Gas Processing News

North American LNG projects struggle amid pandemic

|

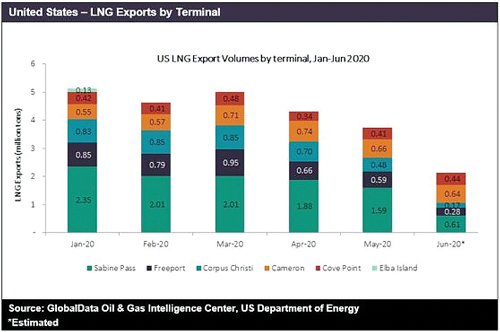

Global economic slowdown has led to reduced demand for LNG produced in the U.S. As a result, LNG exports from the country are likely to remain low in the near future, according to reports by GlobalData. Low prices for gas, along with an LNG supply glut, have pushed companies to revisit their CAPEX on upcoming multibillion-dollar gas projects.

U.S. FID delays and cargo cancelations. In March, Royal Dutch Shell exited the proposed Lake Charles LNG export project in Louisiana. Sempra Energy will not take FID pertaining to the Port Arthur LNG terminal due to current market challenges, which is likely to push back the start of the project by a year to 2024.

LNG exports from the U.S. witnessed an overall declining trend in the first six months of 2020 in the wake of the COVID-19 pandemic. The U.S. Energy Information Administration (EIA) estimated that about 46 cargoes were cancelled in June 2020, and about 50 cargoes were canceled the following month, hitting liquefaction capacity utilization in the U.S.

Although the economic outlook shows glimpses of recovery, the sporadic nature of the pandemic is weighing on growth prospects for the U.S. LNG sector. Moreover, the EIA forecast that utilization of LNG liquefaction facilities in the U.S. would average around 35% over the second half of 2020 when seasonal LNG demand tends to be low.

Canada LNG projects see difficulty. Elsewhere in North America, significantly low gas prices and the global LNG supply glut caused by COVID-19 has led to a delay in upcoming LNG projects in Canada.

Prevailing market conditions are making it difficult to find investors even for projects in Western Canada, which are relatively closer

to some of the biggest LNG buyers in Asia, such as China and Japan. This rising competition amid a supply overhang might make it challenging for Canadian LNG producers to remain cost-competitive.

Participants of Canadian LNG projects have been reducing their overall capital expenditure for 2020. One victim of the sharp fall in gas prices and surplus supply of LNG is Pieridae Energy’s Goldboro LNG export project, which saw delays to its FID in April, with its start year likely to be pushed to 2025. Furthermore, Royal Dutch Shell, Chevron Corp., Petroliam Nasional and Woodside Petroleum have revised their CAPEX guidance in response to weak market conditions due to the pandemic. In February 2020, Woodside wrote down $720 MM in the Kitimat LNG project, in which the company owns a 50% stake.

Canada’s LNG sector must come up with strategies to thwart competition from the U.S., which is expected to become more self-sufficient in terms of natural gas production. However, the unconventional gas reserves in the country and the technological advancements in drilling can also propel growth prospects for the Canadian LNG sector. Although the LNG market faces similar challenges across the world, whether or not Canada’s LNG sector succeeds will depend on how it adapts to the evolving economic situation.

Hammerfest LNG fire repairs could take a year

|

Equinor’s Melkøya LNG plant in Norway could remain closed until October 2021 as extensive repairs are carried out following a fire on September 28. The plant previously had been scheduled to reopen on January 1, 2021. The fire in one of the plant’s electricity-generating turbines was extinguished after about six hours.

Large amounts of seawater from extinguishing the fire also damaged other auxiliary systems, such as electrical equipment and cables in the plant.

Europe’s only large-scale LNG export plant is located outside the Arctic town of Hammerfest and can process 18 MMm3d of gas. The gas is piped in from the offshore Snøhvit field, located 160 km (100 mi) away in the Barents Sea. Snøhvit is owned by Equinor, Total, Neptune Energy, Wintershall Dea and Petoro.

Qatari LNG expansion project taps Baker Hughes, Honeywell

|

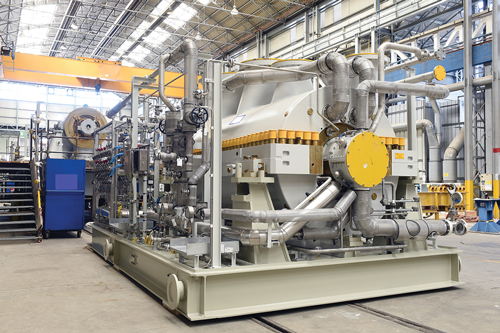

Baker Hughes and Honeywell recently announced contracts with Qatar Petroleum. Baker Hughes will supply multiple main refrigerant compressors for Qatar Petroleum’s North Field East (NFE) project, executed by Qatargas, while Honeywell will supply the main instrumentation and controls.

Turbomachinery contract. The awards are part of four LNG mega-trains, representing 33 MMtpy of additional capacity, which will increase Qatar’s total LNG production capacity from 77 MMtpy to 110 MMtpy and help propel the nation to global LNG production leadership by 2025. First gas from the expansion project is expected to be produced by the end of 2025. The second phase of the North Field LNG expansion project, called the North Field South project (NFS), will further increase Qatar’s LNG production capacity from 110 MMtpy to 126 MMtpy.

The NFE project will feature the latest advancements in compression technology, including enhancing machine performance and reducing 60,000 tpy/train of CO2, without any reduction in LNG production. Each MRC train will consist of three Frame 9E DLN ultra-low-NOx gas turbines and six centrifugal compressors across four LNG mega-trains for a total scope of supply of 12 gas turbines to drive 24 centrifugal compressors. Qatargas already operates six existing LNG mega-trains driven by Frame 9E gas turbine refrigerant compressors provided by Baker Hughes.

I&C award. Qatar Petroleum has also selected Honeywell as the main instrument and control contractor to support the NFE project. Honeywell’s technology will provide the NFE project with streamlined automation and safety systems while reducing schedule risks and delivering CAPEX efficiencies.

The project will deploy Honeywell’s IIoT-enabled LEAP (Lean Execution for Automation Projects) methodology, incorporating virtualization, universal input/output (UIO), channel technology and cloud engineering. The LEAP approach also provides more predictable construction costs and enables remote project engineering from anywhere in the world, which delivers improvements in collaboration and reduction in travel. Honeywell will also implement smart junction boxes technology for control and safety systems to reduce the number of instrumentation cabinets as compared to previous technologies. GP

Comments