Manage risks for trans-country pipeline projects: India case study—Part 2

Sourcing gas by investing in a trans-country pipeline is an option being considered for India. It has potential to improve the country’s energy mix, economy and per-capita energy consumption. The outcome of a situational analysis and a SWOT analysis (discussed in Part 1 of this article) supported the investment to meet project objectives. According to an Energy Politics in Eurasia (ENERPO) journal report from May 2016, the opportunity for India exists primarily in sourcing gas from large producers such as Russia, Qatar, Iran and others through trans-country gas pipeline projects.

The Project Management Institute (PMI) describes project risk as: “An uncertain event or condition that, if it occurs, has a positive or a negative effect on at least one project objective, such as time, cost, scope or quality.” Multiple factors inherent in these projects create or increase project uncertainty, which mandates both risk analysis and financial analysis for decision-making on project appraisal.

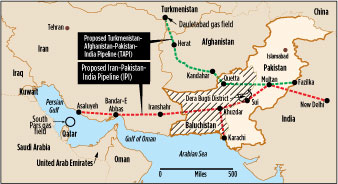

The following sections elaborate on both qualitative and quantitative risk analysis. The procedures and techniques used in this study may include other available project options; however, this case study is limited to two specific projects—the Turkmenistan–Afghanistan–Pakistan–India (TAPI) pipeline and the Iran–Pakistan–India (IPI) pipeline (Fig. 1).

|

|

Fig. 1. Proposed routes for the TAPI and IPI pipeline projects. |

TAPI pipeline project. The TAPI pipeline is proposed to be approximately 1,800 km in length and would export up to 33 Bcm/yr of natural gas from the Dauletabad gas field in Turkmenistan. The countries agreed, in principle, that India and Pakistan would equally share approximately 1 Bft3d, while Afghanistan would take 0.2 Bft3d.

TAPI Pipeline Co. Ltd., incorporated in November 2014, appointed Turkmengaz as consortium leader. GAIL (India) Ltd. and Inter State Gas System Pvt. Ltd. signed a sales purchase agreement as a first step. The Asian Development Bank (ADB) was appointed as transaction advisor.

IPI pipeline project. Iran holds the world’s second-largest natural gas reserves. However, due to sanctions, proven reserves remain under-developed. The IPI pipeline project—also known as the “peace pipeline”—has drawn international attention as a rival to the TAPI project. It envisaged sourcing gas from Iran for delivery to Pakistan and India. The project had an estimated cost of approximately $7 B in 2005 and would bring a total of 5.2 Bft3d of gas to Pakistan and India.

Under the plan, each country would build a pipeline in their respective territories. Iran constructed a 1,172-km pipeline from Asaluyeh to the Iran-Pakistan border and signed a formal agreement with Pakistan in 2010. However, due to international sanctions, progress on the project thawed. India has kept open the option of rejoining the negotiation.

According to a 2013 ADB report titled, “An overview of energy cooperation in South Asia,” no significant further progress has been made on the project, and investors have expressed diminished interest.

Project success criteria. Both the TAPI and IPI projects have similar project success criteria and project rationale. Situational and SWOT analyses gave similar results. Mr. Klaus Gerhaeusser, Director General of the Central and West Asia Department at the ADB, said in 2012 of the TAPI project, “The pipeline represents a win-win scenario for each TAPI country, as it will give Turkmenistan—with the world’s fourth-largest [gas] reserves—more diverse markets and help fuel the energy-hungry economies to the South. Each country stands to gain, making this not only the ‘peace pipeline,’ but a pipeline to prosperity, as well.”

The Central Asia Regional Cooperation (CAREC) strategy for regional cooperation in the energy sector identified TAPI as one of the links in the energy interrelationship among CAREC countries. The project would accomplish this by ensuring energy security through balanced development of regional infrastructure and institutions, stronger integration of markets and economic growth through enhanced energy trading. The IPI project’s success criteria was also found to be strategically aligned with CAREC objectives.

|

Project risk analysis. The project study analyzes and identifies which of the projects is the best fit for the region, has minimal risk and satisfies multiple objectives. The Institute of Risk Management (IRM) has identified four key risks, which are externally driven and beyond control.

- Financial risk

- Strategic risk

- Operational risk

- Hazard risk.

These four risks are examined in the following sections, using a qualitative risk analysis.

Financial risk. Prime factors for economic viability of a project are completing the project within estimated costs and envisaged revenues. Any significant departure from these estimates generates financial risk. The probability of cost overrun is high for complex projects due to technical uncertainties (e.g., challenging terrain, resource mobilization, etc.) and political uncertainties. Furthermore, multibillion-dollar projects rely on loans. The impacts of foreign exchange fluctuation and interest rates also contribute to financial risk.

The mechanisms of public-private partnerships (PPP) and build-own-operate (BOO) implementation serve to manage the financial risk of projects.

|

Strategic risk. Political uncertainties may change the priorities of investor countries, cause project delays or cancellation, or bring revenue loss. Adverse impacts to revenue inflow will lower the return on investment (ROI), thereby jeopardizing the project.

The governments of Turkmenistan, Afghanistan, Pakistan and India have established a natural gas pipeline consortium under a PPP. This mechanism may mitigate risk for the proposed TAPI project if the owners implement the project slowly. However, the success of the project remains reliant on the strategic intents of the participating governments.

Another project organizing strategy is to adopt the BOO route. The BOO contractor of a project usually obtains revenue through a fee charged to the project owner. The project owner (investor) directly takes tariffs charged to consumers. For the proposed TAPI project, the BOO operating company, TAPI Ltd., would use its business expertise, technical skills and resources to mitigate risk. A similar strategy to circumvent risk is envisaged for the proposed IPI project.

Operational risk. As the gap between demand and supply of natural gas is high, the operational risk from consumers and competition is deemed low. However, technical risks run high for the two proposed projects. Almost 50% of the land area of Pakistan and Afghanistan is mountainous. This difficult terrain can be a challenge for workers and heavy machinery.

In addition, the area’s snow-fed rivers are prone to flooding in the summer months, which creates a challenging climatic condition in which to operate the pipeline. Moreover, the portions of the planned pipeline route located in the seismic zone have an increased probability of disruption. The challenges to design, construction, regular maintenance and operation of the pipelines contribute to higher operating cost.

The TAPI and IPI pipelines are characterized by similar operational risks. These risks could be controlled or mitigated by engaging experienced expert consultants and contractors.

|

Hazard risk. India’s Health and Safety Authority states that hazard risk must be assessed for financial, legal, moral and ethical reasons. Accordingly, hazard risk must be eliminated, substituted, isolated or addressed with suitable control measures.

To assess and eliminate such hazard risk, the engaged agencies must have the requisite experience, competence and knowledge. It is imperative that efficient and effective project management be established to ensure the mobilization of resources and expertise required for putting in place control measures and emergency preparedness to avoid safety incidents from flammable natural gas.

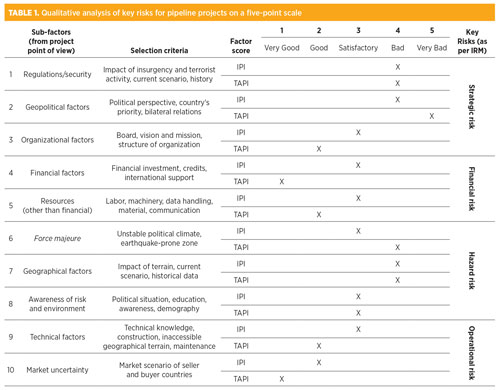

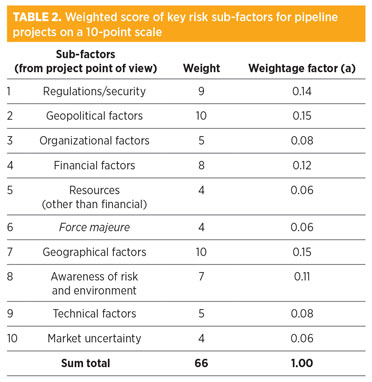

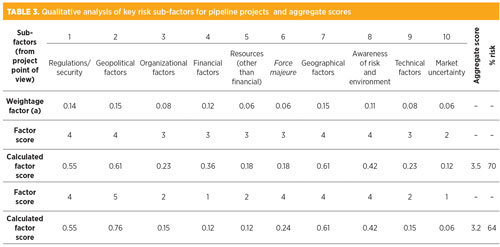

Project risk assessment using a decision-making tool. Project risk assessed for the two competing pipeline projects includes both qualitative risk and quantitative risk, using the weighted factor scoring model as a tool (Tables 1, 2 and 3). With this methodology, the quantified score enables decision makers to assess risks, compare options and make informed decisions. Projects with higher scores involve higher risk.

Risk assessment and outcome. Qualitative analyses are shown in Table 1. Four key risks are identified and considered. Each key risk is broken down into sub-factors for each alternative, and each sub-factor is given a factor score under a five-point scale: very good (1), good (2), satisfactory (3), bad (4), very bad (5).

Quantitative analyses are shown in Table 2 and Table 3. Each sub-factor is assigned weight in a 10-point scale, where the factor with the least risk and impact on the project is scored as “0” and the factor having the most risk and impact is scored as “10.” The weightage factor is calculated for each sub-factor, as summarized in Table 2. The factor score is then calculated, giving an aggregate score. The percentage of the aggregate score gives the percent risk factor for each project alternative, as summarized in Table 3.

The outcome of the aggregate score—i.e., the percent risk factor—for the TAPI project is 3.2 (64%). For the IPI project, it is 3.5 (70%). The aggregate risk of the IPI project is comparatively higher than that of the TAPI project, although it is in a similar range.

Recommendations. The diversification of India’s energy mix and an increase in the volume of environmentally friendly fuel will pave the way for enhanced energy security. Risk analysis, combined with financial analysis, is required to examine high-CAPEX project proposals for different scenarios and countries. The likelihood of project success can be appraised with the help of qualitative and quantitative risk analyses. Project risk must also be managed throughout the entire lifespan of the project, and this case study suggests that project risk management can be a strategic initiative.

Developing India aims to sustain its GDP growth and provide energy access to a wider spectrum of the population. A situational analysis shows that sourcing low-cost, environmentally friendly gas from neighboring nations will not only have a positive impact on per-capita energy consumption, industry and the economy, but it will also provide a platform for sustained trade relations, broaden employment avenues and encourage a win-win solution for investing countries.

However, undertaking such mega-projects requires elaborate risk assessment for informed decision-making. Proposed projects like TAPI and IPI can offer avenues for pinpointing how developing countries with similar challenges may improve per-capita energy consumption and sustain growth. As the future unfolds, it will become clear how stakeholding countries set priorities to successfully harness risk and capture opportunities. GP

|

Anindita Moitra, Deputy General Manager—Projects at Indian Oil Corp. Ltd., has more than two decades of experience in project management. At present, she is pursuing a PhD in business management (corporate governance) and holds a first-class MTech degree from Calcutta University in Calcutta, India, as well as a first-class MBA degree, with specialization in general management, from ICFAI Business School in Hyderabad, India. Ms. Moitra was a GATE scholar, and received honors with her BSc degree from Calcutta University. She was also the recipient of the Best Performer medal during the Hybrid Certificate Program in project management from U21 Global in Singapore, and holds an executive diploma in project management. She has also received a number of women executive awards for her work in the Indian oil and gas sector, particularly with regard to project management. Ms. Moitra has presented papers on project risk management at events organized by Hydrocarbon Processing in Houston, Texas; and on corporate governance at the Business School (Kolkata). She is a member of the All India Management Association (AIMA).

Comments