Go East, young man: Eastern Canada offers viability for LNG projects—Part 2

A few projects will likely find a commercial path at some point in the future, but, in the meantime, producers are able to contemplate a viable and complementary near-term solution to the east.

In Part 1 of this article, which appeared in the January/February 2018 issue, the history of Canadian natural gas development, key technical considerations and the case for the West were addressed.

Part 2 develops the case for moving Canadian gas exports eastward by comparing and contrasting key elements in “West vs. East” LNG export opportunities.

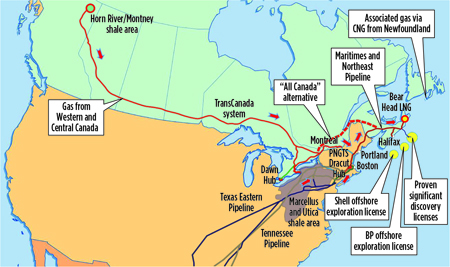

Canadian exports: The case for the East. A quick glance at the map (Fig. 5) shows why proponents of the Alberta and British Columbia shale gas fields have typically looked west—the shortest distance between two points is always a straight line. In addition, the shipping distances to traditional, premium Asian markets are shortest from Western Canada. However, monetizing stranded gas assets is anything but a straightforward process. In this case, that straight-line pathway has become paved with difficulty.

|

| FIG. 5. Gas paths to Eastern Canada. |

As highlighted in Part 1 of this article, to date, many have tried but all have failed to deliver on the promise of Western Canadian LNG exports, with literally hundreds of millions invested to no avail. LNG project opportunities have a shelf life; demand windows of opportunity can be closed by developments in other regions [e.g., US Gulf Coast (USGC), Mozambique, Tanzania, Russia], not to open again for years. Western Canada project proponents have been forced to delay, defer, redesign, optimize, relocate, negotiate and campaign in their quest to monetize their increasingly stranded reserves.

All is not lost, however, as an alternate path is emerging. Transporting the gas east instead of west provides a viable opportunity to reach markets. The world is indeed round, and the “case for the East” has several compelling advantages over the western route, despite initially looking like the wrong direction.

The map in Fig. 5 shows possible gas paths into the Bear Head LNG site at Point Tupper on Cape Breton Island on the eastern tip of Nova Scotia, including the proposed pathway from the western shale fields to the site.

Advantages of going east. A number of compelling advantages exist to moving Western and Central gas eastward, including:

- Regulatory climate. East Coast project sites in established, highly industrialized zones can be utilized, thereby reducing the concerns and environmental approval uncertainties challenging West Coast projects.

- Regional community support. Communities on the East Coast are generally more accepting of responsible industrial development, as the region has been highly industrialized for generations. Expanded industry generates more jobs and an improved tax base to enable communities to grow and thrive, and provides opportunities for young adults to raise their children nearer to their families.

- First Nations support. Key to any development in Canada, the First Nations bands in Eastern Canada are collaborative, organized, cohesive and supportive of responsible industrial developments through mutual benefit agreements, which document project commitments for long-term benefits to their groups. These benefits commonly include specialized training, technical training and internship opportunities, in addition to business opportunities and JV relationships.

- Labor market. Nova Scotia, in particular, has an extensive industrial history and is home to a large, skilled labor pool, including workers who have been supporting projects in Canada’s oil sands and are eager to work closer to home. Union “no-strike” provisions can be negotiated to provide project delivery certainty.

- Site access and regional infrastructure. Unlike the areas around northwest Pacific project sites, substantial regional infrastructure is available in the Nova Scotia tidewater area. Cape Breton Island is home to several industrial developments, and all-weather roads provide ready access to industrial parks and job sites. Electrical power, freshwater and housing are readily available, and industrial services providers are present in the region.

- Plant siting. Excellent project site opportunities are widely available, and are commonly located in existing industrial parks zoned for facilities development. Extensive site preparation is not required, as these areas are generally relatively level and on firm rock foundations, negating the need for massive soil and civil works commonplace at West Coast sites.

- Marine siting. Similar to the plant sites, the marine zones are commonly located within existing deepwater ports and/or shipping zones. They are ice-free or all-weather zones, with minimal marine infrastructure development requirements, enabling reduced overall facility costs to be realized.

- Seismic zones. Projects on the Pacific Coast sit on the “ring of fire” and are subject to very stringent earthquake and tsunami design parameters. East Coast projects sit in a benign seismic zone, reducing both construction risks and project costs while increasing LNG delivery certainty.

- Pipeline route. Pipelines to the west require crossing the Rocky Mountains and sensitive wilderness areas. The route east would leverage almost 2,000 mi of existing, underutilized pipelines that are in search of a new business purpose after the US shale gas revolution. The new sections of the pipelines necessary to reach the Canadian Eastern Seaboard would traverse more benign landscapes and largely fall

within existing rights of way. - Regional synergy. Canada is engaged in a national program to phase out all coal-fired power plants by 2030 on the basis of environmental concerns. One of the barriers to this goal is that Atlantic Canada (the maritime provinces of Nova Scotia, New Brunswick, Prince Edward Island, and Newfoundland and Labrador) face declining gas availability as existing fields (i.e., Sable Island) are depleting, and new exploration is limited.

In Nova Scotia, for example, 2016 natural gas production was less than half of that measured in 2005.9 In 2007, Nova Scotia produced 76% of its electrical power from coal, 13% from natural gas/oil, 9% from renewables and 3% from imported power. The early 2017 breakdown saw coal at 68%, but natural gas down to just 8%. By 2020, the target is to reduce coal further, to 38%, with natural gas/oil falling to 6% on continually eroding supply. Achieving the 0% coal target by 2030 without the opportunity to increase the natural gas component appears impossible, and is further complicated by the need for gas in support of home heating and other industrial use. By initiating LNG exports out of Nova Scotia, the availability of natural gas in the region will actually increase, rather than decrease.

- Investment capital and cash flow. Proponents of Western British Columbia projects would be required to finance, build and operate the liquefaction plants and associated infrastructure. Conversely, a tolling structure would be applied to projects in Eastern Canada, freeing up the balance sheet investment obligations faced by the West Coast projects. This would enable Western gas producers to monetize their sizeable gas investments without having to tap corporate capital or credit lines.

Eastward challenges and solutions. Despite the significant advantages highlighted in this work, the challenges that accompany Canadian East Coast opportunities must be recognized and accommodated. These challenges include:

- Gas supply. Four potential gas supply paths could service East Coast projects:

- US export gas/Marcellus.

At present, two proposed Eastern Canada export plants have shared approval for the export of up to 0.82 Bsft3d of US-sourced natural gas through the Maritimes & Northeast Pipeline into Goldboro, Nova Scotia, to both US free trade agreement (FTA) and non-FTA nations. While this is a significant supply that approaches commercially practical quantities (i.e., nominally 6 Mtpa of LNG), the existing East Coast pipeline infrastructure lacks the

ability to access the low-cost portion of the Marcellus Shale and is insufficient to guarantee continuous flow of this gas during the year, particularly during the winter when consumption in Boston, Massachusetts and Portland, Maine is seasonably high. An expansion of the pipeline infrastructure and/or an alternate route would be necessary to enable this gas supply, and is problematic in the present (but possibly evolving) US regulatory climate. - Existing offshore Canadian gas fields. The Sable gas field has brought gas into the Goldboro/Point Tupper area since the late 1990s, but production is declining and decommissioning is imminent. Associated gas from the White Rose oil field, located 350 km east of Nova Scotia, is potentially available; however, a pipeline is not considered technically feasible from this location, and CNG delivery to an onshore LNG facility is not economic at present.

- New deepwater offshore gas. Limited exploration is underway in potential new fields offshore Nova Scotia. It is anticipated that the associated gas from these fields will eventually develop into a viable LNG plant feed gas source, but with an extended timeframe of unknown duration.

- Western Canadian shale gas. The existing Canadian mainline gas transmission network is available to carry natural gas from the Western gas fields to the vicinity of the Ontario–Quebec provincial border (Fig. 4). An additional pipeline of approximately 1,600 km (length dependent on the routing) would be necessary to bring gas from that point into Goldboro, near the East Coast. Canada is home to a massive infrastructure of 510 Mkm of transmission and distribution pipelines, of which 78 Mkm are high-pressure transmission pipelines. The existing TransCanada mainlines run a total of 14.1 Mkm.10 The terrain for the new lines is non-mountainous, and additional offtake opportunities are available along the route, further enhancing economics while mitigating project risks.

- Pipeline transportation costs. As the US shale expansion took hold and flows in the TransCanada mainlines decreased, toll fees regulated by the Canadian National Energy Board (NEB) were initially increased to account for the declining revenues at the expense of the remaining customers. Firm transportation (including fuel) tolls between the Alberta Dawn hub in Eastern Canada increased by 73% between 2006 and 2013. Subsequently, the NEB has approved new, reduced pipeline tolling rates. Increased usage on the lines holds the potential for further reductions, as the cost can be spread across more flowing molecules.

- Momentum. Substantial investments were made by both Canadian and international energy companies (i.e., Petronas, KOGAS, Mitsubishi, PetroChina, CNOOC, Repsol, Sinopec, Shell and Woodside). Oil and gas acquisition deals involving Canadian companies have run into the tens of billions of dollars. For example, between 2005 and 2015, investments by Chinese private and state-owned companies into Canadian oil and gas assets reached CAD 40 B. Much of this investment was made with a view toward West Coast LNG exports. In the corporate world, to change direction completely can be difficult; it takes time and careful consideration.

- USGC competition. The best project locations on the USGC—particularly expansion projects and those brownfield facilities with existing LNG storage and loading systems—are able to deliver LNG projects at CAPEX levels of less than $800 Mtpy–$1,000/Mtpy. The best projects (i.e., Magnolia LNG) are able to approach the $500/Mtpy level. Canadian projects must deliver a “cost stack” (i.e., cost of gas plus transport

plus CAPEX plus OPEX plus equity plus financing) that is competitive with that which can be achieved on the USGC. - Shipping distances. LNG shipping distances from the Canadian maritimes to Asia are obviously longer than those from British Columbia’s West Coast. Conversely, shipping to Europe, South America and even parts of India are shorter. Cross-basin cargo swaps should be much easier to execute, given the close proximity to the European market (roughly half the distance relative to USGC producers) can also be utilized to offset excessive shipping differentials.

Overall, despite the longer physical distance from the prolific Western Canada shale gas plays to the Canadian East Coast, compared to the West Coast, compelling advantages (including regulatory certainty) point to the east, representing a new opportunity for gas producers (Table 3).

|

Canadian East Coast case study: The Bear Head LNG project. In 2004, Anadarko Petroleum Corp. acquired a 255-acre (103-hectare) tract of land and water lot property in the Point Tupper Industrial Park on Cape Breton Island in Richmond County, Nova Scotia.

Anadarko’s intent was to site the Bear Head LNG import terminal for gas supply to the regional and Eastern US markets. Bear Head was one of nearly 50 import terminals proposed for North America in the face of rapidly declining conventional onshore and offshore natural gas production.

The site was ideal for industrial development for a number of reasons, with the established Industrial Park having an existing coal-fired power plant, an oil storage terminal, an NGL fractionation plant, a paper mill and a coal import marine terminal.

The LNG import terminal received its environmental permits in 2005. Construction was started, including site clearing and preparation, and the building of roads, drainage, fencing and foundations for two LNG storage tanks. However, rapid evolution in the energy markets (i.e., shale gas) caused the project to be put on hold in 2007.

LNG Ltd., the Australia-based parent company of both Bear Head LNG and Magnolia LNG, acquired the project site 7 yr later, in 2014. LNG Ltd. initiated design works for the Bear Head LNG export plant and expanded the property package to 327 acres to accommodate an eventual 12-Mtpy LNG production capacity (Fig. 6).

|

| FIG. 6. The Bear Head project site today. |

The specifics of the Bear Head LNG project demonstrate many advantages of a Canadian East Coast location:

- Regulatory certainty. The Bear Head LNG terminal and the associated Bear Paw feeder pipeline (a 63-km, 42-in., high-pressure line from Goldboro to the project site) have secured all necessary permits and authorizations to construct, ship and export the gas. These permits include Environmental Assessment, Transport Canada/TERMPOL marine permits, Fisheries and Oceans Canada authorization, Navigable Waters Protection Act Authorizations, NEB Import/Export Approval, construction permits and, if US-sourced gas is used, US Department of Energy non-FTA export authorization. The project is ready for construction, from a regulatory standpoint.

In addition, the project continues to put in place approvals for associated documentation, including the Greenhouse Gas Management Plan, Emissions Management Plan, Avian Management Plan, First Nations Communications Plan and regional Complaint Resolution Plan. - First Nations support. The project has established an MOU, followed by a Mutual Benefits Agreement with the Nova Scotia Mi’kmaq chiefs, resulting from a collaborative process to ensure First Nations participation in the project and benefits for the community.

In addition, the Native Council of Nova Scotia (NCNS) has been closely involved in the overall regulatory and agreements processes. Both Nova Scotia Environment and the Nova Scotia Office of Aboriginal Affairs have approved the project Communications Plan with the Mi’kmak chiefs and the NCNS.

Bear Head has made an early demonstration of its commitment to the community by using a First Nations-owned company to provide site safety and security since LNG Ltd.’s acquisition of the property in 2014. - Union agreement. Bear Head has put in place a formal agreement between the project, the Nova Scotia Construction Labour Relations Association Ltd. (CLRA) and regional labor organizations (12 in total), laying out the conditions and agreements under which the Bear Head and Bear Paw projects will be built.

- Regional community support. Point Tupper, an industrial park near Port Hawkesbury, is home to heavy industry, including an oil storage terminal, a gas processing facility, a paper mill and a coal-fired power station. The region is welcoming to responsible industrial development.

- Regional infrastructure availability. The Bear Head project site is located in an existing industrial park near the town of Port Hawkesbury, and is accessible by all-weather roads maintained by Richmond County. Municipal water, sewage, electricity, phones, cellular, internet and medical services are available.

The site is close enough to existing population centers to be readily accessible, yet sufficiently remote to enable excellent safety and security separation. Neighboring facilities are all heavy industrial. The region is a 3-hr drive from Halifax, and a 2.5-hr transit from the Halifax international airport, making it highly accessible from anywhere in the world.

- Job site. The job site is ideal for siting and construction. It is clear and level due to earlier site prep activities, and roads and drainage are in place. The facilities are fenced, on rock with no piling required, and sufficiently elevated above sea level to enable good drainage without affecting marine shipping access. The site is of sufficient size to enable the eventual installation of up to six 2.5-Mtpy mid-scale LNG trains.

- Marine site. The site is located on the Straight of Canso and is ideal for LNG loading and shipping. The straight is ice-free all year, due to the construction of a rock-filled causeway to Cape Breton Island in the 1950s that blocks ice flows. No breakwater is needed, no construction or maintenance dredging is required, and the straight is wide enough that a turning circle does not need to be constructed. Existing marine traffic is light.

The seabed is rock, and deep water is available very close to shore, requiring the construction of only a nominal jetty, 150 m long, from the shoreline to the loading platform,

to reach the 15-m water depth.

An adjacent material offloading facility will be installed for modules and materials, tug docking and ongoing services support.

A few projects will likely find a commercial path at some point in the future, but, in the meantime,producers are able to contemplate a viable and complementary near-term solution to the east.

Economics. The focus of this work is technical, but a brief discussion of economic issues provides a more complete profile. Compared to proposed British Columbian West Coast projects, Bear Head LNG provides a number of substantial economic advantages:

- Low-cost, energy-efficient, patented liquefaction process technology

- CAPEX ($/t) comparable with the best of the USGC projects

- Compact, five-module, mid-scale design, with minimal site hookups

- Optimal site location and civil/environmental/seismic conditions

- Available skilled labor pool and no camps

- Existing infrastructure and prior civil improvements

- Lower OPEX due to higher efficiency, better site accessibility and greater available regional infrastructure

- Low-risk pipeline featuring existing rights-of-way, no mountain range crossing and markets along the route

- No capital outlay by gas producers (i.e., all-tolling model)

- Viable and current monetization solution for Western Canada

gas reserves - Ability to “book” stranded gas reserves, increasing revenue replacement value and share price

- LNG cargo arbitrage opportunities within the Atlantic Basin and across the Middle East and Pacific Rim markets

- Diversity into resource holder’s global LNG supply portfolio.

Overall, it is anticipated that the Bear Head project can put LNG on the water in Nova Scotia for a lower total cost than West Coast projects, despite the longer pipeline transport requirements.

Takeaway. Substantial investments have been made by multiple parties intent on monetizing Western Canada shale gas resources via LNG projects on British Columbia’s coastline. These investments amount to many billions of dollars, including acreage acquisitions. Extensive infrastructure development needs, high project costs, environmental concerns and community issues have combined to effectively close this route as a viable solution to date.

A few of these projects will likely find a commercial path at some point in the future, but, in the meantime, producers are able to contemplate a viable and complementary near-term solution to the east. Gas producers have the opportunity to bring these resources to market now, by following the advice of Horace Greeley and looking in a new direction—this time, East instead of West.

End of series. Part 1 of this article appeared in the January/February issue of Gas Processing. GP

Literature cited

9 Canada National Energy Board, Government of Canada, “Marketable natural gas production in Canada,” December 4, 2017, online: https://www.neb-one.gc.ca/nrg/sttstc/ntrlgs/stt/mrktblntrlgsprdctn-eng.html

10 Gomes, I., “Natural gas in Canada: What are the options going forward?” Oxford Institute for Energy Studies, May 2015.

|

John G. Baguley serves as Chief Operating Officer for the Magnolia LNG and Bear Head LNG projects, and as Chief Technical Officer for LNG Ltd. His involvement in international LNG project development and delivery spans nearly 37 yr and includes project management, engineering, construction and commissioning roles. He holds a BS degree in chemical engineering from Michigan State University in East Lansing, Michigan, and is a registered Professional Engineer in Texas.

|

Scott Atha was formerly Director of LNG Marketing and Commercial Strategy for Bear Head LNG in Houston, Texas. He joined Bear Head from Gazprom Marketing and Trading, where he was responsible for leading the commercial development of long-term LNG supply and marketing opportunities in the Americas from 2007 to 2014. Mr. Atha has 15 yr of experience in the oil and gas industry, with concentrations in the LNG, midstream and upstream sectors. He holds a BS degree in industrial engineering from the Georgia Institute of Technology in Atlanta, Georgia.

Comments