Export potential and challenges for North American LNG from unconventional gas

North America’s shale gas “revolution” has been a game-changer for the global energy industry, and has been particularly significant for the transformation of the US LNG industry. In less than 10 yr, the US has gone from a net LNG importer to one of the largest LNG-exporting countries in the world. This is especially important as the use of fuel oil and coal for power generation is dropping globally, and as gas is increasingly seen as the fuel of choice and a “bridge fuel” until renewables can achieve a larger market share. With all of these factors as a backdrop, including gas production that continues to increase, US LNG is now playing a more critical role in the global energy mix.

While investment in many large-scale LNG projects has been delayed or canceled, US LNG producers have increased their export capacity from almost zero to nearly 10 MMtpy. This LNG is not just being marketed in the Americas, China or other Far East countries, but is even finding its way to the Middle East. As a result of the huge increases in US gas production driven by shale development, US natural gas prices have dropped, and this has been the driving force providing arbitrage opportunities for investors.

However, many questions remain: How long will this domestic gas supply last? Can US shale gas remain competitive at such low prices? Will supply constraints within the US cause delays for LNG projects? Realistically, what is the LNG export potential from the US in the next 3 yr–5 yr? Will Canada eventually become an exporter of LNG, and how will this affect the US?

Historically, large-scale LNG projects have been backed by long-term take-or-pay contracts that provided the ability to finance these projects. Recognizing these challenges, US project developers have taken different routes that included the brownfield expansion of existing facilities. In other areas of the world, floating LNG (FLNG) may provide a lower-cost alternative, allowing for financing options that would otherwise not be available. Neither option is without challenges.

This article discusses the future potential and the accompanying challenges for US LNG exports, future LNG projects, forecasts and chances of success. Furthermore, the dynamics of new international LNG projects competing with the US, and vice versa, will be analyzed.

|

|

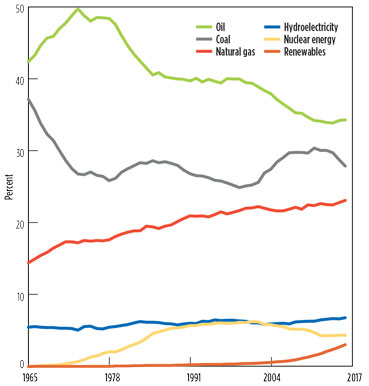

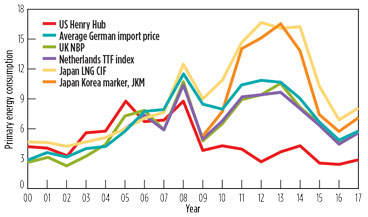

FIG. 1. Share of primary energy consumption showing the steadygrowth of gas. Source: BP. |

The role of LNG in the global energy mix. The demand for natural gas in primary energy consumption has been increasing steadily over the past four decades, as shown in Fig. 1.

Furthermore, natural gas is becoming the feedstock of choice for petrochemical plants, especially as demand has grown and the global economy has picked up after the economic slowdown starting in 2008. This growth in gas consumption is dominated by the industry and power sectors and is likely to continue through the next decades.

Within the natural gas industry, LNG has been the biggest winner by far. LNG consumption has increased globally, with Asian countries such as Japan, South Korea, China and India leading the way. What has been striking, though, is the entry of new countries—Kuwait, Egypt and the UAE, to name a few—as importers of LNG. This proves that for strategic reasons, as a means for peakshaving or to fill a short supply gap, LNG can play a key role. It is ironic that Kuwait, which sits in a gas-rich region, found it easier to import LNG for the peak summer periods rather than rely on pipeline gas from neighboring countries.

One enabler for LNG production and consumption has been the technological advances in offshore LNG production and regasification. For example, Egypt was an LNG exporter for many years, but a lack of investment in new gas supplies coupled with increased local demand led to a shortage of gas and a temporary shutdown of its LNG export plants. As a result, Egypt needed to import gas and turned to offshore LNG regasification, which was seen as the fastest way to import gas.

|

|

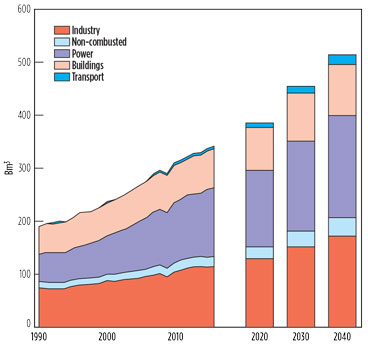

FIG. 2. US LNG exports by destination. Source: US Energy Information Administration (EIA). |

However, the most impressive change in the LNG business has been the change of fortunes in the US, which transitioned from a net importer of LNG into a serious player in the export market. Fig. 2 shows the global reach of US LNG exports.

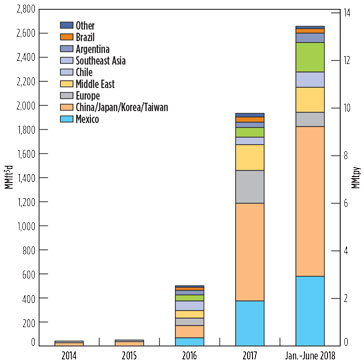

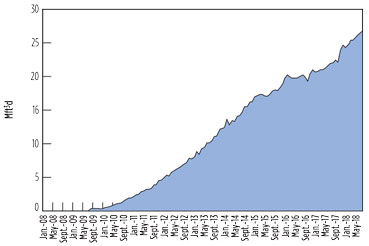

The “shale gas revolution” driving US LNG exports. Despite the downturn in the global oil and gas industry in 2015–2016 due to low commodity prices, US gas production has been increasing in the past 2 yr (Fig. 3) and exceeded 80 Bft3d by the end of 2018.

|

|

FIG. 3. US gas production is increasing, despite the downturn in 2015–2016. Source: EIA. |

This rapid growth in gas supply has had a huge impact on US gas prices, driving them to below $3/MMBtu for most of the past 5 yr. US gas prices, indicated by the Henry Hub price, tracked global gas prices for almost a decade (2000–2009), and in some instances were higher than European prices (e.g., in 2005). However, as the scale of US shale gas production increased, Henry Hub prices diverged dramatically from the rest of the world (Fig. 4). In 2017, the Henry Hub price was almost half of the gas price in Europe and close to one-third of the gas price in Japan. This price differential provides a significant arbitrage opportunity, and has been a driving factor in additional investments for US LNG export capacity.

|

|

FIG. 4. As shale gas production increased in the US, domestic prices ($/MMBtu) diverged from the rest of the world. Source: BP. |

The key question for investors is: How long will this gas price differential last? The answer centers around shale gas production levels, which are showing no sign of dropping and continue to increase year on year. As can be seen in Fig. 5, increasing gas production is not limited to the Permian region; other regions in the US, such as the northeastern Marcellus and Utica shales, are also contributing heavily to production increases. Transportation bottlenecks have been consequential to the gas markets in recent years, but most of these are no longer an issue, except in the Permian basin, where associated gas production continues to ramp up due to drilling. Some of the recent spike in prices has also been due to seasonal and storage issues.

|

|

FIG. 5. Shale gas production from the Northeast US. Source: EIA. |

While the US increases in gas production have been in the headlines, some interesting new developments are also occurring north of the border. Canada has several significant shale regions. While some of the increases in production are being curtailed by lower netback prices in Canada, along with lower import demand in the US, Canadian production in these areas will eventually grow substantially. The bigger challenge will be how this Canadian gas moves to markets, as the long-established relationships with consumption centers in the US are changed by the shale revolution (Fig. 5).

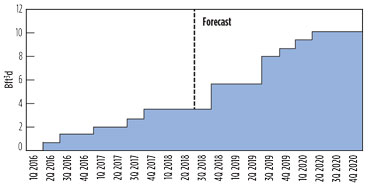

Buoyed by the increase in gas supplies, new LNG export projects are being pursued by investors. Based on the current projects and new projects that are being developed, US LNG export capacity is projected to reach 20 MMtpy by the end of 2020 (Fig. 6).

|

|

FIG. 6. US LNG export capacity growth forecast. |

At present, operating LNG export facilities in the US include Cheniere Energy’s Sabine Pass project in Louisiana and Dominion Energy’s Cove Point LNG project in Maryland. Over the next year, these will be joined by new export facilities, including Cameron LNG (Louisiana), Port Arthur LNG (Texas), Elba Island (Georgia), Corpus Christi (Texas) and Freeport LNG (Texas).

Additional US LNG export projects are at the early stages of development. Some of these projects are awaiting final investment decision and/or regulatory approvals. Naturally, some of the planned projects may not be built, but it is clear that the LNG project pipeline is quite rich for the foreseeable future.

One answer for Canada may look similar to the US: LNG export. Canadian gas exports have always centered on moving gas to the US via long-haul pipelines. This was a natural symbiotic fit, as Canada was a large gas producer and the US was a large consumer. The US provided an almost limitless demand sink for Canadian producers. This has now changed, as the US has moved into a surplus situation with growing gas production.

Attempts have been made to fast-track various LNG projects on the Canadian west coast. The placement of LNG liquefaction facilities in British Columbia are a natural choice, as the shipping time for western Canadian LNG to the Far East provides a distinct cost advantage over shipping times from the US Gulf Coast to Japan and China. The recent investment decision for a British Columbia LNG project may prove to be the first of several projects. The biggest hurdles to these projects are not supply, economics or LNG demand, but the political and environmental approvals necessary for the projects to move forward. The low netback prices available to Canadian gas producers may well prove to be the driving force necessary to push these projects forward.

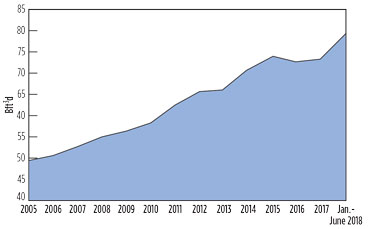

Key challenges and potential way forward. The key element for LNG is affordability, especially when it is competing with coal in the power sector of developing countries. Natural gas is much less polluting than coal or fuel oil, but where coal is locally available (e.g. China, the US and India), social and price pressures exist to continue burning coal. Fig. 7 shows how resilient coal has been, despite strong environmental pressures. In fact, during the higher-oil-price period of 2003–2013, coal showed an increase in its share of global power generation.

|

|

FIG. 7. Percentage share of global electricity generation by fuel. Source: BP. |

Geopolitical issues are also present. With the expansion of the Panama Canal, China and other Far East countries are a natural target for US LNG exporters. However, tariffs and trade wars between the US and China could impact US LNG exports.

Takeaway. LNG exports from the US have been driven by a huge surge of shale gas production, which has greatly exceeded local consumption and has kept US gas prices low. In return, this has provided low-cost natural gas as the feedstock for LNG and pushed lower-cost US LNG into international markets that have traditionally imported high-cost LNG.

US gas production is expected to grow further, ensuring continued growth in US LNG exports. Furthermore, Canadian producers are pushing hard to join the LNG export scene. However, there are challenges to this exponential growth in US LNG exports. The key element is affordability and low cost of LNG, which relies heavily on gas feedstock prices. Secondly, environmental and political hurdles could delay or cancel new LNG export projects.

Nonetheless, the overall future of North American LNG exports looks secure, with a great deal of potential expansion. GP

|

Ajey Chandra is a Director at Muse, Stancil & Co. and the Managing Partner of the Houston office, where he also leads the Midstream and Independent Engineering practice areas

for the firm. He has more than 30 yr of experience in various facets of the energy industry and has had a wide variety of assignments in the US, Europe and Southeast Asia. He worked at Amoco, Purvin & Gertz, Hess and NextEra Energy Resources prior to joining Muse, Stancil & Co. Mr. Chandra is a registered professional engineer. He holds a BS degree in chemical engineering from Texas A&M University and an MBA degree from the University of Houston.

|

Ramin Lakani is a London-based consultant for Muse, Stancil & Co. and has 28 yr of experience in upstream, midstream and downstream projects. His prior experience includes working for Esso Petroleum, Premier Oil, BG Group, Shell, Schlumberger, Petro-Canada, GCA and Halliburton. A chartered engineer, he holds a BEng degree in chemical engineering from University College London, an MSc degree in petroleum engineering from Imperial College London and an executive leadership certificate from Texas A&M Mays Business School.

Comments