EMGC Show Preview

A. Blume, Editor

6th annual EMGC to return to Nicosia, Cyprus on 6–7 March

- Technology developments and ongoing projects highlighted for upstream, midstream, downstream

- Network with high-level decision-makers, speakers and delegates working in the region

- Gain entry to regional markets and seek potential new business partners

Gulf Energy Information is pleased to announce that the 6th annual Eastern Mediterranean Gas Conference (EMGC) will return to the Hilton Cyprus in Nicosia, Cyprus, on 6–7 March 2019.

The conference program is sponsored by Eni, Total, Schlumberger and Deloitte and hosted by World Oil, Gas Processing & LNG, Hydrocarbon Processing, Petroleum Economist, Pipeline & Gas Journal and Underground Construction.

Since its inception in 2013, EMGC has offered attendees unique insight into the region’s energy evolution. The conference provides attendees with the latest information on the Eastern Med’s developing natural gas industry, as well as the ability to gain entry to regional markets and seek potential new business partners.

The 2019 conference program will include expert panels on operations and exploration and production (E&P) technologies, as well as keynote presentations on regional supply/demand economics and outlooks, infrastructure developments, pipeline projects, emerging gas partnerships amid shifting markets, and more.

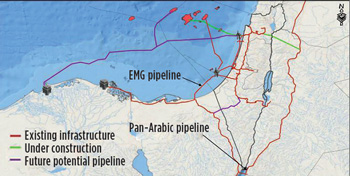

Recent developments in the Eastern Med. The regional picture of gas development continues to expand and change. In September 2018, Delek Drilling, Noble Energy and Egyptian East Gas bought out a 39% stake in pipeline owner Eastern Mediterranean Gas Co. (Fig. 1) for a collective $518 MM. The deal could enable reverse-flow gas exports from Israel to Egypt this year, paving the way for the creation of a $15-B market. The development will also open the door for Israel to secure major European buyers for its gas.

|

|

FIG. 1. The buyout of the EMG pipeline will enable reverse-flow gas exports from Israel to Egypt in 2019, amid other under-construction and proposed pipeline projects. Image: Delek. |

Large reserves close to growing markets, coupled with new market entrants and shifting political alliances, continue to feed E&P initiatives and questions about export infrastructure. Alongside sizable, ongoing developments such as the Leviathan, Tamar (Fig. 2) and Zohr fields, Greece’s ultra-deep waters offer exciting potential prospects. Greek energy officials will make their EMGC debut in 2019.

|

|

FIG. 2. A drilling rig operated by Noble Energy in the Tamar field of the Levant basin offshore Israel. Image: Noble Energy. |

Much talk and many propositions for infrastructure buildout have emerged, but few concrete steps have been taken. International cooperation is needed to get projects off the ground. At EMGC, companies involved in the Eastern Med and regional experts will discuss proposed pipelines and LNG terminals, along with existing and prospective gas developments.

Join the discussion! EMGC is the premier event for those interested in the opportunities the region presents. The conference brings together top executives, government officials and regional experts involved in determining the natural gas policies of the Eastern Med, for an in-depth discussion on the latest developments, challenges and opportunities.

In 2018, 52% of all EMGC attendees held the job title of Director or higher, including CEO, President, COO, Managing Director, Country Manager, Partner and others. Furthermore, 30% of all attendees in 2018 came from operating companies active in the region.

Opportunities are also available to participate in EMGC 2019 as a sponsor/exhibitor and position your company as a leader in this increasingly important market. Your presence allows you to engage with industry professionals, increase brand and product awareness, generate sales leads, meet potential customers and develop new partners. Please visit EMGasConference.com for more information on these opportunities. GP

Comments