Israel seeks options to export huge gas reserves

G. Cohen, Consultant, Herzliya, Israel

Israel is examining its policies and options for exporting natural gas in light of the vast gas discoveries made offshore Israel in 2009 [the Tamar field, with 11 trillion cubic feet (Tcf) of reserves] and in 2010 (the Leviathan field, with 20 Tcf), as well as the smaller Tanin field (1.1 Tcf) in 2011 and the Karish field (1.8 Tcf) in 2013. In June 2013, the government of Israel sanctioned the export of 40% of these proven reserves.

Israel’s various gas export options should be examined with respect to the technical, commercial and logistical aspects of each alternative. A brief presentation of the global gas market is given to frame the context under which Israel will need to operate as it strives to get its gas into the global market toward 2020.

Gas markets: Global or local?

Natural gas is not a global commodity, but rather a local regional commodity that is influenced by global supply and demand, pricing and geopolitical events. In fact, in December 2012, NERA Economic Consulting divided the world natural gas map into 14 distinctive regions (see Fig. 1), each with its own characteristics of supply and demand, pricing mechanisms, concerns regarding security of supply, etc.

|

|

Fig. 1. World gas regions, as defined by NERA Economic Consulting. |

The global gas market runs from Japan and South Korea—which possess little indigenous gas and few current prospects for pipeline connections (although there has been some talk recently of building a pipeline from Russia), and which depend almost entirely on LNG imports—to China and India, which have some indigenous, yet insufficient, gas supplies, and where demand is growing relatively fast. In India, demand is increasing, although slower than anticipated, due to high LNG prices and the depreciation of the rupee. Growth is faster in China, as the country seeks to curb its worsening pollution problem.

In Latin America, a rainfall draught has increased LNG demand by 18% year on year. Conversely, in Europe, consumption growth has decreased as the continent burns additional supplies of cheap US coal and enjoys high renewable energy subsidies. Europe’s gas sector is also characterized by declining local supplies of gas, heavy reliance on Russian gas exports (25%–30% of demand), and environmental concerns keeping a lid on shale gas development. Europe may look to increase its imports of LNG in the future, albeit at a price that would likely be 50% higher than that of the Russia-supplied pipeline gas.

The LNG sector. Focusing specifically on the LNG market, most of the world’s LNG goes to Asia-Pacific, while most of the pipeline gas goes to Europe and the Americas. Data for 2013 show that 75% of the world’s LNG went to the Far East, 10% was shipped to the Americas and only 15% was sent to Europe. Demand for natural gas imports in general, and for LNG in particular, is focused on the Indo-Pacific region.

The Middle East will export more hydrocarbons to the Indo-Pacific region in the future. Russia, which is looking to diversify its export partners, will be exporting more gas to East Asia. After North America begins exporting LNG on a larger scale, it will likely be looking to fix shipments to the Indo-Pacific market under free-on-board tolling arrangements. The consensus is that, over the next 20 years, 85% of total growth in global energy consumption will come from the Indo-Pacific region.

First supply phase: 2016/2017. From the supply side, it is known that, over the next few years, the market will be tight and prices will remain high. Toward 2016/2017, however, new supplies are likely to hit the market, well before any large volumes of gas can be exported from Israel.

This first, relatively bearish cycle in 2–3 years is easy to predict, as it is based mostly on projects that have already been sanctioned (i.e., Papua New Guinea LNG; the Australian Ichthys LNG, Queensland Curtis LNG, Gladstone LNG, Gorgon LNG, Wheatstone LNG and Prelude FLNG projects; and Sabine Pass LNG in the US).

Second supply phase: 2020/2021. What will happen toward the start of the new decade is more challenging to accurately predict, both in terms of the volumes required and the prices that can be achieved. It was originally believed that the market would tighten again toward 2018 and revert to a sellers’ market. This scenario would be beneficial for Israel, especially in light of the slow Federal Energy Regulatory Commission (FERC) approvals for US export projects, delayed progress on Mozambican gas developments, high LNG project costs in Australia and export issues in North Africa.

Future outlook is mixed. However, the future scenario is now mixed, with a sense that some projects are creeping along and will be available to the market within this time frame, such as the Lake Charles, Louisiana LNG project in the US and the Russian Yamal LNG project. Together, these two projects would add 44 billion cubic meters per year (Bcmy) of LNG exports to the market.

Therefore, the second cycle in 2020/2021 is harder to estimate, as forecast elements are constantly shifting. If there is more supply than demand in 2020 and if prices decrease, then this will help projects with lower costs (i.e., brownfield projects in the US, with low Henry Hub prices; or Australian projects, if the currency once again depreciates considerably). If costs for these projects decrease, it will be harder for other projects to achieve final investment decisions (FIDs). On the other hand, if some of the liquefaction projects that have not yet been sanctioned are delayed, then demand could decrease alongside supply by the start of the next decade.

Although gas is indeed a local regional commodity, the old adage of “When the US sneezes, the rest of the world catches a cold” is very true for natural gas markets around the world. Draughts in one area of the world (Latin American); the development of new technology in another (shale exploitation in the US via hydraulic fracturing); the ‘black swan’ effect of a nuclear meltdown (Fukushima, Japan) on the global lack of appetite for nuclear power (as seen in Germany); cheap gas in the US, leading to the export of coal to Europe; and congestion on China’s roads, making coal expensive and raising pollution concerns—all of these scenarios make gas a more attractive energy source, and all impact gas availability, supply routes and prices.

It is, therefore, in this uncertain market that Israel, along with Cyprus, must make difficult decisions on gas exports. Should exports be sent via pipeline or in the form of LNG? What are the countries of destination? What types of contracts should be used, and under what pricing schemes? Here, the possible answers to some of these difficult questions are explored.

Israeli gas export policies

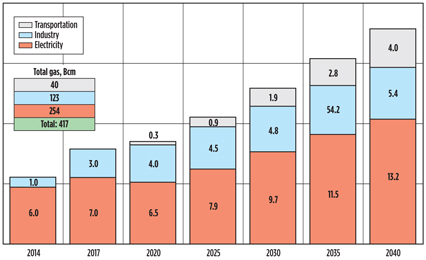

As mentioned previously, in June 2013, the government of Israel declared that 40% of proven gas reserves could be exported. This figure was based on proven reserves of approximately 33 Tcf of gas, a desire to maintain approximately 30 years of supply for the local market, estimated local consumption levels based on 7.4 Bcm of gas in 2013, and accumulated consumption of 540 Bcm over 30 years (Fig. 2).

|

|

Fig. 2. Estimated consumption of natural gas in Israel, 2014–2040. |

Government policy explicitly states that the fields must be hooked up to the Israeli market before exports can commence, and that export quotas will be allocated depending on the size of each field. Fields of 25 Bcm–100 Bcm may export 75% of their reserves, fields of 100 Bcm–200 Bcm may export 60% of their reserves, and fields larger than 200 Bcm may export 50% of their reserves.

In addition, the government granted a level of flexibility to the producers to swap quotas between fields, and a level of discretion to the petroleum commissioner within the Ministry of Energy to be able to enforce specific swap deals. This was recently seen at the end of March 2014, when the commissioner stated that gas from the Tanin and Karish fields would have to be sold to the local market, and their export quota volumes potentially swapped with the Leviathan field.

Other clauses in the government’s export policy include the determination that the Tamar field, which has been producing gas since March 2013, may only export 50% of the volume of gas it had not yet contracted on the date of the government decision. The policy also outlines a preference to establish any export facilities on Israel-controlled territory, as well as assurances that the local market will receive preference for gas (even from Leviathan), as long as no export contracts would need to be rescinded as a result of this clause.

Export options for Israeli gas: pipeline or LNG?

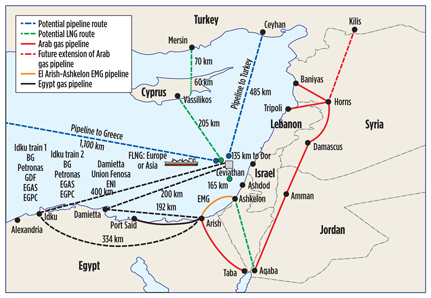

There are a number of options to export Israeli gas, either by pipeline or as LNG, and a number of countries to which this gas can be sold, as illustrated in Fig. 3.

|

|

Fig. 3. Export options for Israeli gas. |

Nearby pipeline options include lines to Palestine, Jordan and Egypt.

All of these potential pipeline projects would meet local consumption needs in these areas. In Egypt, the gas would also be exported onward to other countries.

If longer pipelines are considered, then there are options for pipelines to Turkey or to Greece—again, for local consumption in these markets and/or for further export to the European market.

LNG project options—all of which would include destination flexibility—include:

- Construction of an LNG liquefaction facility onshore Israel, either on the Mediterranean coast or by the Red Sea in Eilat

- Piping the gas directly from Leviathan northward to an LNG facility to be built in Cyprus

- Piping the gas southward to one of two LNG facilities that already exist, but are sitting mostly idle in Egypt

- Exporting the gas via a floating LNG (FLNG) facility offshore Israel

- Constructing a special-purpose reclaimed island offshore Israel for LNG export

- Or, in a different state, exporting the gas as compressed natural gas (CNG), via a floating CNG (FCNG) scheme.

Each of these plausible projects has inherent technological, commercial and/or logistical advantages and disadvantages.

Pipeline options. From the technical point of view, it is clear that the easiest, quickest and cheapest options would be to construct a pipeline to Palestine and Jordan. Palestine and Jordan are on Israel’s doorstep and require only a few kilometers (km) of onshore pipeline on easy terrain, without the need for passage through a transit country. In fact, gas sales contracts were signed with these two countries in January 2014 (for gas from the Leviathan field) and February 2014 (for gas from the Tamar field), respectively. Export quantities are small, amounting to just 4.75 Bcm over 20 years to Palestine for a power station to be constructed in Jenin, and 1.8 Bcm over 15 years to the existing Arab Potash and Jordan Bromine industrial plants on the Jordanian side of the Dead Sea.

Insofar as pipelines to Egypt, Turkey and Greece are concerned, from a technical point of view, the first two options are relatively easy, since the deepwater distances are easily traversable for marine pipelines. The LNG facilities in Egypt are located 200 km and 400 km away, and the southern tip of Turkey is approximately 485 km from the Leviathan field.

Pipeline to Greece. A pipeline to Greece, however, would stretch over 1,100 km, all offshore and crossing very deep waters up to 3,000 m. The cost of such a project would likely be on par with an LNG facility, without having any destination flexibility, and volumes would likely be restricted to 8 Bcmy, making this an unlikely option.

Pipeline to Egypt. Sending the gas to Egypt would combine both the pipeline and LNG options. Two liquefaction facilities have already been constructed by BG and Petronas at Idku, and by Unión Fenosa and Eni at Damietta. Additionally, the route from Leviathan to Egypt requires no transit countries. On the commercial front, the sellers will need to consider Egypt’s $6 billion (B) debt to oil and gas companies, and understand the risks inherent in this option.

Pipeline to Turkey. In a similar frame of mind, the concept of constructing a pipeline to Turkey makes good commercial sense for both the buyers and the sellers. Turkey, which consumes huge amounts of gas and is expected to see its demand increase at a rate of 5%/yr–10%/yr, has very little indigenous gas and imports 60% of its gas from Russia and 20% from Iran. Turkey is eager to diversify its supply sources to increase its energy security and reduce its energy prices. However, regional geopolitics are likely to complicate such a project, unless the pipeline is constructed by Turkish entities.

Israel LNG. A quick look at the other LNG options shows that the scenario of constructing an LNG facility onshore Israel would probably not be possible due to technical reasons. Onshore LNG facilities require large coastal areas (which Israel is lacking), and regulatory approvals would be very difficult to obtain due to the ‘not in my backyard’ (NIMBY) phenomenon.

Cyprus LNG. The option of taking the gas to Cyprus and constructing a joint LNG facility with the international majors operating in Cyprus (i.e., Total, KOGAS, Eni, Noble Energy and Delek Group) and the Cypriot government could be a creative solution. At present, Cyprus has insufficient reserves of gas to construct a two-train export facility, which is the optimal minimum capacity required to enjoy economies of scale and provide LNG buyers with security of supply. An onshore LNG terminal in Cyprus would enable Israel, which has no site of its own on which to construct an onshore terminal, to benefit from an already-determined location (Vassilikos) and the existence of an entry point into the EU.

Although there have been a few successful examples elsewhere in the world where one country enabled its oil or gas to be processed in another country, the Israeli security establishment opposes this option. Furthermore, the lease granted to the Leviathan partners on March 27, 2014 by the Israeli Ministry of Energy states that the field must first be hooked up to the Israeli market before exports can be considered.

Alternate options. The remaining options for gas exports are an FLNG vessel, an LNG facility on a reclaimed island and a FCNG vessel. These are all commercially and logistically feasible alternatives, but there are technical problems associated with each.

FLNG projects are progressing on the world scene, and the Mediterranean is a relatively mild sea, but the technology is untested and would only cater to small volumes of gas (3 Bcmy–5 Bcmy). Also, although the price of gas exported as FLNG is likely to decrease, it is still expensive at present.

The same problems exist, in exaggerated form, with FCNG. There are no FCNG projects under construction, and none have reached FID, making it an untried technology. However, if it were possible to move ahead with the FCNG option, it could be interesting commercially and would circumvent Cyprus’ reluctance to allow a pipeline to be constructed for gas exports to Turkey.

Setting up an LNG facility on a reclaimed island offshore Israel is not a commercially or technically possible option, as Israel does not have enough sand to construct such a project.

Looking toward the future

Israeli gas will eventually reach the global market. All of the aforementioned export options are feasible, albeit complex. Investors must work together with the government of Israel, over time, to gain a better understanding of all the relevant issues and gradually mitigate the risks for the best export option(s). This will enable procurement of finances, help secure offtake agreements and ensure long-term security of demand.

It will be interesting to see which issues will emerge as the most challenging and decisive—commercial, technical or logistical. Once exports are achieved, the financial benefits for the participating companies and the country will be huge. GP

|

Gina Cohen has been working as a natural gas consultant in Israel and Palestine since before the first discoveries were made offshore Israel and Gaza over 15 years ago. Her activities, either on behalf of major oil and gas companies or governmental institutions, have spanned involvement in all aspects of the gas chain: exploration and development, transmission, sales negotiations on behalf of both buyers and sellers, conducting feasibility studies on gas-generated independent power plants and potential FLNG projects, regulatory aspects of the construction and siting of natural gas facilities, and a wide variety of other projects in the region. Ms. Cohen lectures on natural gas law, economics and strategy at the MSc programs for petroleum engineers at Technion University in Haifa, Israel, and at Cyprus University in Nicosia, Cyprus. She is also the author of the Hebrew-English energy lexicon, www.hebrewenergy.com.

Comments