China's epic renewables boom lifts it into rare clean capacity club

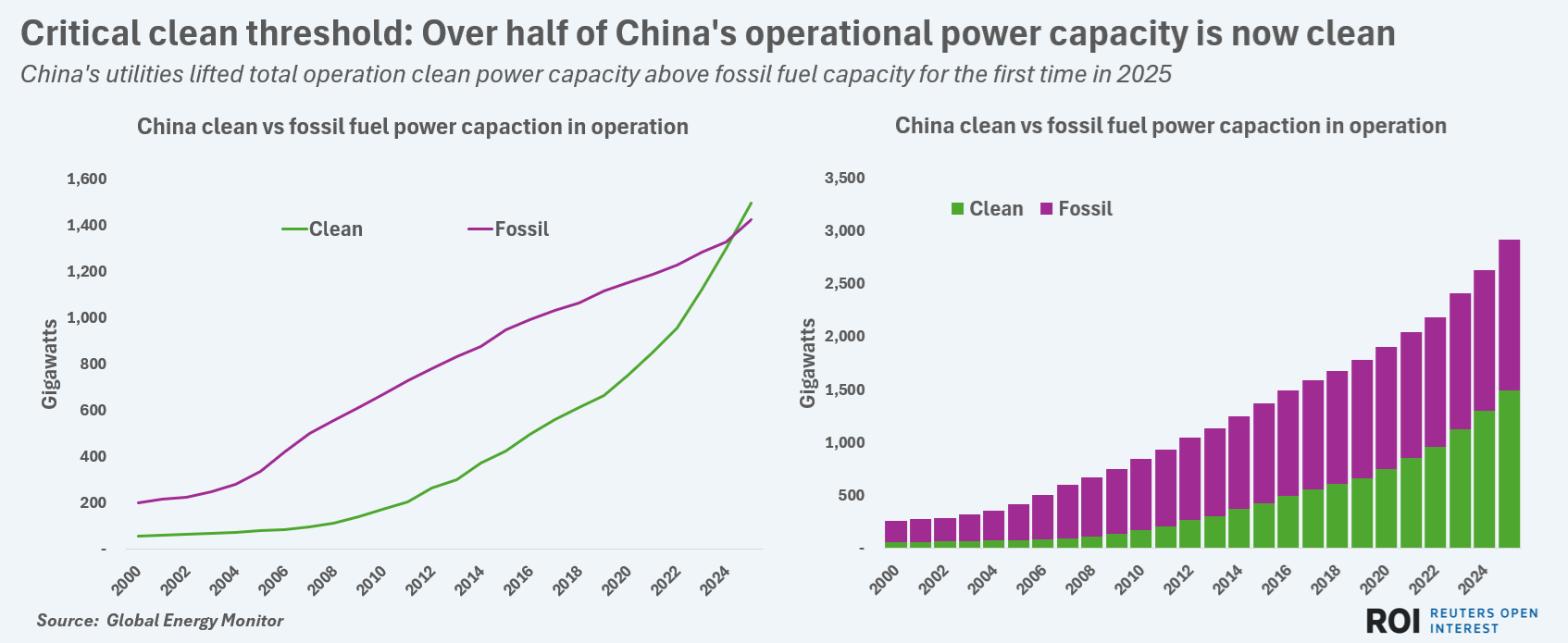

The world's top polluter crossed a critical energy transition threshold in 2025 by deploying more clean power capacity than fossil fuel generation capacity for the first time.

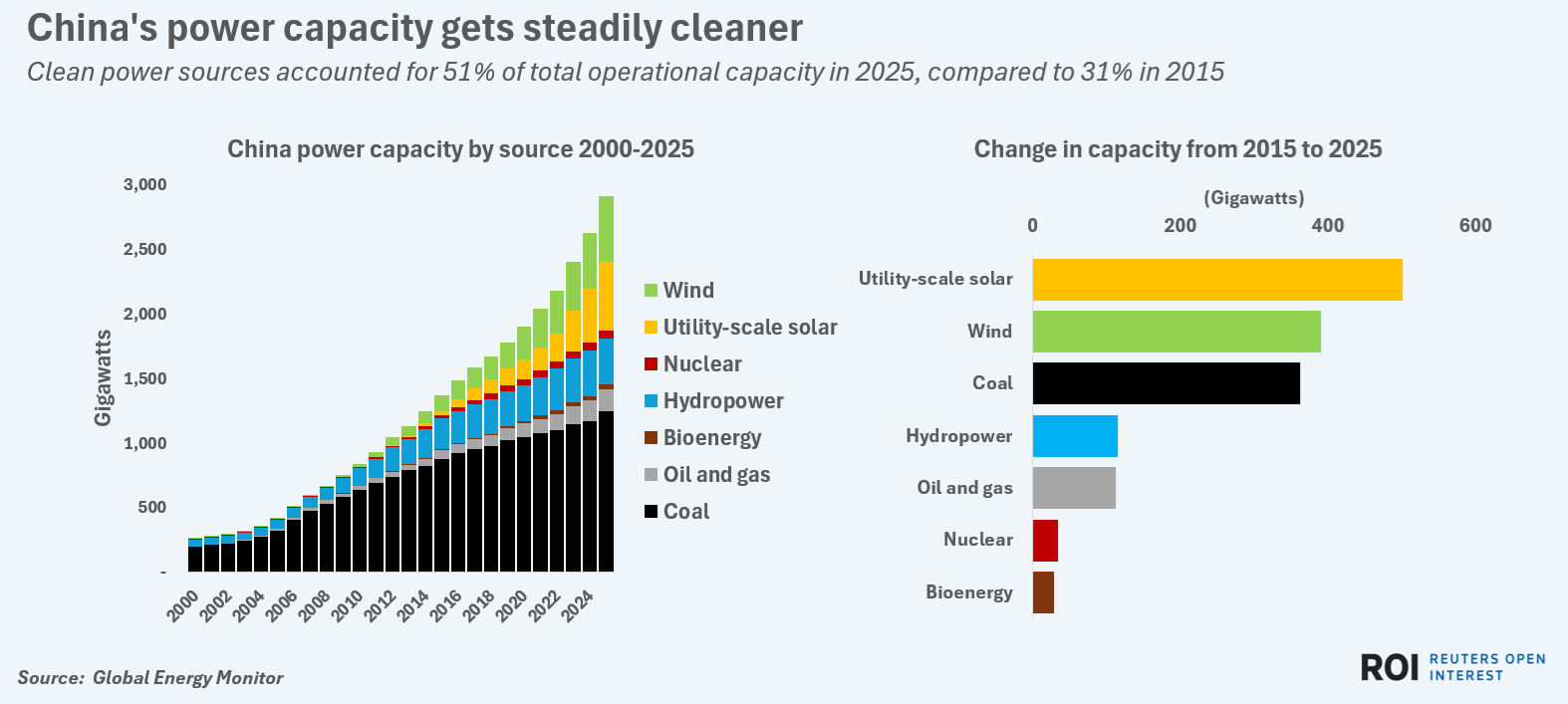

China had 1,494 gigawatts (GW) of clean power generation capacity in operation in 2025, compared to 1,420 GW of capacity fueled by coal, natural gas and other fossil fuels, data from Global Energy Monitor shows.

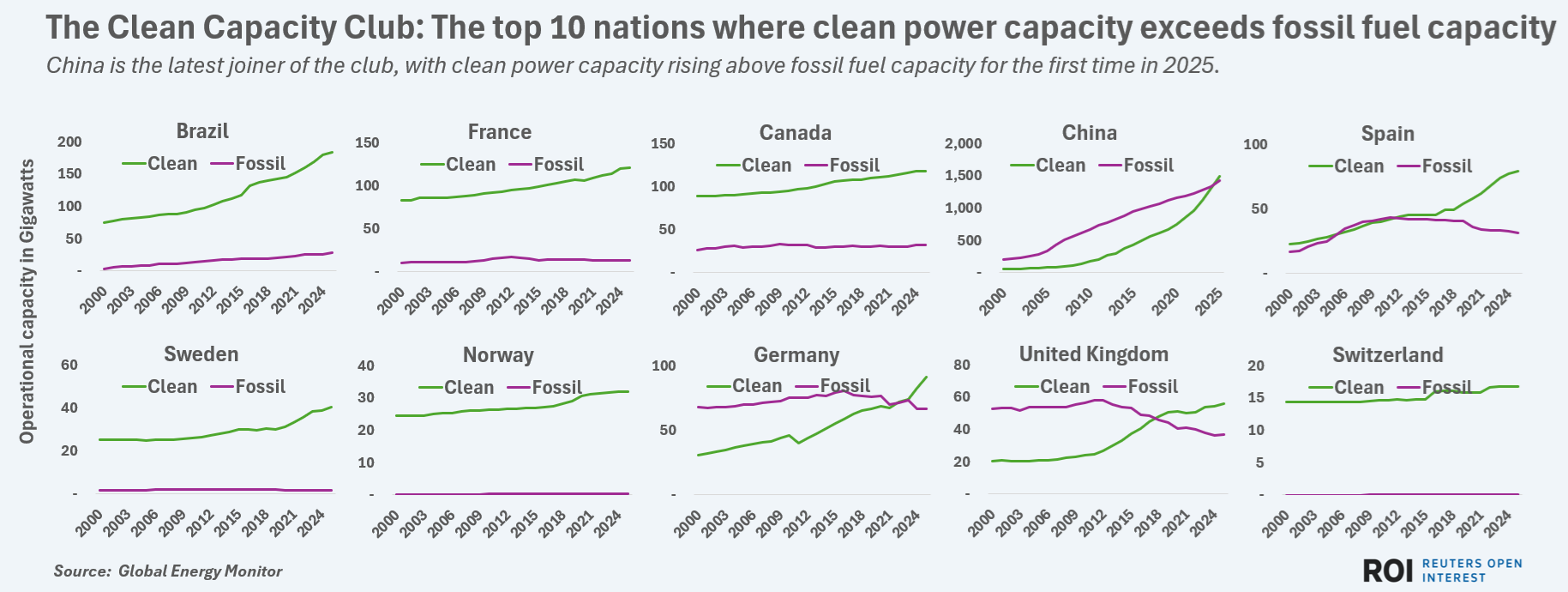

With 73 GW more clean capacity than fossil fuel capacity in use, China now has 51% of its power fleet drawing from clean sources and joins the ranks of Brazil, France and Germany as major economies powered mainly by clean energy sources.

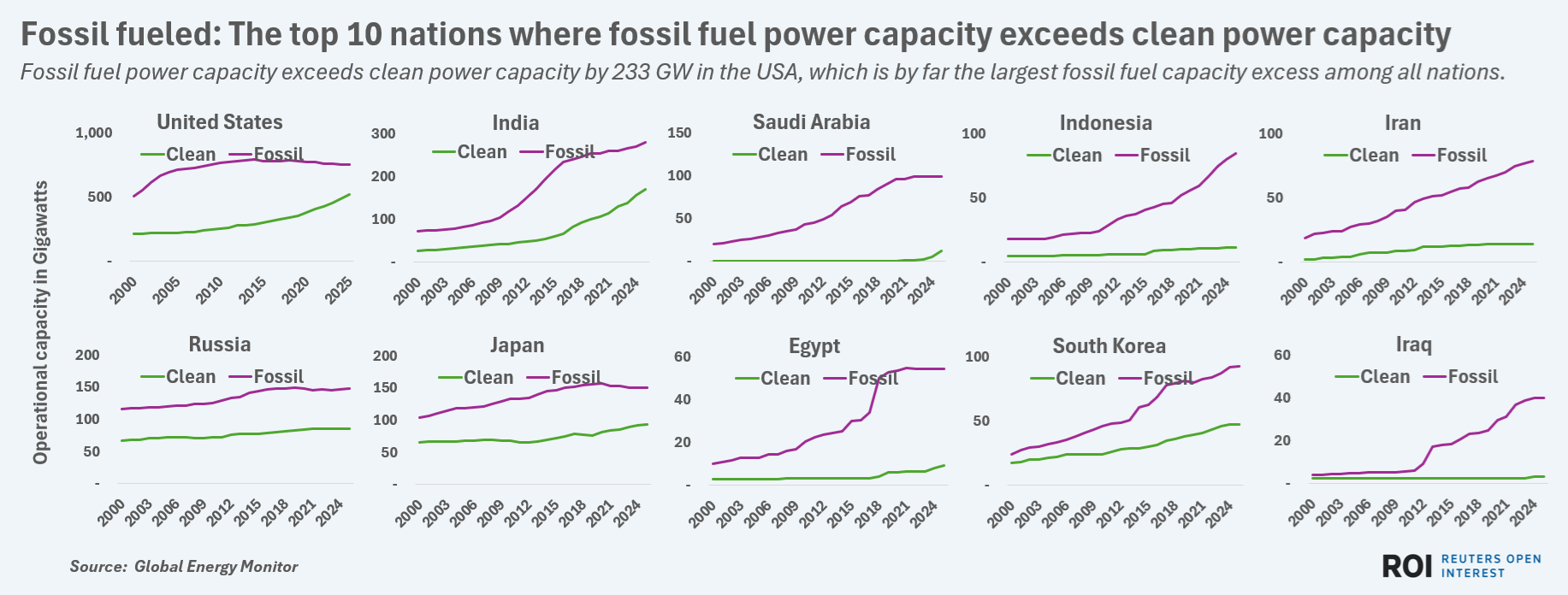

At the other end of the fossil fuel versus clean power capacity spectrum is the United States, which had 233 GW more fossil fuel capacity than clean capacity in operation in 2025, more than any other nation.

India, Saudi Arabia, Russia and Indonesia are other major economies with a similarly fossil fuel-heavy power capacity reliance, GEM data shows.

As the current U.S. administration has cut federal support for renewables and is backing further growth in natural gas and coal power, the U.S. looks set to widen its fossil fuel capacity lead even as China maintains clean growth momentum.

That divergence in the power systems of the two largest economies highlights starkly different views on the future of energy, with China pushing for ever-cleaner generation while the U.S. champions greater fossil fuel reliance.

Solar-powered overhaul. While all of China's power sources have registered capacity growth over the past decade, a 1,554% surge in utility-scale solar capacity since 2015 has been the most transformational development.

Solar farms accounted for a record 18.3% of operational capacity in China last year, up from just a 2.4% solar share in 2015, GEM data shows.

That jump in solar capacity did more than just add clean power to China's energy system. It also allowed China to reduce coal-fired power's share of the overall generation mix, from 64% in 2015 to a record low 42.7% share last year.

Solar now has the second largest power capacity footprint in China behind coal, and looks primed for additional growth through the remainder of the decade thanks to massive gains in the production of solar components within China in recent years.

All told, China's total clean power capacity expanded by 253% between 2015 and 2025, while its fossil fuel generation capacity expanded by 50% to yield a 113% rise in total power generation capacity during that decade.

Looking forward, China's world-leading battery production sector looks set to further accelerate clean power momentum by helping to store ever-greater volumes of surplus solar power output during the day for later discharge during demand peaks.

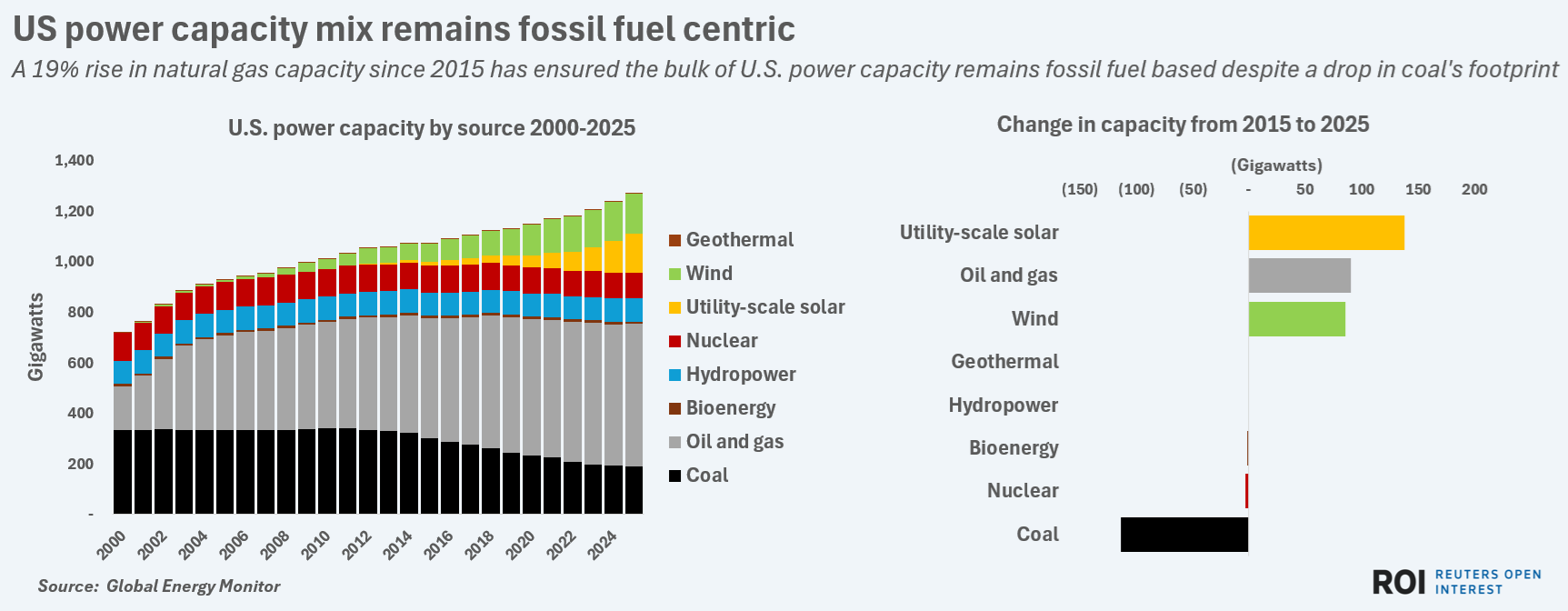

U.S. U-turn? U.S. clean power capacity climbed by 74% between 2015 and 2025 from around 300 GW to 520 GW.

Over the same period, fossil fuel capacity contracted by around 3% from around 775 GW to 753 GW as outdated coal-fired plants were shuttered.

In sum, the total U.S. power capacity footprint expanded by 18% since 2015 to a record of 1,272 GW last year.

Given the pressing need to boost electricity supplies to run data centers and AI applications, further jumps in U.S. generation capacity will emerge in the coming years.

However, following the scrapping of federal incentives for renewables, utilities and power developers are expected to boost natural gas capacity by more than most other power sources.

The amount of new gas-fired capacity under construction in the U.S. has doubled from a year ago, while the amount in pre-construction has jumped fivefold, GEM data shows.

Once complete, that gas power building boom will further lift total U.S. fossil fuel generation capacity and may reverse the recent growth of clean power's share of the overall capacity mix from around 28% in 2015 to a record 41% last year.

Indeed, the prioritization of fossil fuels over renewables by U.S. utilities looks set to ensure the U.S. power system more closely resembles the development paths of other fossil fuel-centric economies such as Saudi Arabia than China's.

Saudi Arabia's clean power capacity footprint has grown steeply so far this decade, especially its solar capacity which has jumped from less than 0.5 GW in 2020 to over 11 GW last year.

However, around 90% of Saudi Arabia's total power footprint is still based on fossil fuels, which look set to remain the primary pillar of the oil-rich kingdom's energy system for decades more.

The U.S. is similarly bound to fossil fuels as it is the world's top natural gas producer and exporter, and its power system can be expected to continue exploiting its gas reserves for the foreseeable future.

That gas-centric drive may dovetail with U.S. President Donald Trump's near-term "energy dominance" agenda, but will result in the U.S. falling behind in building out the clean energy systems expected to run most economies by the end of the century.

The opinions expressed here are those of Gavin Maguire, a columnist for Reuters.

Related News

Related News

- Freeport LNG export plant in Texas reports shutdown of liquefaction train

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

Comments