U.S., Qatar to fill gap after EU bans Russian LNG imports

- EU to ban Russian LNG imports from 2027

- S., Qatar to boost LNG export capacity by then

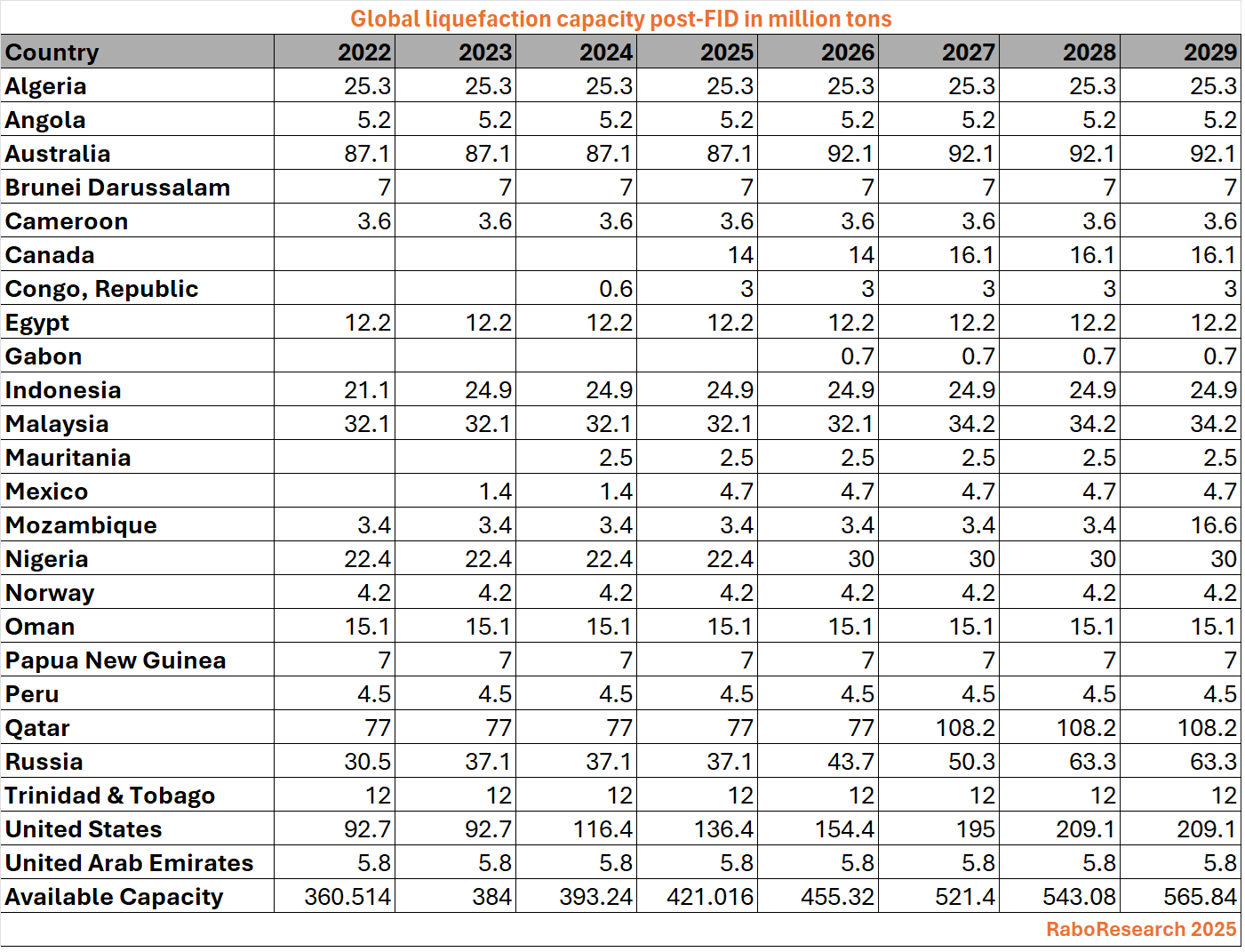

- Global LNG capacity to rise by 161 MMtpy by 2027

The European Union will be able to fully replace Russian liquefied natural gas (LNG) imports with alternative supply from 2027 without major price shocks, thanks to booming projects in the United States and Qatar, according to data and analysts.

The EU on Thursday approved new sanctions against Russia for its war in Ukraine that ban Russian LNG imports from January 1, 2027, a year earlier than planned.

EU energy payments to Moscow have come under renewed scrutiny after U.S. President Donald Trump demanded that Europe cease all purchases. While the EU has cut its reliance on Russian energy by 90% since 2022, it has still imported more than €11 B worth of Russian energy so far this year.

European economies suffered from a gas price spike in 2022–2023 after Russia invaded Ukraine but the world has witnessed a boom in LNG projects since then, which analysts say will result in a global gas supply glut later this decade.

Russia supplies the European Union with 21 MMtpy of LNG, of which 15.5 MMt come under long-term contracts, according to data from the International Group of Liquefied Natural Gas Importers.

That is insignificant compared to the predicted jump in the global LNG export capacity by 161 MMtpy by 2027, according to Rabobank estimates.

"2027 is a key year for new LNG export capacity, especially from the U.S. and Qatar... There is enough coming online to make up for a Russian shortfall, especially if Russian LNG can just flow into other markets like China," said Florence Schmit, energy strategist at Rabobank.

The United States will add more than 50 MMtpy by the end of 2027 on top of 2025 levels, cementing its position as the top exporter, Rabobank data showed.

The U.S. is already supplying over 50% of the EU's LNG and the share may rise to as much as 70%, according to Energy Aspects.

Qatar is expected to add around 31 MMtpy, thanks to its North Field expansion while Canada and Nigeria will also have new projects.

"All in all, ... halting Russian LNG imports in Europe should have minimum impact on gas prices," said Anne-Sophie Corbeau, a scholar at the Columbia University Center on Global Energy Policy.

The EU LNG ban will not reduce overall Russian supply in the market, but rather reshape global trade flows as cargoes will likely shift to Asia, said Arturo Regalado of Kpler.

Russia is expected to add nearly 20 MMtpy from its Arctic LNG 2 project to its existing capacity of nearly 33 MMtpy.

Prices in Europe and Asia could rise, though, if Russia is unable to sell significant volumes of LNG in Asia due to a combination of sanctions and unwillingness of Asian buyers to import it, Corbeau said.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments