Market development is key to success for small-scale LNG

S. Bonini, Muse, Stancil & Co., London, UK; and A. Chandra, Muse, Stancil & Co., Houston, Texas

The small-scale LNG (SSLNG) industry continues to grow, driven largely by rising environmental factors. When combined with the low cost of natural gas vs. competing fuels, LNG makes a good societal and economic choice. The growth of interest in LNG as a primary energy source has led to technological developments in end-user markets, driven foremost by China, with the US and Europe considerably behind in terms of installed capacity. This article examines the factors behind the SSLNG renaissance and concludes that it is a sustainable trend.

Although the recent collapse in liquid fuel prices has slowed the conversion rates from diesel and gasoline, the environmental imperative to improve air quality in cities around the world continues. This environmental issue will determine the SSLNG sector’s future. The collapse in natural gas prices in the US, and for LNG globally, makes natural gas an attractive primary energy source with clear environmental benefits.

Forecasters anticipate that the spread between oil and gas is likely to open up again, given that oil prices have more upside potential than natural gas prices in most markets.

SSLNG market progress. The SSLNG industry generally encompasses projects producing less than 1 metric MMtpy of LNG, which is equivalent to a natural gas flow of 140 MMscfd, or 1.72 MMgpd of LNG. The average SSLNG plant is only one-tenth of this production; it requires approximately 14 MMscfd of feed gas.

The industry is structurally very different from the large global LNG business, even though the underlying gas processing needs are the same and are achieved in similar ways. The primary challenge for SSLNG lies in developing the markets and infrastructure downstream of production units.

In terms of capacity, according to International Gas Union statistics, SSLNG provides approximately 5% of total LNG production capacity at 20 metric MMtpy of installed capacity. China has 75% of total SSLNG capacity, with 15 metric MMtpy of total production across 125 plants, suggesting an average production of only 0.12 metric MMtpy. These Chinese plants are liquefying gas primarily for use in trucks.

The large-scale LNG industry is driven by utility companies and follows a well-established and readily understood model. A large-scale LNG project is driven by the presence of substantial natural gas reserves that are cheap to produce. These supplies are purchased by a few buyers, which are typically large, sophisticated industrial utilities and power companies purchasing under long-term contracts for at least a decade. The LNG is imported to terminals, where is it is regasified and sent out into a high-pressure transmission system. In this scenario, both the sellers and the buyers are involved in the energy industry.

The small-scale industry is far more fragmented, with a wide variety of players and drivers. As a result, it is less understood and far less developed. SSLNG is typically sold to much smaller, fragmented buyers whose motivation could be environmental and/or economic. In the small-scale world, LNG will often be distributed to displace diesel usage. The buyers are often not energy companies at all; they are simply buying a fuel for their own use.

Typical drivers for SSLNG production include:

- Air quality issues around particulate emissions from diesel engines and, in the marine world, the introduction of Emission Control Areas (ECAs)

- The drive to reduce natural gas flaring, particularly in US shale areas

- The displacement of liquid fuels with cheaper LNG (this is the most prevalent driver for the US).

Marine regulation—A key driver. Due to the sharp increase in world trade, a rise in air pollution from shipping has been seen. Unlike the land transport sector, shipping has historically been much more lightly regulated and has had minimal air emissions regulations placed upon it.

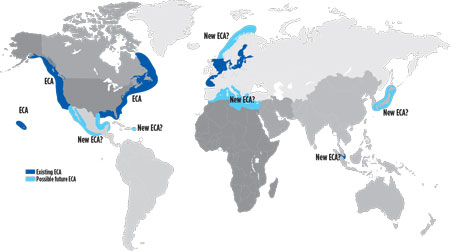

The International Maritime Organization (IMO) began work on this problem in 1997 and developed international standards, policies and agreed zones in which nations could implement ECAs. In these coastal areas, all marine traffic is required to control emissions of some or all of the following: SOx, NOx and ozone-depleting substances, volatile organic compounds (VOCs) and particulates.

Fig. 1 shows the designated areas for control. These zones have been agreed upon internationally, and individual states are now implementing regulations within their jurisdictions. The US began drawing up its regulations in 2009 and is now beginning enforcement. Europe has implemented its ECAs in the Baltic and North Seas.

|

|

Fig. 1. Existing and possible future ECAs. Source: DNV. |

Meanwhile, China announced at the end of 2015 that it will be establishing ECA measures across a large area of the Pearl River Delta. The regulations will be tightened over time and differ between zones, with a trend of stricter controls and cleaner operations.

The introduction of ECAs has meant that ships must either fit scrubbers to remove SOx, or switch to expensive ultra-low-sulfur-content fuels while in the ECA. An alternative is to move to fuels such as natural gas. The LNG carrier fleet has, for some years, been developing dual-fuel (diesel/natural gas) propulsion systems. A tremendous effort is being made globally to develop LNG as a marine transport fuel, with a strong emphasis on smaller, nearshore and inland vessels.

The LNG volumes required for the marine industry are significant when studied collectively, but they are small on an individual basis. The LNG fuel tank for the world’s first LNG-fueled container vessel is 900 m3, or approximately 400 metric t. Existing large-scale LNG export facilities supply cargoes of 170,000 m3 and larger, and load a ship every three days. A whole new set of infrastructure and production units are required to serve the transportation market. It is an entirely different business, with different commercial models.

China: A success story. China represents 75% of installed global capacity and has experienced strong, rapid growth, despite its comparatively low gas reserves. The country has achieved success in SSLNG with strong central policy directives aimed at increasing the use of natural gas as a vehicle fuel, displacing diesel from larger trucks as part of the effort to improve air quality in cities.

China has an LNG-fueled heavy truck fleet of approximately 200,000. Energy prices are regulated in China, with the government setting key prices to achieve particular policy objectives. The country keeps natural gas prices low and sets locally produced LNG prices to be at least 20% cheaper than diesel, making it more attractive for end users to switch. When oil prices were high, the SSLNG producers had a good business model with low input prices and a significantly higher LNG price. Recent drops in diesel prices have caused Chinese regulators to lower LNG prices to protect the trucking industry at the expense of SSLNG producers, and the growth has slowed dramatically.

The SSLNG plants are built predominantly alongside pipelines providing pipeline-quality gas. A significant number of plants take feed from coalbed methane or stranded inland gas reserves located away from gas infrastructure. SSLNG provides a monetization route for these reserves.

This non-free market approach may appear strange to US readers. The Chinese have kickstarted the use of LNG as a transport fuel, rapidly increasing SSLNG production capacity, the truck fleet and associated infrastructure. The effort has been so successful that the Chinese government is looking to repeat the program for marine transport for inland river traffic. As previously mentioned, China has announced its first ECA area, as well as its first LNG marine bunkering facility. The expectation is that these moves will result in the same sort of growth in SSLNG serving the Chinese marine sector.

This approach is currently inconceivable in the US, although it is worth remembering that, until the 1980s, US wellhead prices were determined by the federal government. It does show that the technologies are viable and can be rapidly deployed, if a coordinated approach is made with clear policy directives.

US experience and outlook. The US experience has been built on a free-market approach and is helped by a key marine regulation. The country’s SSLNG industry has received a tremendous boost in recent years as a result of the natural gas bonanza. The US also has access to large, cheap natural gas reserves for the foreseeable future.

When oil prices were high, the price differential between natural gas and gasoline/diesel made switching between the fuels attractive. Considerable investment followed in natural gas engine technology and distribution infrastructure, most notably by oil tycoon T. Boone Pickens’ Clean Energy initiative. However, the subsequent crash in oil prices has reduced the price differential and, therefore, the motivation to switch away from gasoline and diesel. Nonetheless, progress continues to be driven by the US gas reserve base and the move toward “greener” transportation.

The most notable recent developments in SSLNG production in the US are taking place in Florida around interconnected markets in port and rail infrastructure. These developments are driven by both economic and environmental factors. New Fortress Energy, a wholly owned subsidiary of New York-based global investment management firm Fortress Investment Group (FIG), also owns Florida East Coast Railway. The railway has ordered LNG-fueled locomotives from GE and is actively converting its fleet.

FIG also purchased Raven Transport, a trucking company with one of the largest LNG-fueled fleets in the US. Raven owns nearly 200 LNG-fueled trucks and plans to reach approximately 500 units by 2019. The “chicken-and-egg” problem that faces many small-scale developers that try to develop downstream markets with third parties can be alleviated by partnering or cooperating with a group of affiliated companies. FIG, which is developing rapidly in the SSLNG space, has taken the latter approach.

In other developments, the JAX LNG plant at Jacksonville will shortly be supplying LNG to the port as a bunkering fuel. This facility was developed and is owned by Crowley Marine and Pivotal LNG, with the primary focus on the marine market. It will be the supply source for the world’s first LNG-powered container ships based there—Isla Bella and Perla Del Caribe, planned for use within the Caribbean. Crowley is already shipping 10-Mgal ISO tanks to Puerto Rico for use in the Coca-Cola bottling facility, providing a cleaner and cheaper alternative to diesel.

European SSLNG efforts. The SSLNG sector has seen the most activity in northern Europe, around the Baltic and North Seas, where the first ECAs have been implemented. The Norwegian government has established a NOx fund that charges all NOx emitters in the zone while offering subsidies to companies that reduce emissions using new technologies. In recent years, this has led to payments of $58 MM to LNG-fueled vessel owners.

Two offshore platform supply vessels, three passenger ferries and one gas carrier are now operating in the region, with 17 more LNG-powered vessels under construction and planned. The LNG-powered fleet is growing rapidly, with 80 or so forecast to be in operation by the close of 2016. Of this total, 56 are forecast to be operating in the Baltic and North Seas.

SSLNG production has grown around Norway to support the marine market. Norway also uses SSLNG to supply remote coastal communities, and it serves these markets with a number of SSLNG carriers.

SSLNG for international trade. This review has looked at the principle growth areas for SSLNG as a local clean fuel supply, and where the LNG is produced and consumed within the same country, or even the same province. This scenario is quite different from the large-scale industry, which exists to transport large, remote and stranded reserves to populous markets.

SSLNG is now carving out niche markets. As mentioned above, Crowley Marine is supplying LNG in ISO tanks to Puerto Rico. The company recently announced the purchase of 19 additional ISO tanks to meet increasing demand.

Meanwhile, FIG recently received approval from the US Department of Energy to export LNG to Jamaica in ISO tanks. Also this year, Hawaii Gas announced its intention to import LNG from Clean Energy in ISO tanks.

In Thailand, Thai-based LNG Plus International Co. Ltd. recently completed a small-scale gas-fired power plant in Myanmar, supplied with LNG by road tanker from Thailand. In June, Japan’s Ministry of Land, Infrastructure, Transport and Tourism announced that it will be seeking to trial LNG bunkering in the port of Yokohama.

All of these developments are significant for SSLNG production and supply-chain technologies. It is particularly notable that the US is leading the charge with new entrants and not with traditional LNG players. SSLNG is truly a separate industry with a shared technology. GP

|

Simon Bonini has over 30 years of experience in the LNG and international energy industries, and has managed all aspects along the LNG chain, including developing and implementing new strategies. He spent 17 years at BG Group developing several businesses, including the Trinidad export project, BG’s shipping business, BG’s position in Lake Charles, and the global LNG trading business. Mr. Bonini also worked at Woodside, establishing its US LNG strategy, and at Centrica, founding its LNG import business. Most recently, he has been active as COO and board member of 4Gas and Dragon LNG. He was also one of the founding partners of Parallax Energy and the CEO of Louisiana LNG and Live Oak LNG. Mr. Bonini holds a first class degree in chemical engineering from Imperial College in London, and an MBA degree from INSEAD in France. He is also a fellow of the Institute of Chemical Engineers.

|

Ajey Chandra is a director at Muse, Stancil & Co., and the managing partner of the Houston office, where he also leads the midstream practice area for the firm. He joined Muse in 2014 after 28 years of experience in various facets of the midstream industry, including operations, engineering, business development, management and consulting. During his career, Mr. Chandra has had a wide variety of assignments covering all aspects of the energy industry, and he has had several long-term expatriate assignments overseas, including Europe and Southeast Asia. His operating, consulting and management experience includes working at Amoco, Purvin & Gertz, Hess and NextEra Energy Resources prior to joining Muse. Mr. Chandra holds a BS degree in chemical engineering from Texas A&M University and an MBA degree from the University of Houston. He has also attended executive education classes at Harvard Business School and is a registered professional engineer in Texas.

Comments