Go East, young man: Eastern Canada offers viability for LNG projects—Part 1

The phrase, “Go West, young man” is widely credited to the American New-York Tribune newspaper editor and author Horace Greeley in the year 1865. The full text of the quote reads: “Washington is not a place to live in. The rents are high, the food is bad, the dust is disgusting and the morals are deplorable. Go West, young man, go West and grow up with the country.”

Greeley was addressing opportunities for soldiers who had the good fortune to survive the horrors of the US Civil War only to return to a civilian life where jobs were scarce as the nation demobilized from war footing. He was promoting the emerging West Coast as a new frontier of promise and opportunity.

An interesting parallel exists between Mr. Greeley’s advice and the current Western Canada natural gas market. In a time when old solutions are fading, becoming no longer viable or leading to potential risk and failure, turning in a new direction can create a fresh opportunity to succeed.

In the case of post-Civil War America, the new prosperity lay in the West. In the case of monetizing today’s Canadian gas markets, the opposite is emerging, with a new path to success now pointing East.

Canada’s gas markets. Canada became a natural gas superpower in the early 1950s due to prolific production in the Western Canadian Sedimentary Basin, an intrinsic need for heating to combat its cold climate, and a burgeoning petrochemical business in the eastern part of the country.

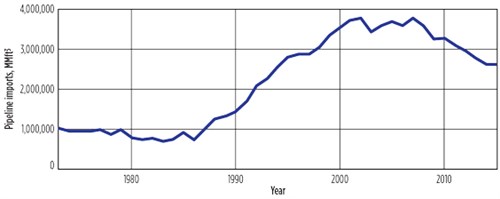

As Canada’s pipeline network and production capability continued to expand, significant quantities of natural gas production were exported to the US. For the 15-yr period from 1973–1988, the US-bound export volume averaged 1 Tft3y (2.7 Bft3d) (Fig. 1).1 From the late 1980s, this volume began to increase rapidly and steadily, reaching a peak of 3.8 Tft3y from 2002–2007 as US domestic gas production went into decline.

|

|

FIG. 1. History of annual US natural gas imports from Canada.1 |

In those peak export years of 2002 and 2007, Canadian exports to the US represented:

- 60%–62% percent of Canadian gas production2

- 30%–32% percent of US total gas supply.

A symbiotic relationship evolved, where US imports of Canadian natural gas represented both a significant export market for the Canadian source gas and a significant portion of the total US gas supply market.

By 2015 (latest reported information), this situation had changed dramatically. Canadian gas exports to the US had declined by 30%, from a peak of 3.8 Tft3y to 2.63 Tft3y. Despite a reduction in Canada’s total gas production during that time, the percentage of gas exported to the US declined from the peak of 62% in 2007 to 48% in 2015. The rationale for this decline is the emergence of shale gas production in the US. The geographic proximity of the Marcellus Shale reduced the need for imports from Canada as domestic US gas production climbed. In late 2016, the US became a net exporter of natural gas for the first time in history.

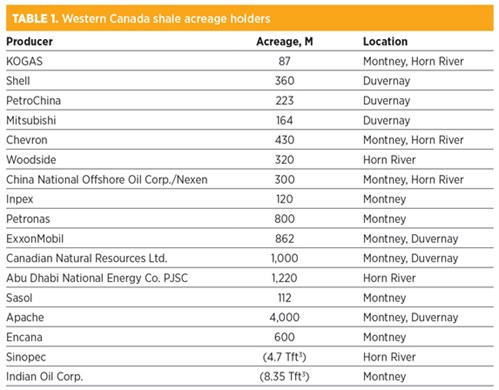

Despite this decline in the traditional market for Canadian natural gas, the shale oil and gas revolution also reached north of the border, including the Montney, Horn River, Duvernay, and Liard basins and the Cordova embayment. Both domestic and international resource development companies have invested heavily in Western Canada’s shale plays with the intent to bring these resources to the market. A sample listing of companies active in these plays is shown in Table 1 and includes some of the leading organizations in the LNG production and marketing business.

|

In the face of waning market demand from the southern direction, strong investments were made in these shale plays. These investments were based on a strategy to move the gas westward, over the Rocky Mountains, to the west coast of the Province of British Columbia for processing into LNG; and then further westward, by ship, to the premium markets of Asia and beyond.

Technical considerations: Unconventional gas as LNG feedstock. Traditionally, LNG liquefaction facilities have been supplied with natural gas feedstock from specific, dedicated stranded gas assets. These gas fields have been very large, with the expectation that they would supply the LNG facility for its 20-plus-year lifecycle to recoup the large upfront capital investment. While the gas composition from these fields was often variable, it was a known quantity, making determination of the design basis for the LNG plant a relatively straightforward task.

The situation is different with pipeline-fed liquefaction facilities. Pipeline gas can be classified as “unconventional” in this context, as the LNG facility has no direct control or involvement in the gas being supplied to the pipeline(s). It is provided from multiple sources and multiple fields that can be spread over vast geographic distances, and it can consist of conventional natural gas, shale gas, tight gas, biogas and coalbed methane. Variable commodity prices may impact decisions by producers over time regarding the extent of liquids extraction.

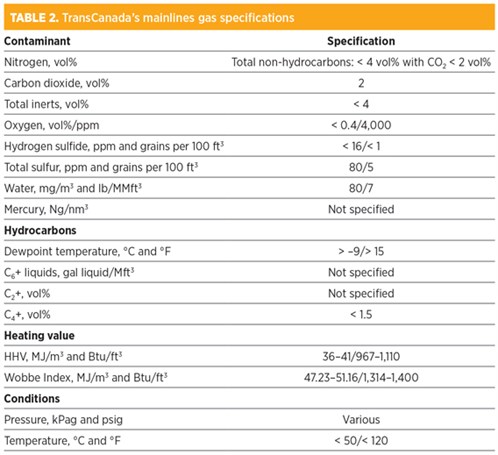

Gas reaching the project must also meet pipeline quality specifications stipulated by the companies that transmit the gas. The quality specifications include heating value, inert gas content, sulfur component limits and water content. Canadian pipeline quality specifications are regulated by the National Energy Board (NEB), and gas quality requirements for the long-haul lines across Canada are further regulated within these NEB requirements by pipeline owner/operator TransCanada.3

Gas transmission pipeline specifications for hydrocarbons, inerts and contaminants, such as sulfur components and oxygen (O2), are designed to allow numerous gas producers access to the natural gas network. Certain contaminants are tolerated at higher levels at small flows, as the commingled total flows in the system will dampen any adverse effects to end users. This fact is evident when reviewing historical gas compositional data of the main lines in the network, where actual levels of sulfur components, nitrogen (N2) and O2 are much lower than the pipeline limits.

Furthermore, historical reasons may exist for certain specifications—e.g., higher N2 specifications were introduced in the 1990s to enable heating value/Wobbe Index adjustment of imported LNG into networks (most common in the US). Higher O2 levels were permitted to provide access to biogas producers and gas storage sites in certain parts of the network.

Trace component analysis and design management are critical elements of successful LNG liquefaction facilities. The pretreatment systems of LNG plants accessing a pipeline network to source feed gas must be designed to ensure that the freezable materials are removed and that the LNG product meets export quality specifications to satisfy international buyers.

To achieve commercially reasonable facilities, LNG plant designers must ensure that pragmatic limits for contaminants and heavy hydrocarbons are defined with consideration of historical data from the gas supply sources, rather than relying solely on broad pipeline specification limits. Facility designers must take a measured approach to setting contaminant composition limits.

The potential for future variations in feed gas conditions must also be considered. Typically, both shale gas and conventional gas producers treat their gas near the source, based on the optimal economic conditions in play at the time, while remaining within pipeline specifications.

The most economic point for the extraction of mid-range (C2, C3, C4, C5) and heavy (C6+) hydrocarbons can change over time with market conditions. Consequently, knowing today how gas from certain fields is treated provides no precise assurance that this will always be the case. The design of LNG liquefaction facilities requires maximizing feed gas flexibility while avoiding unnecessary cost for the installation of treatment systems that may never be required.

The potential for variances can be even greater depending on where a facility is located. Liquefaction plants in eastern Canada may need to accommodate gas from such disparate locations as western Canada (Horn River, Montney), offshore Nova Scotia, offshore Newfoundland, and Marcellus in the US.

Heavy hydrocarbon removal (HHR). Pipeline natural gas can be classified as a light feed gas, yet it can also have a heavy tail. This type of feedstock can be challenging to LNG plant designs, as the heavy hydrocarbon components (C6+) are present in sufficient quantities to cause freezing and blockage in the liquefaction unit, yet the middle hydrocarbons (C2–C5) are largely absent (having been removed for sales upstream), complicating HHR operations. HHR processes that can be considered for treating these light pipeline gases feeding LNG facilities include:

- Conventional scrub column designs: Simple and cost effective, but the absence of feedstock middle hydrocarbons makes the traditional scrub column HHR process ineffective, as these mid-range components are not available for column reflux. LNG plants with light gas feed and this type of HHR system have proven to be challenging to operate. It is theoretically possible to import a mid-range hydrocarbon (i.e., C5) to serve as a reflux agent, but calculations have shown that the continuing losses/makeup quantities would be impractically high.

Like all two-phase separation systems, the operating pressure of the feed gas must be reduced from common pipeline pressures to below the critical point to enable distillation and separation. Licensed design optimized systems have been developed by at least one proponent (IHI E&C), which has applied for a patent on this design.4 Other optimizations intended for scrub column lean feed gas have been proposed.5 - Refrigerated extraction: Facilities with multiple levels of refrigeration available and sufficient refrigeration installed capacity can consider the use of a chiller system to simply condense the heavy hydrocarbons from the feed gas. The functionality of such a design over the expected range of heavy hydrocarbons would need to be carefully considered to ensure effectiveness in all potential situations. As with all two-phase separation systems, the chiller system must operate at a reasonable margin below the critical pressure.

- Turboexpander processes: Various open-art and proprietary processes can be applied. The feed gas pressure is decreased across a turboexpander, reducing both the enthalpy and gas pressure, and resulting in an increased temperature drop compared to a simple expansion across a valve or an orifice (where dH ÷ dP = 0, theoretically). These types of systems typically include a combined expander-compressor unit (“compander”) to improve efficiency. Overall, they are more complex and costly than the traditional scrub column designs, but are very flexible in operation. They readily accommodate light feed gas with a heavy tail, as well as a wide range of feed gas compositions. Operation below the critical point pressure is necessary.

- Adsorbent processes: A number of suppliers offer regenerative adsorption processes to extract heavy hydrocarbons from natural gas feedstock while allowing the methane and mid-range hydrocarbons to pass through the system. The potentially significant advantage to this approach is that it eliminates the necessity to reduce the feed gas pressure to below the critical point, which can then enable greater efficiency in the LNG facility through liquefaction at higher pressures and/or elimination of feed gas booster compression. This process is reported to have been applied to smaller peakshaving liquefaction facilities, but is not known to have been applied to export-scale plants.

Refrigerant extraction. Conventional LNG plant feed gas has contained sufficient quantities of mid-range hydrocarbons to enable extraction, fractionation and use as makeup to the refrigeration circuits. With these cuts already extracted upstream from pipeline-fed plants, all refrigerants must be imported over the life of the project. The import refrigerant logistics, supply chains and storage quantity requirements must be carefully assessed to ensure that there is no potential impact on the operational reliability of the facility. In particular, any refrigerants that are lost due to the need to partially deinventory/depressurize refrigerant loops to enable compressor restarts (i.e., with single-shaft gas turbine compressor drives), following shutdowns or trips, must be considered in the quantity balances.

Feed gas CO2. Pretreatment facilities must remove feed gas CO2 to below 50 ppm (0.005 vol%) to avoid freezing in the cryogenic sections. Table 2 shows that TransCanada’s mainlines specification for CO2 is < 2 vol%. Historical data for actual gas composition shows that concentrations of well under 2% are expected. A 2 vol% maximum percentage is also typical for US interstate pipelines.

|

Feed gas nitrogen. Excessive N2 levels in feed gas can both reduce the liquefaction capacity of LNG facilities and result in off-spec LNG. High N2 can also impact LNG plant fuel systems, as it boils off/flashes from LNG preferentially. US pipeline specifications for N2 were generally established by the US Federal Energy Regulatory Commission (FERC) at a maximum of 4 vol%, significantly above historical measured values, to enable LNG importers to adjust the Wobbe Index/heating value of heavier imported LNG to meet US requirements. TransCanada’s mainlines incorporate the maximum N2 concentration into a total inerts limit (basically N2 + CO2) of 4 vol% maximum. As with CO2, measured values are significantly below these limits.

Feed gas oxygen. High O2 levels in feed gas can cause degradation of acid gas removal unit solvents and require the removal of the degradation products from the circulating system. Depending on the configuration of the molecular sieve driers and mercury removal unit selected, high O2 can also result in water entering the cryogenic liquefaction section, causing freezing and blockage. Based on historical measured values, an O2 level of less than 5 ppm volume is expected, while the pipeline maximum allowable level is substantially higher (2,000 ppm for US line gas and up to 4,000 ppm for TransCanada mainlines). The extremely high TransCanada O2 limit was established to enable biogas producers to blend their gas product into the mainlines.

Sulfur. Sulfur in LNG plant feed gas represents a unique challenge, as the total sulfur can comprise a broad spectrum of compounds (e.g., H2S, COS, dimethyl sulfide, methyl mercaptan, ethyl mercaptan, iso-propyl mercaptan and others), while pipeline specification limits typically address limits as total sulfur only.

Different sulfur species respond in different ways to treatment. For instance, while H2S, COS and methyl mercaptan are readily removed in the acid gas removal unit (AGRU), typically using an activated MDEA aqueous solvent, other mercaptans are transparent to aqueous solvents. These other mercaptans end up being removed in the molecular sieve beds (and then entering the fuel stream) or are passed through the pretreatment process and remain in the LNG product. The species removed in the AGRU are combusted to SOx and either removed by adsorption beds or discharged to the atmosphere, depending on local regulations. Alternately, sulfur removal beds can be located upstream of the AGRU to capture specific species to avoid their discharge to atmosphere.

Overall, pipeline gas can be classified as an unconventional feedstock to a conventional LNG plant. Rational design assessments and practices must be utilized to provide a facility that is both cost efficient and able to accommodate a reasonable degree of variation in the feed gas composition. Opportunities for modifications in the case of long-term structural changes in the gas supply market must be identified and considered in the design.

Canadian exports—The case for the West. The number of LNG liquefaction facilities and the total quantities of exports proposed for the Canadian west coast province of British Columbia (BC) are astounding. Nominally, 20 different facilities, most with multiple LNG trains, that would collectively produce more than 240 metric MMtpy, have been put forward by BC project proponents. This capacity is nearly equivalent to the total amount of LNG traded globally in 2015. Exporting this quantity of gas would require an incremental supply of 14 Tft3y of natural gas (including retainage and losses) or an increase in Canadian gas production to 3.5 times existing domestic production.

Meeting this scenario is unrealistic. Even if the production rates and associated infrastructure could be permitted, approved and built, the global market could not absorb the new export volumes. However, these plans do demonstrate the tremendous interest in developing LNG export facilities in Western Canada, even if only a small percentage of the proposed projects reach completion. Several driving forces for such developments exist:

- High gas availability. The total estimated quantity of shale gas in Western Canada (British Columbia, Northwest Territories, Alberta, Saskatchewan and Manitoba) amounts to 2,240 Tft3, of which the US Energy Information Administration identifies 538.4 Tft3 as technically recoverable.6 Even at the full 14 Tft3y (240 metric MMtpy) of LNG exports, this represents nearly a 40-yr supply.

- Limited regional gas demand. Western Canada has limited competing industrial demand for gas resources of this scale.

- Low production costs. Production prices are not published, but the Alberta Province natural gas price forecast remains below US$3/MMBtu through 2019. The AECO Alberta hub pricing is projected to maintain a discount to US Henry Hub pricing of nominally US$0.60/MMBtu–US$0.70/MMBtu through 2019.7 This forecast indicates that the gas is being produced at a profit at low sales values. A 2014 Canadian Energy Research Institute (CERI) report identified breakeven gas production costs at that time to be in the range of US$0.10/MMBtu–US$3.00/MMBtu, depending on the volume of associated liquids obtained.

- Proximity to Asia. Shipping distances from the Canadian West Coast to Asia are advantageous compared to many other potential LNG project sites. This transit route reduces the delivered cost of LNG to these prime locations.

- Geopolitical stability. Canada has a very stable business environment, although achieving various approvals can be challenging, as will be later discussed. Once a plant is permitted, it will remain that way; the rule of law provides decades of assurance.

- Favorable climate. The cool and constant temperatures on the BC coast enable projects to obtain relatively high efficiency and stable annual production, compared to less-temperate regions of earth.

Challenges to project feasibility. Despite the advantages delivered by these elements, BC projects face three fundamental challenges that have stymied development to date. Of the approximately 20 projects and 240 metric MMtpy of capacity proposed, not a single BC project has reached a true final investment decision (FID) as of the beginning of 2017.

- Environmental challenges. Obtaining the necessary environmental approvals for both the LNG project sites and the associated pipelines over the Rocky Mountains has proven to be a difficult exercise. Only a few of the proposed BC projects have managed to successfully navigate a Canadian regulatory path that incorporates a wide range of federal, provincial and local jurisdictions—most notably Shell’s LNG Canada project, Chevron’s Kitimat terminal and the private Woodfibre LNG project.

These approvals have come at great cost, with numerous remaining challenges. For example, the Pacific NorthWest LNG project, which was to be built on Lelu Island 750 km north of Vancouver, received environmental approval but had 190 conditions to resolve. The project was ultimately canceled in July 2017. - First Nations, community and special interest concerns. In Canada, First Nations refers to organized indigenous aboriginal groups or communities, especially any of the bands officially recognized by the Canadian government. Project proponents must work effectively and collaboratively with First Nations, and with any other interested community parties, to ensure that their cultures, customs, traditional knowledge and concerns—including sustainability and environmental protection—are adequately addressed (Fig. 2).

- Cost challenges. The majority of the Western Canada LNG project sites are remote and unsupported by existing infrastructure. Suitable terrain for LNG plant construction and waterways for LNG shipping and berthing are scarce. Pipeline construction over multiple mountain ranges to connect project sites to upstream gas production adds a further complication. Access for large construction workforces and materials delivery is challenging. LNG plant construction craft labor skills are limited in the region. The climate, although temperate, is often wet, foggy and windy, with occasional heavy snowfall. The investment necessary to overcome these challenges can be substantial, including the costs of building the worker housing camps and other temporary facilities to enable pipeline construction.

|

|

FIG. 2. British Columbia LNG project opposition. |

The first two challenges potentially can be accommodated for at least some of the proposed projects. However, the challenge of project cost represents a severe competitive disadvantage compared to other viable project locations, such as the proliferation of proposed projects on the US Gulf Coast (USGC), with project capital costs in Western Canada projected to be as high as 4.5 times those of the most cost-efficient USGC facilities on an equivalent basis.8

Part 2. In March/April, Part 2 of this article will develop the case for moving Canadian gas exports eastward, including advantages, challenges and solutions. It will compare and contrast key elements in “West vs. East” LNG export opportunities. GP

Literature cited

- US Energy Information Administration, “US natural gas pipeline imports from Canada,” 2017, online: https://www.eia.gov/dnav/ng/hist/n9102cn2A.htm

- Government of Canada, National Energy Board, “Marketable natural gas production in Canada,” 2017, online: https://www.neb-one.gc.ca/nrg/sttstc/ntrlgs/stt/mrktblntrlgsprdctn-eng.html

- TransCanada, “Customer express,” 2017, online: http://www.tccustomerexpress.com/search_results.html?q=terms&x=0&y=0

- Shah, K., E. Browning and P. Saxena, “Tackling the issues with pipeline gas contaminants for LNG export facilities,” IHI E&C, Canada LNG Export Conference and Exhibition, May 11, 2016, online: http://ihi-ec.com/wp-content/uploads/2016/08/Tackling-Issues-Associated-with-Pipeline-Gas-Contaminants-for-LNG-Export....pdf

- Kameta, et al., “Lean LNG plants—Novel heavy hydrocarbon removal technologies for efficient liquefaction,” LNG 18, April 12–15, 2016, Perth, Australia.

- US Energy Information Administration, “Technically recoverable shale oil and shale gas resources: Canada,” September 2015, online: https://www.eia.gov/analysis/studies/worldshalegas/pdf/Canada_2013.pdf

- Gomes, I., “Natural gas in Canada: What are the options going forward?” The Oxford Institute for Energy Studies, May 2015, online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2015/05/NG-98.pdf

- Gaffney, Cline and Associates, LNG World Shipping, January 28, 2016.

Comments