Benchmarking a large gas turbine fleet

At present, Saudi Arabian Oil Co. (Saudi Aramco) operates more than 200 gas turbines. Such a large investment justifies more focused efforts to better protect and utilize these critical assets. Maintaining overall fleet data and statistics are considered to be the main challenges in establishing a firm fleet management program.

Of 192 gas turbine packages present in mechanical drive and power generation applications, 117 packages were benchmarked with a unified approach. The objective was to provide areas of strength and enhancement in operational aspects of the gas turbines, to optimize operational availability and affiliated performance factors. A plant information corporate database was utilized to extract the data and feed the performance metrics algorithms for the period of June 2016–June 2017.

Compiling turbine report performance indicators. The report focuses on key performance and asset indicators, including utilization, load profile, energy consumption and other fleet statistics highlighting areas for potential improvement.

By using calculation tools developed in-house for each gas turbine type, an average of 6 MM data points were collected from the plant information server, utilizing the engineering solution center (ESC) as the connection for all company corporate servers.

The raw data was processed, using MS Excel, to calculate a number of key performance and asset indicators:

- Running hours

- Start attempts

- Trips

- Utilization

- Loading and capacity factors

- Annual and monthly average load profile

- Annual and monthly average fuel consumption.

Additionally, the model consists of complex calculations, which cover several parameters:

- Pump required horsepower from flow and speed, using a performance curve from an existing datasheet

- Pump required horsepower taking into consideration differential head deterioration at different conditions

- Gas turbine site available power at different ambient conditions, using a correction curve and degradation factor

- Gas turbine heat rate and overall thermal efficiency.

The in-house developed models allow validation (isolation) of any out-of-range plant information system raw data, including sudden data jump (spike), sudden disappearance of data, and time-out. The output results of each site and gas turbine model were validated using three methods:

- A year’s trip data for the units, manually collected from operating sites

- Equipment datasheets

- Previous performance test reports.

Driving for results. In an effort to relate the impact of age on fleet performance factors, trip factors were found to be independent of the unit age, on a fleet level. Different gas turbine models of variable ages were studied.

Among the fleet, the Frame 5002 B fleet (40 yr or older) was found to have the highest equivalent number of trips, followed by Frame 7EA, which is the youngest of the fleet. Frame 7EA turbines had more trips per unit than the Frame 5002 A units, which are the largest and oldest turbines of the fleet. These numbers are closely related, with marginal deviation, regardless of age. The trips were primarily caused by instrumentation and wiring faults, as well as outdated control systems.

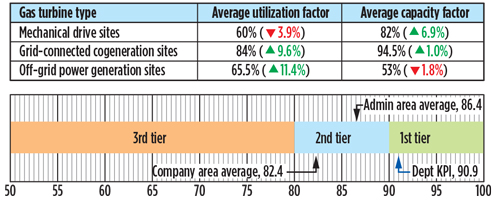

Based on 71 gas turbine-driven pumps and compressors, the report shows an average annual utilization of 60%, while operating at 82.5% capacity (FIG. 1). At some sites, the figure is even lower than 50%, which indicates reduced demand. This gives greater flexibility to operate more machines to satisfy operational targets. At present, there are ongoing efforts to explore the possibility to retire, regroup or mothball several of the units in the water injection application. The lower percentage of underutilized units in the compression application still shows the benefit of carrying out a similar exercise, but at a lower return.

|

| FIG. 1. Average utilization and capacity factors for off-grid and on-grid sites. |

For power generation, a clear mixture of low and high utilization was seen. Looking at off-grid power generation sites (23 survey sites), the data shows an average low annual utilization of 65.5% and generation of 53% power as a percentage of its rated site power. A number of power generation sites are underutilized in terms of capacity. The common factor among these sites is a steam generation shortfall. Steam generation has been found to cap the power export for several grid-connected sites. It is recommended to carry out a steam demand and reserve study to optimize the use of heat recovery steam generators, along with existing boilers. Another viable solution, which will aid in power reclamation, could be the integration of steam turbine generators. The off-grid power generation is directly linked to the house-required load of different oil and gas sites.

For the grid-connected power generation sites (16 surveyed sites), the analysis showed an imbalance in power demand and availability in some locations, which revealed an opportunity for return on investment. The study showed that 53.2% of the island operation capacity is not utilized. This under-utilization is due to lower-than-expected power demand, as much of the fleet operates as spinning reserve, standby or offline. An opportunity exists to study the feasibility of connecting the previously mentioned locations to the grid for energy export.

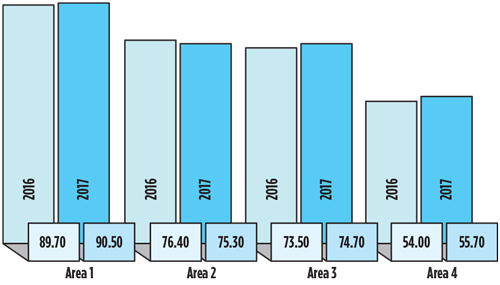

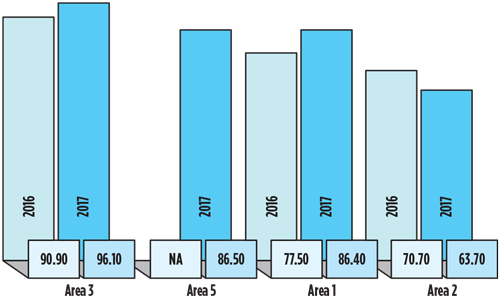

Recommendations. The first published report in 2016 was well received by all Saudi Aramco operating sites. In 2017, the team started to realize the positive impact of the benchmarking efforts. The 2017 results were compared with the 2016 results for each operating site and administration area, as well as by application, to identify which facilities experienced improvement (FIG. 2 and FIG. 3).

|

| FIG. 2. Mechanical drives improvement by area. |

|

| FIG. 3. Power generation improvement by area. |

The analyses show several areas of improvement throughout the fleet, including utilization, loading and reduced number of starts and trips. Several key findings and recommendations are common across multiple facilities and have significant impacts on the fleet key performance indicators:

- Mechanical drive units and off-grid (island) power generation sites generally have lower utilization and capacity factors. Despite notable improvement in the general utilization factor and a significant mechanical drive loading improvement of 17%, a number of gas turbine units were below the expected targets. This situation is significantly inefficient in terms of fuel consumption and hardware life, which led to reevaluations of those units and considerations of mothballing, retirement or relocation. Low utilization may be required, depending on the application or process demand in an island operation.

- Focus energy efficiency efforts on the largest fuel consumers. As a general observation from the evaluated fleet data, an opportunity can be realized by focusing on energy characterization and optimization, especially for the highest-throughput units. Applying best practices for compressor washing, along with performing condition-based inlet air filter replacement, will result in the highest benefits and payback to the company. For this purpose, a best-practices program was launched for the most-energy-intensive units.

- Key performance monitoring instrumentation calibration and connectivity. Compared to the 2016 report, the number of monitored units has expanded by 5%. Observations are primarily related to instrument calibration; in addition, some sites have no individual fuel and capacity measuring devices. To ensure accurate monitoring of equipment performance, rehabilitation of instrumentation, wiring and terminal connections is sufficient to attain a higher state of operation at present.

- Startup practices required. Across the fleet, the startup count is higher than expected, which has a negative implication for the hardware expected life. Analysis indicates that the startup procedures are not completely followed, or require enhancement. Additionally, carrying out post-shutdown inspections, instrumentation checks and installations, wiring checks for looseness, and project management checks for completeness would address many of the failed startup attempts. GP

|

Osama Y. Zidan is a Gas Turbine Engineer at Saudi Aramco. He obtained an MSc degree in thermal power and fluid engineering from the University of Manchester in the UK. Mr. Zidan has 13 yr of work experience in rotating equipment and gas turbines, including failure analysis, repair, technical consultation, standards development and project management. He is the Vice Chairman of Saudi Aramco’s gas turbine standards committee and represents the company in the Saudi Arabian Metrology and Specification Organization.

|

Mahmoud Sabban has more than 20 yr of experience in oil and gas. He started his career as a plant engineer and has held various positions throughout his career in facilities planning, commissioning and startup teams; project engineering; technical support; and central engineering. At present, Mr. Sabban is a Lead Rotating Equipment Consultant and the gas turbine standards committee Chairman at Saudi Aramco. He is on the board of directors of Gas Turbine Users International and represents the company at American Petroleum Institute (API) and Gulf Cooperation Council Standards Organization (GSO). He holds an MSc degree in thermal power from Cranfield University in the UK.

|

Yousef Al-Malki is a Gas Turbine Engineer at Saudi Aramco. He holds an MSc degree in mechanical engineering from the University of Tulsa in Oklahoma. Mr. Al-Malki has 9 yr of work experience in rotating equipment, including maintenance, failure analysis, repair and overhaul.

Comments