Manage risks for trans-country pipeline projects: India case study—Part 1

A. Moitra, Indian Oil Corp., New Delhi, India

The World Bank’s “South Asia Economic Focus” report, released in October 2016, predicted that India’s GDP growth of 7.6% in 2016 would persist or even strengthen in 2017. However, the challenge remains in extending this economic growth to a broader range of human development outcomes.

India’s per-capita energy consumption (in kg of oil equivalent) is less than 600, compared with 1,000 for developing countries like China and Brazil. Data from the World Bank and the International Energy Agency (IEA) on per-capita energy consumption predicts that achieving energy security will be a daunting task for India.

Oil demand has traditionally been driven by the power, fertilizer and refining/petrochemical industries. However, depleting sources, volatile prices and associated environmental concerns have shifted the preference toward natural gas. Natural gas is environmentally friendly and comparatively cheaper than crude oil, opening an alternate avenue to improve per-capita energy consumption at a lower cost.

India eyes trans-country gas pipeline. India’s Petroleum and Natural Gas Regulatory Board (PNGRB) predicts a 6.8% increase in natural gas demand growth between 2010 and 2025 (CAGR) and a 9% rise in the share of natural gas in the energy mix.

While these predictions support the Indian government’s vision to improve per-capita energy consumption, they also raise feasibility, reliability and sustainability concerns related to sourcing gas. Proposals for sourcing gas through trans-country pipelines have been under discussion for some time. However, the multibillion-dollar TAPI pipeline project signed by Turkmenistan, Afghanistan, Pakistan and India in July 2014 is characterized by complexity and uncertainty due to the conduit’s cross-country route, geopolitical imbalances and projected difficulties in sustaining trade relations. The TAPI project, and others like it, involve high risks that require diligent analyses.

The following case study examines the challenging aspects associated with trans-country projects. Such challenges include diversifying the energy mix to improve per-capita energy consumption, and qualitative and quantitative project risk assessments. The study also illustrates a framework and technique to assess risks for complex projects by using the weighted scoring model as a decision-making tool.

Pipeline scenario analysis: The macro picture. India depends heavily on crude oil, which raises its import bills. Of late, alternative sources of energy have attracted focus and redefined global priorities. In December 2016, The Economic Times reported on a $25-B pipeline project that would source gas from Russia and involve gas swapping between Russia and China, and Myanmar and India. However, the agreements were characterized by uncertainties and risks.

The primary project options being discussed include sourcing gas from Turkmenistan, the Middle East, Iran, Myanmar or Russia. The proposed Iran-Pakistan-India (IPI) pipeline and the TAPI project were also on the fray. The perceived risks of the TAPI project included non-conformance of governments to hold necessary meetings, changes in government priorities, and insurgencies or external political conflicts.

At present, efforts to improve India’s energy mix by investing in trans-country natural gas pipeline projects seem evenly poised between opportunity and threat. The following sections illustrate the motivations for the proposed projects.

Supply and demand. The PNGRB’s “Vision 2030 natural gas infrastructure in India” report1 detailed consolidated demand by segment and consolidated supply of natural gas by source, as shown in Table 1 and Table 2, respectively. Expected gas demand was approximately 242.7 MMsm3d in 2012–2013 and around 746 MMsm3d from 2029–2030 (Table 1).

|

|

Natural gas supply is expected to grow by 400 MMsm3d by 2021–2022 and by 474 MMsm3d by 2029–2030. Forecasts suggest that the gap between demand and supply will be maintained into the future. Boosting gas supplies via a trans-country pipeline is, therefore, a strategic fit to improve India’s energy mix.

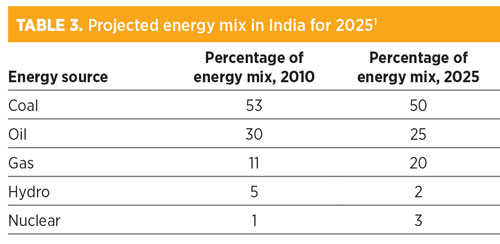

Table 3 outlines India’s projected energy mix for 2025. Estimates indicate that the share of natural gas in the energy mix will increase from 11% in 2010 to 20% in 2025.

|

Alternative avenues for energy sector. The power sector relies on high-priced, high-quality, imported coal. By contrast, the power, fertilizer and refining/petrochemical sectors have traditionally relied on gasoline, naphtha, diesel and fuel oil. Natural gas has been a cheaper alternative fuel due to lower demand. However, with the expansion of the natural gas base and processing technology, preferences have shifted to larger plants with higher efficiency and bigger economies of scale.

Natural gas emits 45% less carbon dioxide than coal and 30% less carbon dioxide than oil, making it an environmentally attractive substitute. By adopting natural gas, industry could circumvent the risk of price volatility associated with traditional fuels, allowing companies to protect their bottom lines.

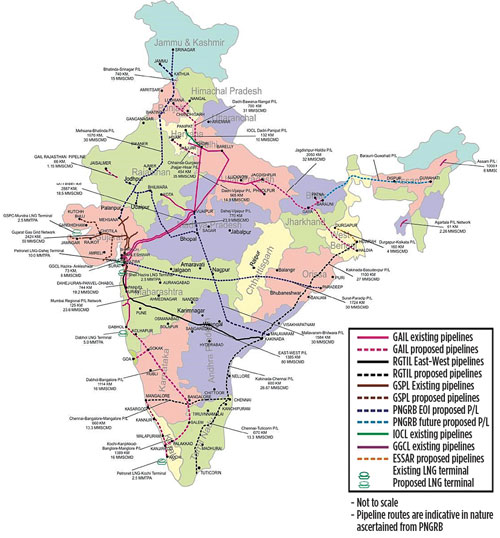

Infrastructure. Natural gas cannot be stored for a long time. The infrastructure of the pipeline network ensures uninterrupted supply for continuous consumption by users.

At present, India has a network of gas pipelines spread across the country. The ability to use the existing gas grid infrastructure for the further distribution of sourced gas was an advantage of the pipeline project. Fig. 1 shows the existing and planned network of gas pipelines in India.

|

|

Fig. 1. Existing and planned network of gas pipelines in India. |

Economic perspective. Energy is inexorably intertwined with economy. It is involved in the supply and demand of nearly all goods and services, and holds the key to sustaining economic growth. Volatile crude oil prices not only pose risks to the energy sector, but they also severely affect the country’s economy.

The uninterrupted availability of energy sources and affordable prices for those energies are two aspects of energy security, as defined by the IEA. India’s integrated energy policy aims to improve the reliability of energy services for all economic sectors, and to cater to the energy needs of vulnerable households around the country with safe, clean and convenient energy at a low cost. The pipeline project objective was, therefore, in alignment with policy. India’s power, coal and petroleum sectors are poised to witness radical growth and help boost natural gas demand.

International aspect. The proposed trans-country pipeline projects have earned the attention of both supplier and consumer countries, including the US. Turkmenistan, meanwhile, would benefit from the further development of its gas fields for the TAPI pipeline. China is sourcing an estimated at 65 Bm3y of gas from Turkmenistan.

Pakistan may have already tapped 40% of its gas reserves, according to analyst reports. The remaining resources are not expected to last more than 15 yr–20 yr. Therefore, securing gas supplies from Iran and Turkmenistan to meet future demand makes sense.

As seen from the situational analysis, these mega-projects seem to be attractive from both a social cost-benefit aspect and a financial benefit aspect, in addition to bridging the supply/demand gap.

However, the risks involved in the TAPI project necessitate consideration, particularly when evaluating investment decisions.

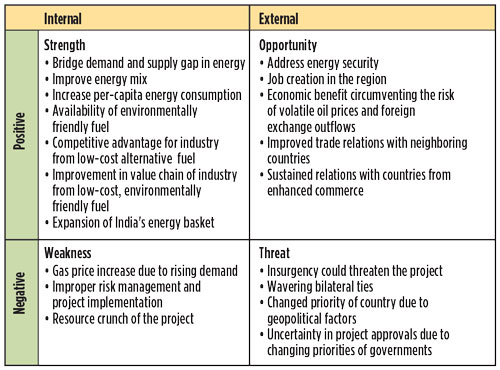

SWOT analysis. A SWOT analysis was conducted to explore major strengths, weaknesses, opportunities and threats of the project, and to examine project risks (Fig. 2). It can be concluded that strengths and opportunities outweigh weaknesses and threats, and the downside risk requires additional critical analysis and review.

|

|

Fig. 2. A SWOT analysis shows that the strengths and opportunities of the proposed TAPI pipeline project outweigh its weaknesses and threats. |

Part 2 of this article will delve into qualitative and quantitative risk analyses, and present a project risk assessment using the weighted scoring model for decision-making, considering project risk for competing options. GP

Literature cited

- India Petroleum and Natural Gas Regulatory Board (PNRGB), “Vision 2030 natural gas Infrastructure in India,” 2013, online: http://www.pngrb.gov.in/Hindi-Website/pdf/vision-NGPV-2030-06092013.pdf

|

Anindita Moitra, Deputy General Manager—Projects at Indian Oil Corp. Ltd., has more than two decades of experience in project management. She is presently pursuing a PhD in business management (corporate governance) and holds a first-class MTech degree from Calcutta University in Calcutta, India, as well as a first-class MBA degree, with specialization in general management, from ICFAI Business School in Hyderabad, India. Ms. Moitra was a GATE scholar, and received honors with her BSc degree from Calcutta University. She was also the recipient of the Best Performer medal during the Hybrid Certificate Program in project management from U21 Global in Singapore, and holds an executive diploma in project management. She has also received a number of women executive awards for her work in the Indian oil and gas sector, particularly with regard to project management. Ms. Moitra has presented papers on project risk management at events organized by Hydrocarbon Processing in Houston, US and on corporate governance at the Business School (Kolkata). She is a member of the All India Management Association (AIMA).

Comments