Embracing innovation and diversity in liquefaction technology—Part 1

The LNG liquefaction business has witnessed many transitions as it has moved from the remotest corners of the world to settle in more developed industrial environments, including the US Gulf Coast (USGC). The innovative combination of elements from existing technologies, together with creative engineering designs, introduces an optimized facility process and execution profile to enable the successful realization of projects in these new market conditions.

Departure from the “tried and true” is viewed with a healthy and appropriate dose of technical and commercial skepticism. However, the application of proven technologies—including one with over 100 yr of industrial experience—makes it possible to introduce enhancements to the LNG production process and generate surprisingly beneficial results. The increasing importance of thermal efficiency in LNG liquefaction facilities is addressed, including the appropriate selection of refrigeration compressor drivers as a means to lower GHG emissions, enhance production and facilitate startup.

Using an ongoing USGC project as a case study, the effects of recovering waste heat to drive the precooling process are discussed and quantified. A discussion on the available alternatives for precooling refrigerant is also presented. In Part 2, the application of a proprietary single mixed-refrigerant (SMR) liquefaction process in a mid-scale LNG project will be explored, in which existing technologies are combined in an innovative manner to improve key project attributes, enabling the delivery of a creative, reliable and efficient design.

Evolution of the LNG market. The foundations of the global LNG industry were established on the firm bedrock of safety and reliability, consistent with the demands of a closed market with carefully balanced supply and demand. For the producers, the capital investments necessary in the LNG value chain have always been substantial, often with extended payout periods requiring a high degree of certainty in the revenue streams to ensure the financial viability of the projects.

For consumers, access to a reliable supply of LNG has been vital to electricity generation, industrial consumption and domestic use underpinning national economies. The solution was a closed market with point-to-point deliveries from specific producers to specific consumers using dedicated shipping. These operations were locked under long-term, highly restrictive contracts intended to protect the interests of all parties. Energy and capital efficiencies were important, but somewhat secondary, considerations within the greater equation of project viability.

Today, the LNG market is changing. While long-term “take-or-pay” contracts still dominate the industry, an emerging market of spot cargoes, short-term contracts and arbitrage opportunities is freeing up opportunities for nimble producers. Nominally, 70% of the world’s LNG still trades (at least initially) under the historic long-term contract model; however, this percentage is slowly and steadily dropping as more producing nations and facilities enter the market.1

Throughout this market evolution and increasing flexibility in the value chain, LNG baseload production facilities have remained substantially unchanged. This extended design inertia in the face of changing industry dynamics has created the opportunity to take a fresh look at production facilities to generate innovation and diversity in the production market.

LNG construction trends. Since the inception of the commercial LNG industry in the 1960s, LNG projects have maintained certain defining characteristics:

- Historically, LNG projects have been limited to the domain of large, integrated national and international oil companies. Only major organizations of this nature have had access to the technical, financial, logistical and managerial resources to successfully deliver projects of this cost and complexity.

- Facility owners have traditionally been involved in the development of the entire gas supply value chain, from gas field discovery and assessment through production well installation, feed gas pipelines, LNG facilities, shipping and marketing of the product.

- LNG proponents have been (or have partnered with) highly mature organizations with extensive global engineering standards, processes, procedures and existing operational petrochemical facilities.

- LNG facilities have been located in some of the world’s harshest and most remote environments—challenging to reach, let alone to operate successfully within (Fig. 1).

- Extensive logistics programs have been vital to operations and to the success of the projects. The absence of local or regional facilities are a hallmark of LNG sites, and excellence in logistics planning and execution is essential to mere existence.

- Massive infrastructure development programs are necessary, sometimes requiring years to complete. The project sites can be hundreds of km from existing regional infrastructure. They may lack roads, docks, marine facilities, food, water, shelter, electricity, communications, emergency response and security capacity. They may also be subject to extreme weather conditions. The costs of these infrastructure developments can run into the billions of dollars while providing zero direct return on their investment.

- Regulatory programs at many of the traditional sites are loosely defined (if existing at all), with no previous industrial development of a similar nature. Overlaps, conflicts and gaps between local, regional and national requirements can exist.

- LNG facilities in these locations potentially represent life-changing and culture-changing transitions in local communities. Great care and planning must be taken to ensure that the new facilities and the associated construction and operational workforces can harmonize with the region, providing a positive catalyst for necessary and positive changes without altering the nature of the communities being served.

|

|

Fig. 1. A typical remote LNG project site. |

With the emerging migration of LNG projects to the US Gulf Coast and other economically and structurally developed regions, the project and proponent profile has changed radically and rapidly. Key differential characteristics of projects under development include:

- Brownfield or brownfield-type environments. Many of the new US export facilities are converted import terminals with existing storage and marine facilities.

- Small, lightly funded, lightly staffed emerging owner organizations with total company headcounts in the 100s rather than the tens of thousands.

- Limited infrastructure development requirements. Sites may have access to nearby regional power grids, water, roads, ports, telecoms, security and hospitals.

- Ready access to well-established regional supporting industries, often located amidst the world’s largest petrochemical complexes.

- Ready access to supporting expertise—suppliers, contractors, subcontractors, engineers, craft skills, vendor service centers and representatives.

- Broad choice of readily available specialty chemicals and refrigerants.

- Third-party gas supply from a national grid accessing multiple providers.

- Well-established regional and national regulatory processes with extended schedules.

- Increased sensitivity to greenhouse gas emissions. (Note: Whether one agrees or disagrees with the impact of greenhouse gases on the global environment, there is certainly an enhanced interest in the topic).

- Background air emissions from existing regional industries that must be incorporated into plant emission modeling and limits.

- Greater attention paid to plant energy efficiency. Energy efficiency has always been a consideration, but at remote sites the gas is essentially “free,” as it has no regional value unless converted into a transportable product such as LNG. On the USGC, LNG facilities must pay for every Btu of gas they receive from a pipeline, so efficiency and its impact on project finances become more important and visible.

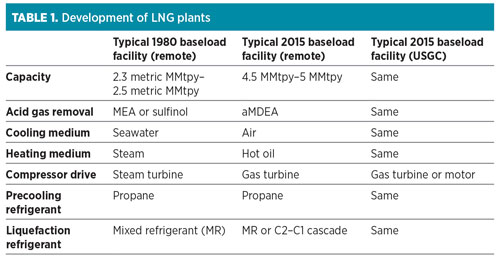

Fundamentally, this is not LNG “business as usual.” Yet, despite these substantial structural changes, the vast majority of LNG plant development in North America is proceeding on the same technical and execution bases as the historical remote site facilities (Table 1).

|

From Table 1, the most significant changes over a 35-yr period from 1980 to the present include:

- Nominal increase in capacity by 100%

- Migration from water-cooled to air-cooled

- Migration from indirect-fired steam turbine drive to direct-fired gas turbine drive

- Emergence of the cascade liquefaction process as a baseload technology.

Table 1 also shows that the migration of LNG facilities from remote environs to the substantially more industrially developed USGC has resulted in virtually no changes. The US/USGC facilities being constructed or newly in operation at Sabine Pass, Corpus Christi, Cameron, Freeport, Cove Point and Lake Charles Trunkline are virtually indistinguishable from their remote-site cousins, despite the substantial structural differences highlighted previously.

Barriers to innovation. Humankind inherently resists change. A report in the November 2010 Journal of Experimental Social Psychology2 concluded that the longer something is believed to have existed, the more highly it is regarded. The nature of the LNG industry—characterized by high development costs, long development schedules, delivery contracts of up to 20 yr, criticality of supply reliability to importers and limited alternate sources—does not lend itself to risk taking. Several key groups must be satisfied with the project design concepts and arrangements to enable a project to move forward to market:

- Investors: For small companies requiring access to external funding sources, investors must be confident in the technology. This confidence enables the initial development funds to be secured, thereby allowing the project to be advanced through the design, estimation and regulatory processes. For an LNG project, this level of investment can be significant (in excess of $100 MM from inception to start of EPC when bank funding can be secured), and the entire development cycle, from initial activities through to LNG production, can span 6 yr–7 yr. High costs and long durations require a high degree of confidence by investors that the project and its technology will eventually generate a return on their investments.

- LNG purchasers: When an LNG buyer signs up with a producer to provide LNG (through a tolling arrangement or a conventional sales purchase agreement), the buyer takes itself out of the market for that volume of LNG near the start of the project’s EPC phase, nominally 3 yr–4 yr prior to the actual delivery. The buyer makes onward commitments for the sale or use of that LNG and, consequently, must have confidence that it will be available as contracted, as alternate sources may be unavailable or characterized by unacceptable economics. As with investors, the purchasers of LNG cast a wary eye on anything considered novel or new, as this represents a risk to their business models and onward commitments.

- Lenders: Lending institutions are vital to developing projects, providing access to the significant capital requirements of LNG projects amounting to billions of dollars. Obviously, these organizations are not charities; they expect timely repayment and take a dim view of any perceived risks to reimbursement. The lenders must be confident that the facility will reliably and safely deliver LNG over its design life.

- Insurers: LNG facilities must obtain insurance coverage during the construction, startup and operational phases. This coverage should include construction risk, delayed startup, business interruption and operations coverage. Insurance organizations closely review the risk profile of a facility to understand how it compares to the historical industry experience. Step-out technologies can make it challenging for insurers to perform their risk assessments to develop this profile, potentially impacting availability and/or premiums for insurances.

- Regulatory agencies: Stepping outside of a well-traveled technical or project execution pathway can result in the need for additional time for regulatory agencies to complete their activities and satisfy their obligations under governing laws. Conversely, innovations that inherently improve safety or reduce plant emissions can be viewed favorably by regulators once they have gained familiarity with the arrangements.

- EPC organizations: LNG plant developments rely heavily on the skills and knowledge of highly qualified EPC contractors to deliver these complex facilities to market. Lending institutions require project developers to obtain guarantees from the EPC contractors for plant capacity, fuel consumption and schedule. These guarantees often include “make-good” obligations on production rates and contract terms, with substantial performance damages for failure to achieve. Within this commercial environment, the EPC contractors must be comfortable with the expected performance of the technology to avoid taking on excessive risk.

Drivers for innovation. Albert Einstein is quoted as saying, “We cannot solve our problems with the same thinking we used when we created them.” With this advice in mind, the question “why innovate?” seems almost silly. Drive an automobile from the 1970s or 1980s, replete with an AM radio and perhaps an optional eight-track player, hand-crank windows, bias-ply tires, solid rear-axle suspension and hard-starting carburetors, and the benefits of innovation become quickly obvious.

Companies innovate to stay in business and respond to the demands of an evolving market. In the case of LNG, the market has indeed changed, although in more subtle, fundamental ways:

- Efficiency matters: Purchasing feed gas from third parties makes plant energy efficiency an economic necessity. For a 10-metric MMtpy LNG facility, a nominal change in the retainage (quantity of feed gas consumed as fuel) from 8% to 6% of feed gas represents an annual savings to the facility of $35 MM, at a gas purchase price of $3/MMBtu, to produce the same quantity of LNG.

- Emission matters: According to the US Energy Information Administration (EIA),3 burning 1 MMBtu of natural gas generates 117 lb (53.1 kg) of CO2. Reducing the retainage from 8% to 6% of feed gas in a 10-metric MMtpy LNG facility reduces CO2 emissions by 1.38 B lb/yr (626 metric Mtpy of CO2 emissions reduction).

- Reliability matters: Engineering to achieve high levels of simplicity and provide facilities with inherent redundancy increases reliability.

- Flexibility matters: With the nature of the US gas supply market (not accessing a designated gas field), there is a need for production flexibility. These emerging projects benefit from having LNG trains with designs that enable significant turndown and feed flexibility.

- Safety matters: Simplification also promotes inherent safety. The safest piece of equipment in a process facility is the one that was eliminated. Reducing quantities of flammable and explosive hydrocarbons through improved configurations and use of alternate refrigerants promotes inherent safety.

Overall, the status quo is comfortable but inherently incapable of advancement. Innovation is a necessity.

Key elements impacting LNG plant efficiencies. LNG plant efficiencies can be addressed in two fundamental ways: process selection and plant configuration. Process selection garners the most attention, representing the core of the LNG technology licenses and technologies commonly applied and including the choice of refrigerants. Numerous articles have been published on the topic. Not all have performed comparisons of process efficiencies on the same basis, nor have they demonstrated a consensus agreement on the results.4,5,6

Comparing inconsistent elements of plant configuration can contribute to differences, and others may not have had access to the latest optimizations applied to the designs. An additional complication is that, in some cases, the differences in process efficiencies are quite small, such that variations in the assumptions used in the modeling (ambient temperature, refrigerant compositions, etc.) can impact the results.

Plant configuration can have an even larger impact on the effective efficiency of a given LNG installation. Plant configuration in this context refers to several elements:

- Driver selection (steam turbine, industrial frame gas turbine, aeroderivative gas turbine, motor)

- Waste heat integration (process heating duty oil/water coils, combined-cycle steam systems)

- Application of liquid expanders

- Application of LNG product flash gas as a heat sink

- Number of refrigerant stages selected

- Cooling medium (air vs. water)

- Where system boundaries are drawn (i.e., including or excluding infrastructure utility loads).

Setting aside the hyperbole, some generalizations can be made:

- The difference in efficiency between facilities with the greatest and the least efficiency is not numerically large, representing only a few percent of the feed gas supply to an LNG plant. The best achievable LNG plant efficiencies run in the range of 92%–94%, while the lowest run in the range of 88%–90%.

- While these differences are small numerically, considering the large gas flowrates into an LNG facility, they are significant on an absolute basis.

- Mixed refrigerants are generally more efficient for liquefaction than pure component refrigerants, as the natural gas cooling curve can be more closely approximated. Depending on the composition of the natural gas and the number of refrigeration stages selected, this difference can be minor or it can be more significant.

- Precooled liquefaction arrangements are generally more efficient than arrangements using a single refrigerant. It is challenging to maintain a close approach to the natural gas cooling curve over the entire range of ambient down to –160°C (–260°F) with a single refrigerant selection.

- Nitrogen expansion processes are some of the least efficient.

- Gas turbine plants deliver their greatest efficiency when the turbines are run at full capacity.

- Aeroderivative gas turbine drivers are more efficient than industrial gas turbine drivers, although some of the newer-generation industrial machines deliver efficiencies as high as, or higher than, those of competing aeroderivative machines.

- Newer-generation gas turbines are more efficient than earlier-generation machines.

- Addition of waste heat recovery can greatly increase overall gas turbine cycle efficiency.

- A common industrial frame gas turbine efficiency is on the order of 32%–34%. Adding “light duty” process heating recovery can raise efficiency to 36%–38%. Aeroderivative and high-efficiency industrial machines provide efficiencies in the range of 40%–45%, while incorporation of combined cycle can increase delivered efficiencies to the range of 50% and higher.

- Motor drives introduce additional inefficiencies. Instead of directly coupling a gas turbine to a compressor, the gas turbine drives a generator, which then drives a motor, which drives the compressor. Some of the additional, inherent inefficiencies induced by the generator and motor can be recovered if the power plant efficiency is high enough.

- Steam turbine-driven LNG plants, while highly reliable, are among the least efficient.

Efficiency elements. Part 2 will address two of the key efficiency elements in greater detail, followed by a case study of an innovative USGC LNG design and delivery project opportunity. GP

Literature cited

- International Gas Union, “IGU world LNG report,” 2015.

- Eidelman, S., J. Pattershall and C. S. Crandall, “Longer is better,” Journal of Experimental Social Psychology, Vol. 46, Iss. 6, November 2010, online: http://www.sciencedirect.com/science/article/pii/S0022103110001599

- US Energy Information Administration, “How much carbon dioxide is produced when different fuels are burned?” June 8, 2017, online: https://www.eia.gov/tools/faqs/faq.cfm?id=73&t=11

- Bronfenbrenner, J. C. et al., “Selecting a suitable process,” LNGIndustry.com, Summer 2009.

- Vink, K. J. and R. K. Nagelvoort, “Comparison of baseload liquefaction processes,” LNG12, Perth, Australia, 1998.

- Ransbarger, W., “A fresh look at LNG process efficiency,” LNGIndustry.com, Spring 2007.

|

John G. Baguley serves as Chief Operating Officer for the Magnolia LNG and Bear Head LNG projects, and Chief Technical Officer for LNG Ltd. His involvement in international LNG project development and delivery spans nearly 37 yr and includes project management, engineering, construction and commissioning roles. He holds a BS degree in chemical engineering from Michigan State University and is a registered Professional Engineer in Texas.

|

Lincoln Clark is the Group Engineering and Operations Manager for LNG Ltd. He has 25 yr of experience in oil and gas projects covering the design, construction, commissioning and operation of LNG plants, gas processing facilities, oil production facilities and power stations. Mr. Clark joined the LNG Ltd. team in 2005 and has been closely involved with the development of the Gladstone LNG, Magnolia LNG and Bear Head LNG projects.

Comments