Turn compliance into competitive edge by optimizing safety and environmental costs

P. Moran, Associate Director, Navigant, Houston, Texas

Since the collapse of oil and gas prices in late 2014, many energy companies have taken steps to delay capital expenditures (CAPEX) and reduce operating costs to slumping markets. Although prices have stabilized since the steep drops of 2014, most market participants agree that low oil and gas prices are expected to persist for another 3 yr–5 yr, and that the present market situation will continue to demand a focus on cost cutting to maintain competiveness.

When companies tighten belts, safety and regulatory compliance are often designated as exempt from cost cutting, so that companies do not negatively affect performance relative to occupational safety and environmental requirements. It is well recognized that the long-term impacts of a safety or an environmental incident are too expensive, both in terms of increased costs and damage to reputation.

From another perspective, viewing cost cutting in safety and regulatory compliance as a tradeoff between annual spending and performance (i.e., slashing the budget will negatively influence safety) is an outdated model that can lead to false choices. Moreover, the ongoing focus on reducing costs, and increasingly stringent regulatory requirements, demand a closer consideration of approaches to compliance, as well as a careful examination of related costs.

Here, the potential effects of proposed federal rules governing natural gas pipeline and storage safety are discussed. A framework for improving compliance effectiveness and efficiency is also introduced.

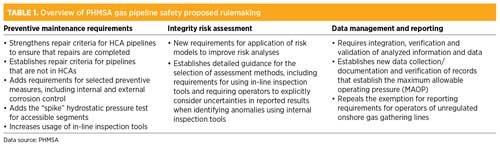

Proposed rules expand safety, reporting requirements. On March 17, 2016, the US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) announced proposed regulations that may have a dramatic impact on the gas pipeline industry.

The regulations would impose new requirements for gas transmission and gathering lines, and would significantly expand regulation and safety protocols to areas of pipeline operations that have been previously excluded from regulation by doing the following:

- Creating a new category of regulation (the moderate-consequence area) to supplement the existing high-consequence area category

- Expanding safety protocols to include previously exempt pre-1970 pipelines

- Narrowing the exemptions for gas gathering lines by applying certain PHMSA safety standards to larger-diameter, higher-pressure gathering lines in rural areas, and by extending federal reporting requirements to all gas gathering lines.

The rulemaking also strengthens existing regulations covering preventive maintenance, risk assessments, and data management and reporting, as shown in Table 1.

|

In addition to pipeline safety, other legislative and regulatory activities are aimed at natural gas storage safety and the monitoring of methane emissions at oil and gas wells, gathering and processing facilities, and pipeline compression stations.

US gas storage safety. On June 22, 2016, former President Obama signed the Protecting our Infrastructure of Pipelines and Enhancing Safety Act of 2016 (PIPES Act) into law to reauthorize the Pipeline Safety Act and the PHMSA. Among the requirements of the PIPES Act are that the PHMSA must establish minimum safety standards for underground natural gas storage by June 21, 2018.

In addition, the legislation charged the US Department of Energy (DOE) with establishing an Aliso Canyon natural gas leak task force. The task force includes the PHMSA, the US Environmental Protection Agency (EPA), the US Federal Energy Regulatory Commission (FERC), the US Department of the Interior, and state and local government representatives, among others. This group submitted a final report to Congress in December 2016 on the cause and contributing factors of the Aliso Canyon leak. This report includes details on the impact of the leak, the effectiveness of the measures taken to respond to the leak, agency responses, and recommendations for preventing future leaks.

US methane monitoring. In May 2016, the EPA finalized methane rules for new, heavily modified or reconstructed oil and natural gas facilities. As part of an effort to advance White House climate change targets, the new Clean Air Act New Source Performance Standards (NSPS) rules will require operators to detect and repair methane and volatile organic compound (VOC) leaks at new oil and gas wells; production, gathering and boosting stations; gas processing plants; and gas pipeline compressor stations.

In addition, the EPA issued a draft information collection request for data on how equipment and emissions controls on existing onshore facilities are configured and their associated costs; and how natural gas is vented in conjunction with maintenance activities, equipment malfunctions and flashing emissions from storage tanks.

It should be noted, however, that the EPA rescinded its data collection request in March 2017; and in April 2017, it issued a 90-day delay for oil and gas companies to comply with the rule to monitor and reduce methane leaks from their facilities.

Expanded pipeline oversight in Canada. Pipeline operators in Canada also face more rigorous regulation. In June 2016, amendments were passed to the National Energy Board (NEB) Pipeline Safety Act, expanding the observation of federally regulated pipelines from construction through abandonment. The significant changes to the Act include the creation of absolute liability and financial resource requirements for pipeline operators.

In addition, pipelines will remain under the NEB’s jurisdiction in perpetuity, or until they are removed from the ground, which means that pipeline companies retain liability as long as a pipeline remains in place.

A new paradigm—optimizing the cost of compliance. Many companies focus extensively on the effectiveness of their compliance efforts, but fail to optimize the costs of compliance by thoroughly analyzing the efficiency of their compliance approaches.

Few midstream and pipeline companies fully understand the magnitude of their compliance costs and have done little (if anything) to optimize these operating expenses. Recent conversations with C-level executives and industry association leadership have indicated that many midstream companies are placing increasing focus on cutting costs and delaying CAPEX. In addition, the proposed EPA rules on methane emissions monitoring and PHMSA rulemakings on pipeline and gas storage safety are top concerns, due to their expanded compliance requirements and increased emphasis on safety and issues related to aging infrastructure.

The greater complexity of the strengthened and extended pipeline and gas storage safety rules and methane emissions reporting will magnify existing inefficiencies and could dramatically increase compliance costs. For many, ignoring the cost of compliance is no longer an option. Moreover, indiscriminately overspending on compliance efforts does not necessarily reduce the risk of noncompliance.

Compliance activities span all parts of the organization—front-line operations, technical functional groups, and back-office groups in both field locations and centralized in headquarters. As a result, understanding the full costs of compliance and addressing the sources of waste, non-value-added activities, delays and other inefficiencies is a complex undertaking.

Before these new rules take effect, companies must review their approaches and the costs of achieving compliance to become more effective. Steps taken in these directions can help reduce expenses today while preparing for tomorrow’s regulations.

A structured focus on the key levers—eliminating complexity, reducing waste and improving standardization—can reduce the variability of existing compliance processes and reduce costs while establishing the foundation to prepare for more complex regulations in the future.

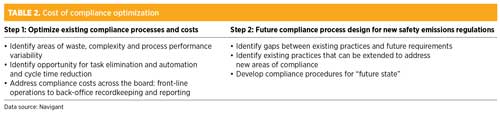

A simple, yet robust, two-step process can provide the framework for companies to improve existing processes. This process can also establish a platform to ensure effective and cost-efficient compliances with future requirements, as shown in Table 2.

|

Step 1 involves a quick but thorough investigation of the existing process to deliver a rapid and clear path to cost optimization while providing valuable information and key learnings for Step 2. Key questions to be addressed in Step 1 include:

- What tasks can be eliminated, simplified or reduced to save time and compliance costs while reducing risks?

- What opportunities exist to improve alignment across key processes that span work management, asset management and integrity management?

- Where are delays, rework or mistakes caused by misinformation or poor communication between functions or with service providers?

- What leading compliance practices from legacy organizations, acquired operations or peer companies can be applied uniformly across the entire business portfolio?

- How can utilizing new technologies or third-party services reduce compliance costs and minimize noncompliance risks?

If not addressed early on, inefficiencies in existing processes will be magnified upon implementation of the revised PHSMA, EPA and NEB rules.

Step 2 is designed to create a platform to extend the optimized compliance processes identified in Step 1 and design new processes that are aligned with meeting the forthcoming requirements. This approach includes adjustments to existing processes and the identification of the required systems and organizational and capability enhancements needed to achieve future state compliance.

The key benefit of this approach is the creation of a comprehensive implementation plan that includes a number of critical components:

- Defining the advantages, risks and potential costs of specific improvements

- Conducting stakeholder analyses to identify potential obstacles/contingencies

- Identifying key metrics to measure future performance

- Articulating the value proposition of specific recommendations

- Prioritizing implementation based on a benefits-vs.-effort analysis

- Determining required resources and capabilities

- Defining implementation timing and responsibilities

- Identifying key risks and creating mitigation actions.

Recommendations. The oil and gas industry is committed to the safe and reliable exploration, production and delivery of crude oil, refined products and natural gas. This commitment is demonstrated through a track record of strong performance in the areas of workplace and environmental safety.

Notwithstanding this commitment to excellence, new rules are broadening the regulatory reach of the PHMSA, the US EPA and the Canadian NEB across the oil and gas industry. The rules also create new compliance obligations that will be both costly and time-consuming to address.

Companies are advised to take the time to review their approach to compliance and align their processes, people and technology to reduce the cost and enhance the effectiveness of their compliance efforts. In doing so, these companies can create a sustainable source of competitive advantage. GP

|

Paul Moran is Associate Director at Navigant’s Energy practice and is responsible for leading engagements for clients in the energy sector, including electric and gas utilities, power generators, pipeline and midstream companies, gas storage operators and LNG export project developers, in addition to private equity and infrastructure funds. His 15 yr of energy industry experience include providing subject matter expertise related to corporate strategic planning, power and natural gas market analysis and forecasting, business process improvement, organizational design and change management.

Comments