Small-scale LNG: A reality today may be a game-changer for tomorrow

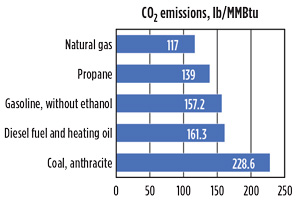

As an energy source, LNG is gaining ground compared to coal and oil, not only because it is cheaper, but also as a way to meet emissions reduction commitments by governments. As a transportation fuel, natural gas emits approximately 20%–30% less greenhouse gas than diesel or gasoline, and it emits 50% less greenhouse gas than coal when generating electricity (Fig. 1).

|

|

Fig. 1. Natural gas CO2 emissions compared with other fossil fuels. Source: US EIA. |

Fluctuations in crude prices, environmental concerns and the imbalance of natural gas resources across the globe are driving today’s LNG import and export markets. Global LNG consumption in 2017 was estimated at 285 MMtpy, and demand is expected to increase by approximately 4%/yr. However, large-scale LNG plants are complex and require many years for planning and execution.

An alternative solution to large-capacity LNG is small-scale LNG (SSLNG). The ability to produce LNG at remote locations, and the availability of technologies to conveniently transport the product, has made small-scale LNG an attractive way of delivering natural gas to areas of demand. The $25-B SSLNG market is forecast to double over the next decade.

Advantages of SSLNG. The primary business platform for SSLNG is the transportation industry. LNG can be used as a fuel in large, commercial trucks. Air pollution concerns in China’s major cities are driving the road transportation fuel market toward the use of SSLNG in that country. A 2007 World Bank report, conducted with China’s National Environment Agency, found that outdoor air pollution has caused approximately 400,000 premature deaths and indoor air pollution has caused another 300,000 deaths. At present, China has the highest number of LNG trucks in operation in the world.

Stricter emissions restrictions in the marine sector are providing traction for the use of LNG as a bunker fuel. The International Maritime Organization (IMO) has imposed new regulations to limit sulfur emissions in emission control areas (ECAs) to 0.1% from the previous limit of 1%, and to 0.5% from 3.5% in non-ECAs. These regulations will be implemented from 2020. These stringent emissions regulations will push the marine industry toward the use of LNG as bunkering fuel.

Interest in SSLNG is also growing from the remote residential and industrial sectors for power generation. The ability to use LNG in its liquid form, without undergoing the regasification process, enables small-scale business developers to build more profitable business models. Advantages of SSLNG over large-scale LNG projects are lower CAPEX, shorter construction timelines and shorter payoff periods.

SSLNG supply chain and challenges. SSLNG development is dependent on the development of a complete supply chain. Only a few companies have successfully developed the infrastructure required for a complete supply chain. This supply chain includes natural gas production, gas processing facilities, liquefaction units, export facilities, LNG carriers, import terminals, small-scale LNG transportation, SSLNG remote storage facilities and truck refueling stations (Fig. 2).

|

|

Fig. 2 The sslng supply chain. |

SSLNG is more feasible and attractive when all of the segments of the supply chain can operate more profitably. Since SSLNG requires less capital than large-scale LNG facilities, a greater number of small-scale business developers are entering the market. However, a lack of experience is challenging the creation and maintenance of high safety standards. Key challenges are the modularization of plants and the development of cost-effective technologies to minimize both CAPEX and OPEX while maintaining safety standards. The average shipping cost per ton of LNG is high for SSLNG, compared to large-scale LNG transportation; however, the smaller CAPEX and shorter rate of return for SSLNG can offset these costs.

Small-scale business owners, such as the owners of truck fueling stations, may face high CAPEX to develop the required infrastructure for SSLNG, especially since SSLNG requires low-temperature-rated materials for storage. Where a higher demand for GTL, CNG or methanol fuel exists, it will be challenging for SSLNG producers to operate more profitably.

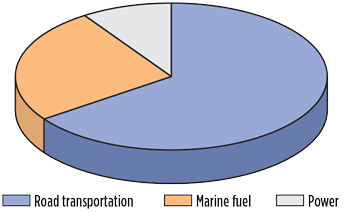

Global demand forecast. The International Gas Union (IGU) predicts that the global SSLNG business will grow to 30 MMtpy by 2020, while strategy and research firm Engie expects it to expand to 100 MMtpy by 2030. Fig. 3 shows the expected market share of SSLNG by segment in 2030 (Fig. 3).

|

|

Fig.3. Expected market share of SSLNG by segment in 2030. |

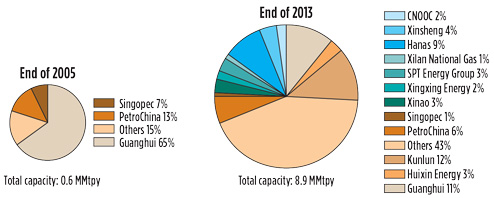

China is the world’s largest consumer of SSLNG. Significant expansion in China’s SSLNG sector was seen between the second half of last decade and the first half of this decade, with many new players joining the market (Fig. 4). Recent developments and ongoing expansions are expected to grow China’s SSLNG market to 20 MMtpy by 2020. The majority of this growth will be in response to government regulations for the use of cleaner fuels to help reduce air pollution. Increases in domestic natural gas production will also play a significant role in the growth of China’s SSLNG market.

|

|

Fig. 4. Rise of China’s SSLNG market, 2005–2013. Source: IGU. |

Outside of China, island nations in southeast Asia and the Mediterranean are creating greater opportunities for SSLNG in power generation. Infrastructure buildout is taking place in these areas.

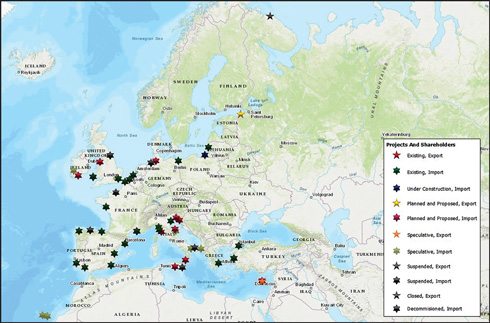

Europe is both an LNG exporter and importer (Fig. 5). In northern Europe, Norway plays a significant role in the regional LNG market, and particularly the Nordic LNG market. At present, Norway has the largest LNG business of any country in Europe. New tax policies and an environmental NOX agreement are driving Norway’s investments in LNG research and development.

|

|

Fig. 5. Location and status of LNG terminals in Europe. Source: Energy Web Atlas. |

Japan has been one of the largest LNG importers in the world since the 1990s. Its highly developed and efficient highway system enables the transport of LNG via road, while railway and small seagoing vessels also provide transportation for domestic deliveries. The high costs associated with pipeline construction also serve to encourage the production of LNG and SSLNG over pipeline shipments of natural gas.

Takeaway. SSLNG is becoming an increasingly viable energy source for the transportation fuel and remote power industry sectors, partly due to the lower emissions associated with natural gas use.

Although the total present market share of SSLNG in comparison with the total oil and gas industry is small, potential for strong growth in SSLNG has emerged over the past few years. Rising use of SSLNG could alter the landscape of regional and local gas demand and use, becoming a game-changer for the energy industry as a whole over the coming decades. GP

|

Srinivasa Pachipulusu is a Lead Process Engineer at Optimized Process Designs in Katy, Texas, where he has worked for 6 yr. He has participated in projects at various gas processing plants and at LPG export terminals.

Comments