Gas Processing News

HIMA supports safe operations at Ichthys LNG

HIMA, an independent provider of smart safety solutions, has signed a long-term service contract with INPEX to support the maintenance of the safety instrumented systems at the Ichthys LNG project in Australia. Under the scope of the contract, HIMA will provide a comprehensive safety service framework.

|

HIMA has been engaged in work on the Ichthys LNG project since 2009. It supplied the project’s safety instrumented system, fire and gas systems, emergency shutdown and high-integrity pressure protection system, among others.

Moving into the operational stage, HIMA is now continuing the relationship with INPEX on the Ichthys LNG project. HIMA will be responsible for supporting INPEX in maintaining the safety instrumented systems on Ichthys LNG, including the supply of parts, along with services to ensure that the safety system is permanently operating at its optimum.

Operated by Japan’s INPEX, the Ichthys gas field represents the most extensive discovery of hydrocarbon liquids in Australia in more than 50 yr. It is expected to produce up to 8.9 MMtpy of LNG and 1.6 MMtpy of LPG at peak, with up to 100 Mbpd of condensate at peak.

The Ichthys LNG development includes both offshore and onshore facilities, including a floating production storage and offloading vessel, central processing facility and onshore LNG plant, with an accompanying 890 km of subsea pipeline.

DNV GL sees shifts in shipping on energy transition

DNV GL recently published its “Maritime Forecast to 2050,” which analyzes the impact of

the changing global energy system on the shipping industry through 2050.

|

The report explores how expected shifts in energy production and demand, GDP growth, industrial production and regional manufacturing could change the maritime industry, and the impact of those shifts on individual ship segments.

DNV’s Energy Transition Outlook shows that, by mid-century, the energy supply mix is likely to be split equally between fossil fuels and renewable energies. Advances in energy efficiency will cause global demand for energy to flatten after 2030. These trends are expected to impact all participants in the maritime sector.

The forecast projects that shipping will continue to experience robust growth heading to 2030. From 2030 to 2050, demand is expected to continue to increase, but less rapidly, with the growth occurring primarily in non-energy commodities, such as the container trade and non-coal bulk.

In addition to changing energy production and export patterns, shipping’s fuel mix will become more diverse. In 2050, oil will remain the main fuel option for trading vessels, but natural gas will become the second-most widely used fuel, and new low-carbon alternatives will proliferate.

The current wave of digitalization transforming the energy industry is also anticipated to have a profound impact on shipping by advancing design and operation and creating new business models.

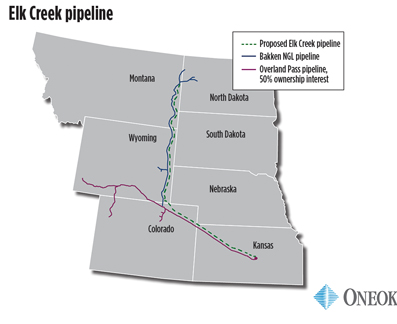

ONEOK to build NGL pipeline in Rocky Mountain region

ONEOK Inc. announced plans to invest approximately $1.4 B to construct a new pipeline and related infrastructure to transport NGL from the Rocky Mountain region to the company’s existing mid-continent NGL facilities.

|

The Elk Creek Pipeline—a 900-mi, 20-in.-diameter pipeline that is expected to be completed by the end of 2019—will have the capacity to transport up to 240 Mbpd of unfractionated NGL from near the company’s Riverview terminal in eastern Montana to Bushton, Kansas.

The Elk Creek Pipeline is anticipated to cost approximately $1.2 B, with related infrastructure costs expected to total approximately $200 MM. The pipeline will have the capability to be expanded to 400 Mbpd with additional pump facilities.

The Elk Creek Pipeline is anchored by long-term contracts, with terms ranging between 10 yr and 15 yr and totaling approximately 100 Mbpd, supported primarily by minimum volume commitments.

The pipeline project is part of ONEOK’s $3 B–$3.5 B of potential capital growth projects. The company expects to finance the Elk Creek Pipeline with a combination of new equity, including approximately $450 MM of net proceeds received from common stock issued during 2017 under its “at-the-market” equity program, with cash from operations in excess of dividends and short-term and long-term borrowings.

GTT acquires shipping firm Ascenz

GTT has acquired 75% of the share capital of Ascenz from Chia Yoong Hui and Sia Teck Chong, its two executive founders, and from several investment funds. Based in Singapore and specializing in “smart shipping,” Ascenz designs operational monitoring and performance optimization systems for vessels. Ascenz’s solutions enable ship-owners to achieve significant fuel savings and ensure vessel compliance with environmental standards.

The shipping industry is increasingly opening up to new uses and services driven by digitalization. In this context, the energy efficiency systems marketed by Ascenz are meeting with growing success among ship-owners.

This transaction reinforces GTT’s service portfolio in the area of LNG shipping. The two co-founders of Ascenz will retain 25% of the share capital and will continue to manage the company, notably to contribute to the implementation of the synergies between the two companies.

Comments