and the Middle East (approximately 30 Bm3/yr).2

|

|

Fig. 1. Global gas flaring intensity per m3/bbl of oil produced. Source: The World Bank’s GGFR partnership.3 |

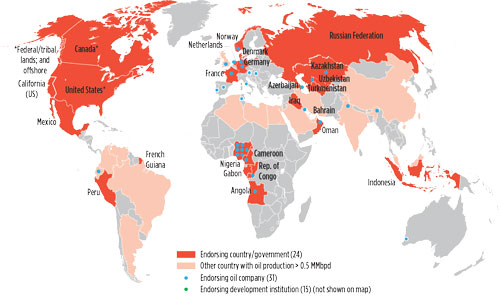

The World Bank’s Zero Routine Flaring by 2030 initiative aims to end routine flaring of associated gas by the end of the next decade. A number of governments, oil companies and development institutions have endorsed the initiative (Fig. 2).3 Among the participating governments is Iraq, which joined the initiative in 2017 in what The World Bank called “a remarkable and bold decision.” The GGFR partnership previously named oil production increases in Iraq (which has been a member of the GGFR since 2011) as a significant possible source of increased flaring.2

|

|

Fig. 2. Map of endorsers of The World’s Bank’s Zero Routine Flaring by 2030 initiative. Source: The World Bank.3 |

The World Bank wrote in May 2017, “The volume of gas currently flared in Iraq represents an estimated annual economic loss of about $2.5 B and would be sufficient to meet most of the country’s unmet needs for gas-based power generation.” Shortages of gas-based power cost the country an estimated $6 B/yr–$8 B/yr in imports of alternative fuels, although the volume of power that could be generated by Iraq’s flared associated gas is estimated at approximately 8.5 GW.4

Iraq established Basra Gas Co. (BGC) in 2013 as a partnership between state-owned South Gas Co., Shell and Mitsubishi. BGC aims to capture, process and monetize associated gas from its southern oil fields and could eventually become the world’s largest gas flaring reduction project.4

Meanwhile, shale-heavy production areas in the US, such as the Bakken shale in the Dakotas, or the Marcellus formation in the Appalachian basin, saw the implementation of methane flaring and venting regulations by the US Bureau of Land Management (BLM) under the Obama administration. The US Senate has upheld the BLM’s methane flaring rule under the Trump administration, drawing criticism from the American Petroleum Institute and other organizations.

Challenges to reducing flaring vary among geographies and regions, but in some cases they have been magnified as shale oil production technology has improved. If gathering lines are present, they may be undersized to accommodate the amount of gas flared from expanded oil sites. This scenario is seen in the Williston basin in the US Dakotas and Montana. Additional infrastructure and compression capacity are needed to handle the large volume of associated gas coming from plays like the Williston. Although gas processing plant capacity in the US has increased by several hundred percent over the last decade, the installation of additional infrastructure still takes time. Stop-gap solutions are needed.

Flaring regulations and initiatives in the US and around the world have provided small-scale gas processing technology firms with an opportunity to offer solutions to the problem of excess flaring. SSGTL may prove an especially attractive option in areas where flaring is not allowed, aiding oil production when no other associated gas utilization methods are available.

The scaling down of GTL technology to under 2 Mbpd is anticipated to open up a significant percentage of the world’s untapped gas fields to economic feasibility. The opportunities for small-scale gas processing will increase as oil and gas prices improve after the past 2 yr of sharp declines.

SSGTL, SSLNG offer alternative solutions. The small-scale gas processing market is growing as technology improvements make the installation of SSLNG and SSGTL facilities easier and more economically viable. In 2013, the GGFR named a number of challenges for the small-scale monetization of associated gas, including:

- Distance to market

- Lack of local infrastructure

- Small gas reserves often change in volume

- Price distortion due to local fuel subsidies

- Availability of capital

- Need to develop modular, skid-mounted monetization technologies that can be deployed and redeployed close to the gas source in a phased manner

- Associated gas monetization is traditionally viewed as requiring economies of scale.2

In the 5 yr since the GGFR report, a number of technology solutions have emerged to address these challenges and change the conventional thinking on associated gas monetization. These solutions include modularization and standardization of production units and construction plans. A number of small-scale technology providers are touting “off-the-shelf” and “plug-and-play” units as answers to reduce costs and speed time to market for SSLNG and SSGTL facilities. Modular construction also reduces risk, enhances flexibility and encourages higher efficiency.

These units have small footprints, are usually mobile and can sometimes be hooked up directly to the wellhead. Pipeline, trucking and/or shipping solutions support the transport of the captured gas to facilities for further processing, or to distribution networks for delivery to end-users.

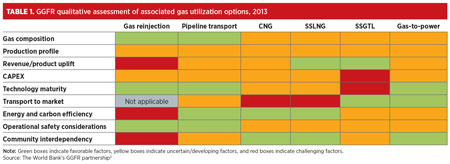

Other solutions for associated gas monetization include gas reinjection into reservoirs, pipeline transport (where infrastructure is present), CNG, gas-to-power and gas-to-chemicals, such as methanol and DME. In 2013, the GGFR’s feasibility assessment of the various drivers of associated gas monetization for fuel and power appeared to favor gas-to-power and CNG (Table 1).

|

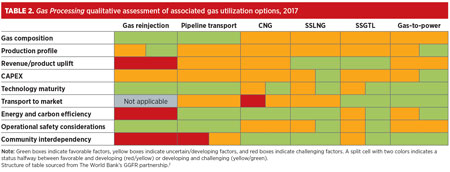

In 2017, however, the picture has shifted (Table 2). A number of SSGTL and SSLNG companies have made great strides in their technology offerings, creating solutions that are more economically and logistically feasible. A number of small-scale gas processing projects are in commercial operation in the US, China, Europe, South America and Central Asia, and others will soon advance beyond the pilot plant and demonstration stages.

|

Factors to consider for small-scale development. Not surprisingly, capital cost is the most critical factor for these developments, particularly in a downward price cycle. Products with high energy densities—i.e., liquid fuels produced through SSLNG or SSGTL processes—are generally more desirable and lucrative.

SSLNG and CNG compete mainly with other hydrocarbon fuels (i.e., oil, coal, LPG) for power generation, while SSGTL fuels compete directly with other transportation fuels (i.e., diesel, DME). Stricter International Maritime Organization (IMO) marine regulations are also stimulating demand for SSLNG as a bunker fuel in Europe. Operating costs for SSLNG and SSGTL are primarily influenced by operating complexity (which has seen simplification in recent years), distance to market and energy efficiency.

Some SSGTL and SSLNG opportunities are only viable when a complete supply chain is developed, from the wellhead to the end-user. Designing, building and operating all components of a supply chain effectively and competitively are continuing challenges for small-scale gas processing companies.

These challenges must be met while accommodating each project’s available gas supply and local demand, existing and required infrastructure, technology demands and limitations, and environmental considerations, among other factors. The development of standardized, flexible, cost-effective supply networks will be crucial to meeting these challenges. GP

Literature cited

- International Gas Union, Program Committee D3, “2012–2015 triennium work report,” June 2015.

- Svensson, B., “Best practices for evaluating and reducing emissions from oil and gas production: An evaluation of flare gas reduction opportunities,” The World Bank’s Global Gas Flaring Reduction partnership, presented at the Methane Expo, Vancouver, British Columbia, Canada, March 12–13, 2013.

- The World Bank, “Zero Routine Flaring by 2030,” 2017, online: http://www.worldbank.org/en/programs/zero-routine-flaring-by-2030

- The World Bank, “Amid ongoing conflict, Iraq to begin snuffing out flares,” May 9, 2017, online: http://www.worldbank.org/en/news/feature/2017/05/09/amid-ongoing-conflict-iraq-to-begin-snuffing-out-flares

Comments