Gas processing news

B. Andrew, Technical Editor

Australia plans LNG export limits

|

The country’s conservative government unveiled a radical plan to restrict exports of LNG at times when domestic shortages push up local prices, aiming to ease soaring energy costs for local manufacturers.

The plan would allow Australia’s resources minister to impose controls on LNG exports, on advice from the market operator and regulator. The government is seeking to cap domestic gas prices, which have become a hot-button issue.

Poland to receive first LNG supplies

|

Polish state-run gas firm PGNiG signed a deal with Cheniere Energy to receive a spot delivery at the Świnoujście terminal on the Baltic Sea. Poland consumes around 15 Bcmy–16 Bcmy of gas. It built its first LNG terminal in Świnoujście as part of a bigger plan to reduce reliance on gas imported from Russia’s Gazprom.

The terminal, which commenced commercial operations in 2016, has a capacity of 5 Bcmy. Since that time, it has been receiving LNG from Qatargas, which in March agreed to double deliveries to 2 MMtpy. It also took one delivery on the spot market from Norway.

The ambition of Poland’s conservative Law and Justice government is to replace the Russian deliveries with alternative supplies after 2022, when the long-term deal with Gazprom expires. Poland also plans to build a gas pipeline to the Norwegian shelf via the Baltic Sea.

Gazprom sees rising EU market share

|

A new pipeline from Russia’s Arctic fields to Germany will boost Moscow’s share in European gas markets, despite competition from Qatar and the US. It will also mean that less fuel is delivered via Ukraine, Russian gas monopoly Gazprom said. Gazprom CEO Alexei Miller believes that supplies via Ukraine will fall after 2020—but will not stop entirely, as Moscow has previously threatened—when the world’s largest gas firm opens a pipeline under the Baltic Sea.

Gazprom’s Western partners have agreed to provide half of the financing for the $10.32-B Nord Stream 2 pipeline, removing a large hurdle for a Russian plan to pump more gas to Europe from 2019. Gazprom supplies Europe via three main routes: pipelines through Ukraine, the Yamal-Europe route via Belarus and Poland, and the new Nord Stream link under the Baltic Sea to the German town of Greifswald. Gazprom wants to double the capacity of Nord Stream. It signed a deal to co-fund the link with European companies Uniper, Wintershall, Shell, OMV and Engie.

Ukraine has the capacity to handle the transit of up to 120 Bcmy of Russian gas and has been the main route for supplies to the West since the Soviet era. However, volumes have fallen to 50 Bcmy–80 Bcmy in recent years, as Gazprom has built new pipelines. A further decrease of 15 Bcmy is possible.

Other reasons for the drop in Ukrainian transit include the increasing shift of Gazprom’s gas production to the Arctic Yamal peninsula. This route, via the Baltic and between new Russian centers of production and Germany’s Greifswald, is 1,250 mi shorter than the route through Ukraine.

Gulf Publishing Company strengthens midstream offerings

|

On May 1, 2017, Gulf Publishing Company (GPC) announced the acquisition of 109-yr-old Oildom Publishing Company of Texas. The move brings monthly Pipeline & Gas Journal and Pipeline News into the GPC suite of publications. In addition, Oildom Publishing—now to be known as Gulf Pipeline and Utilities Group—covers the utility sector with Underground Construction and two annual events in the US: the Pipeline Opportunities Conference and Underground Construction Technology events.

Total to build Cote d’Ivoire LNG

|

An international consortium led by France’s Total SA plans to start construction of an LNG terminal in Cote d’Ivoire by mid-2017. According to Azeri consortium member SOCAR Trading, the project cost is estimated at $130 MM–$142 MM, with an initial capacity of 36 MMBtu/yr. The possibility exists to increase the capacity to 100 MMBtu/yr, if Cote d’Ivoire becomes a regional gas hub for neighboring countries.The first gas supplies to the terminal were planned from mid-2018. In November 2016, Azeri state energy firm SOCAR acquired a 26% stake in Ivory Coast LNG, an international consortium with Total, Shell, Golar, Endeavor Energy and Cote d’Ivoire state companies Petroci and CI Energies.

US DOE authorizes Golden Pass to export LNG to non-FTA countries

|

The US Department of Energy signed an order authorizing Golden Pass Products LLC to export domestically produced LNG to countries that do not have a free trade agreement with the US. Golden Pass is authorized to export LNG from the Golden Pass Terminal near Sabine Pass in Jefferson County, Texas, up to the equivalent of 2.21 Bcfd of natural gas, to any non-FTA country not prohibited by US law or policy.

The US Energy Department’s extensive review of the application considered many factors, among them economic, energy security and environmental impacts. The review included macroeconomic studies with positive benefits to the US economy, in scenarios with LNG exports of up to 28 Bcfd. The Energy Department determined that exports from Golden Pass, which is jointly owned by Qatar Petroleum (70%) and ExxonMobil (30%), are viable over a period of 20 yr.

African gas pipelines compete with coal, LNG

|

Sub-Saharan Africa is in dire need of greater power generation capacity to provide energy to the 600 MM people on the continent who have no access to electricity. The region’s proven natural gas reserves of more than 496 Tcf could be a major driver for countries in the region to achieve energy security.

A few sub-Saharan countries are studying the implementation of proposed gas pipeline projects to move natural gas from production fields to power generation plants. However, concerns are emerging that investment proposals could become unviable due to increasing competition from cheap coal, a preference for LNG imports, and studies indicating that electricity transmission lines could be a better option, in some cases.

Major gas pipeline projects are at different stages of planning or implementation, as several countries in sub-Saharan Africa—including Nigeria, Tanzania and Mozambique—integrate gas transportation infrastructure into their natural gas monetization and energy security programs.

Across sub-Saharan Africa, increasing demand for sustainable sources of electricity is driven mainly by a growing middle class population, urbanization, increased household consumption and other infrastructure projects directly linked to power generation, transmission and distribution.Plans are in place to expand existing pipelines, or to construct new ones, to transport natural gas to processing plants or power generation facilities within and outside of sub-Saharan gas producing countries. These projects will be carried out through public-private partnerships.

Gas output test from methane hydrate

Japan’s trade ministry reported recent success in extracting gas from methane hydrate deposits offshore. Tests at two different wells over spans of 4–5 weeks are the first since 2013, when Japan achieved the world’s first-ever extraction of gas from offshore deposits of methane hydrate. Japan’s first methane hydrate tests in 2013 ended abruptly, after less than a week of testing, due to problems with sand flowing into the well. A Japanese study estimated at least 40 Tcf of methane hydrate lie in the eastern Nankai Trough off the country’s Pacific coast, which is approximately equal to 11 yr of Japanese gas consumption.

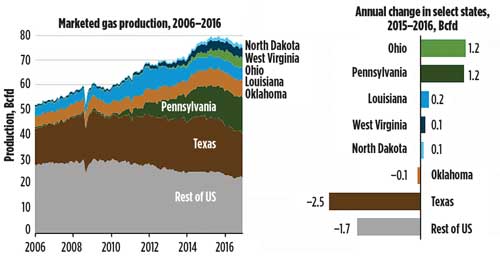

Ohio, Pennsylvania raise gas production

|

After reaching a record high of 79 Bcfd in 2015, US marketed natural gas production fell to 77 Bcfd in 2016, the first annual decline since 2005. Texas, the state with the largest natural gas production, fell by 2.5 Bcfd, while Ohio and Pennsylvania each saw their output rise by about 1.2 Bcfd.

Pennsylvania and Ohio had the two largest annual natural gas production increases from 2015–2016, reflecting higher production from the Utica and Marcellus shale plays, which have accounted for 85% of US shale gas production growth since 2012. Production in Pennsylvania and Ohio has collectively accounted for an increasing share of total US natural gas production in recent years, rising from less than 2% in 2006 to 24% in 2016.

Petronas eyes second FLNG in 2020

Petronas loaded its first cargo to India from the PFLNG 1 vessel in east Malaysia in April, becoming the first company to produce LNG from a floating production unit. The second floating LNG vessel under construction, PFLNG 2, with a processing capacity of 1.5 MMtpy, will enable liquefaction, production and offloading of natural gas in the Rotan field, 240 km off the east Malaysian state of Sabah, upon completion. PFLNG 1 will reach its designed capacity of 1.2 MMtpy by June 2017, and it will be stationed at Kanowit in East Malaysia for 5 yr.

Other producers that are developing floating LNG production facilities include Royal Dutch Shell, which is building the Prelude FLNG vessel in Australia. Prelude will be the world’s largest and most expensive maritime vessel, at a cost of over $12 B. Japan’s Inpex is also building a large FLNG unit as part of the $37-B Ichthys export project, also for use in Australia.These expensive projects have been plagued by delays and a global LNG supply glut, as new LNG projects come online in Australia and the US. The significant development costs have led some to question whether FLNG units on this scale will be ordered again in the future. However, Petronas believes that Asia will still be a large buyer of LNG—particularly new markets like India and growing markets like Thailand. GP

Comments