The path to midstream profitability: Retrofit to improve returns

The U.S. shale revolution has matured. Due to higher oil prices, shale production has shifted from natural gas basins to oil-rich basins. Oil-focused drilling typically produces associated gas as a byproduct, which is a blend of natural gas and natural gas liquids (NGLs). The U.S. is the world’s largest NGL producer, supplying 11 MM metric t, or 29% of the global NGL supply, earlier this year. To manage these volumes, the U.S. has more than 400 gas processing plants that separate the associated gas into distinct streams of NGLs and natural gas.

Most gas processing plants recover NGLs, such as ethane and propane, using a process technologya developed in the late 1970s. Downstream of the gas processing plant, ethane and propane are feedstocks for producing ethylene and propylene. The abundance of these products has boosted U.S. petrochemical production and has driven the dramatic increase in petrochemicals exports to the global market.

Pivoting to profitability. Oil markets recently have faced three significant downturns: the 2007 global financial crisis, a global price war in 2014 and the severe drop in demand caused by the COVID-19 pandemic in 2020. Prior to COVID-19, particularly between 2018–2019, the growth rate of U.S. oil production had already begun to slow because of years of oil production growth without a focus on profitability. Overall, investor returns of Standard & Poor’s 500 index dramatically surpassed that of the exploration and production sector, causing investors to pressure shale producers to focus more on slower but more profitable growth.

Gas processors responded by modifying existing assets to improve returns. In a capital constrained environment, gas processors can typically upgrade or retrofit their existing equipment for less than 5% of the total installation cost of a new gas processing plant. By doing so, they can efficiently improve product recovery, operational flexibility, energy efficiency and plant capacity. Given the historical volatility of the oil market, gas processors can ensure profitability by increasing the flexibility of their assets in preparation for a range of market conditions.

The value of ethane and propane. As the global economy recovers from COVID-19, the growth of U.S. oil production is forecast to be slower than it was pre-COVID-19, reducing the growth of NGL supply. Simultaneously, global demand for petrochemical feedstocks (e.g., ethane and propane) is forecast to surpass pre-COVID-19 growth rates.

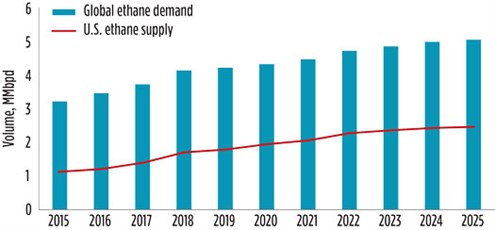

Global ethylene demand is forecast to increase 5%/yr to approximately 200 MM metric t by 2025. Forty percent of ethylene production will be derived from ethane as a feedstock. Global ethane demand is forecast to increase to 5.2 MMbpd in 2025 (FIG. 1), a large portion of which is driven by U.S. demand centers along the U.S. Gulf Coast. To match the increase in ethane demand, U.S. gas processors will recover more ethane from associated gas. During this period, U.S. ethane supply will increase by 5%/yr, ultimately supplying 49% of global ethane in 2025.

|

| FIG. 1. Global ethane demand (MMbpd), 2015–2025. Source: IHS Markit |

Ethane will be more valuable for gas processors with close geographical proximity to the major demand centers—such as the U.S. Gulf Coast, where most U.S. petrochemical facilities and export terminals are located. For example, the Permian Basin—the fastest growing oil production basin in the U.S.—is near U.S. Gulf Coast export terminals and local demand centers. In addition, the Permian Basin has lower production costs due to an abundance of oil reserves and established infrastructure. Ethane pricing at the Mont Belvieu terminal will continue to increase through 2025. Because of these economic advantages, gas processors in the Permian Basin have shifted their operations to ethane recovery—the practice of recovering ethane and other high-value NGLs, such as propane.

Conversely, due to smaller profit margins, the same may not be true for capturing ethane in basins with higher production costs (e.g., the Niobrara Basin in northeast Colorado and southeast Wyoming). These basins tend to operate under ethane rejection, where ethane is not recovered but simply left in the natural gas stream to be sold at lower natural gas prices. For this reason, ethane’s price floor is the price of natural gas. The profitability of either operation mode—ethane rejection or ethane recovery—will depend on the market price of ethane at a point in time. As the price of ethane continues to increase, there are new opportunities for swing basins to switch from ethane rejection to ethane recovery to capture ethane’s additional value.

Global propylene production via propane dehydrogenation, a process that utilizes propane as a feedstock, is projected to grow 14%/yr to 25 MM metric t in 2025. The increase in propylene production equates to a 5%/yr growth in propane demand, which will result in high propane prices for the foreseeable future in all U.S. regions. By 2025, global propane demand will be approximately 6.4 MMbpd (FIG. 2), 37% of which will be supplied by the U.S. Therefore, efficiently capturing as much high value propane as possible is critical for improved profitability for U.S. gas processors in all basins.

|

| FIG. 2. Global propane demand (MMbpd), 2015–2025. Source: IHS Markit. |

Optimization through retrofits. Gas processors have started retrofitting existing assets to further optimize operations. Retrofitting a gas processing plant upgrades the existing design to more advanced technology, which improves ethane and propane recovery, operational flexibility, and increased plant capacity. A retrofit can improve ethane rejection, ethane recovery or both. In addition, a retrofit can increase the plant’s capacity and energy efficiency. Given the unpredictability of the oil industry, a retrofit is a proven, high return method to increased profitability.

The best retrofit technology depends on the gas processor’s feedstock, contracts, location and regional market conditions. For example, the authors’ retrofit technologies can increase NGL recovery, reduce energy consumption, improve operating flexibility and increase processing capacity. Typically, a retrofit can recover nearly 100% propane and 99% percent ethane when operating in ethane recovery. When in full ethane rejection, more than 98% ethane can be left in the natural gas stream, while recovering 99%, or more, propane. Furthermore, the plant’s capacity can often be increased above 120% of the original plant design, depending on existing equipment limitations. The required compression horsepower of the retrofit will vary but, due to the focus on energy efficiency, retrofits can fit within the existing compression limits of the plant.

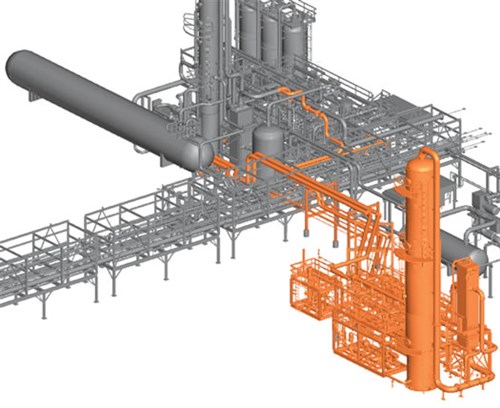

Many of the authors’ retrofit technologies are modular designs that provide easy connection to existing gas processing plants, minimizing the changes to the existing equipment and on-site construction required during the installation. The equipment that may be installed during a retrofit is highlighted in FIG. 3. The efficiency of a modular design can reduce plant downtime to less than 1 wk and allows the facility to recoup the installation cost in a shorter period. Depending on the gas processor’s contracts and market conditions, some retrofits can be paid off in less than 1 yr.

|

| FIG. 3. An example of a retrofit modification with new equipment highlighted in orange. |

In the Permian Basin, Brazos Midstream is retrofitting two 200-MMft3d gas processing plants, each using the authors’ company’s proprietary gas processing technologya. These retrofits provide greater flexibility with improved product recovery when operating in ethane recovery or rejection modes. The standard process technologya design can switch from ethane recovery to rejection but, with the retrofit, the recovery of ethane and propane will be nearly 100%. The plants also can increase production volume as market conditions dictate. The retrofits are scheduled to be fully operational by the end of this year.

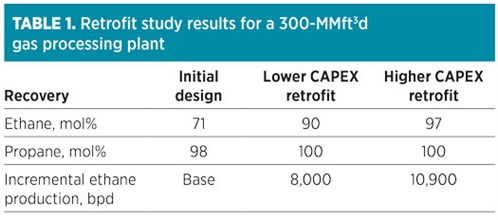

Retrofit studies. Globally, the authors’ company has retrofitted more than 50 gas processing plants. The ideal retrofit to maximize value add will be customer specific. A recent study was completed on a 300-MMft3d gas processing unit. The client’s focus is to increase ethane recovery in anticipation of future ethane demand, while minimizing capital expenditure (CAPEX). The study determined that a low CAPEX retrofit would improve ethane recovery from 71% to 90%. Installing additional equipment would further increase ethane recovery to 97% (TABLE 1). For this facility, improving ethane recovery to 90% or 97% would increase annual revenue by an estimated $24 MM or $34 MM, respectively. These values do not include the additional revenue that would be generated from the improved propane recovery. It is projected that both the lower and higher cost retrofits would be paid off in less than 1 yr.

|

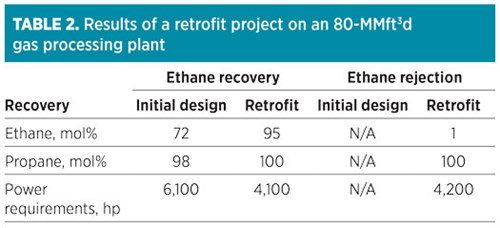

A retrofit was completed on an 80-MMft3d unit that was originally designed to recover 72% ethane and 98% propane. This facility was not capable of switching to ethane rejection operation. The authors’ company retrofitted the unit, while satisfying the customer’s four primary objectives:

- Enable flexibility to operate efficiently in either ethane recovery or ethane rejection modes

- Increase propane recovery to above 99% in all operating modes

- Maximize the use of existing equipment to reduce CAPEX

- Minimize plant downtime for installation.

The authors’ company implemented a retrofit that provided the customer with a stable and simple operation that exceeded design expectations. As detailed in TABLE 2, ethane recovery was increased from 72% to 95%, while reducing power consumption by 33%, which reduced the plant’s operating expense and significantly improved profitability. The facility is now capable of running effectively in either ethane rejection or ethane recovery modes. To minimize downtime, new equipment was delivered as a bolt-on package that was easily integrated into the existing unit.

|

By combining the gas processing technology with modular equipment design, the authors’ company is uniquely positioned to provide customized retrofits in a cost-efficient manner. As global petrochemical demand increases, ethane and propane prices are forecast to rise. Gas processors that have upgraded their plant technology will be in a better position to maintain strong profitability. GP

|

| FIG. 4. Brazos Midstream’s 200-MMft3d gas processing facility. Source: Brazos Midstream. |

NOTES

a Gas Subcooled Process developed by Ortloff Engineers. Ortloff was acquired by Honeywell UOP in 2018.

|

JASON ARLOTTA is a Senior Product Manager for Honeywell UOP's global aftermarket business. Jason has 10 years of experience in the oil & gas industry.

|

J. ANGUIANO is the Director for UOP Ortloff's NGL/LPG technologies with 23 years of experience in the gas processing market.

Comments