U.S. natural gas trade will continue to grow with the startup of new LNG export projects

Data source: U.S. Energy Information Administration, Short-Term Energy Outlook (STEO)

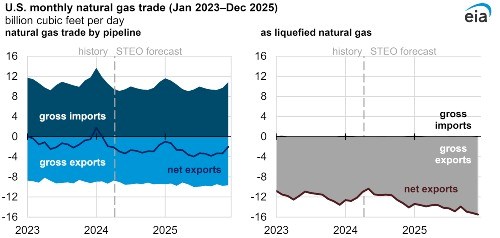

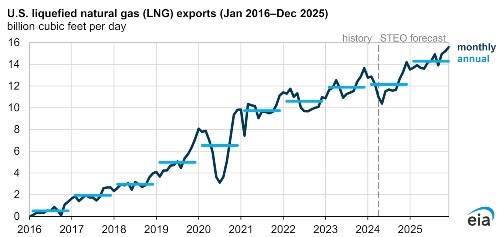

In our recently released Short-Term Energy Outlook (STEO), we forecast that U.S. liquefied natural gas (LNG) exports will continue to lead growth in U.S. natural gas trade as three LNG export projects currently under construction start operations and ramp up to full production by the end of 2025. We also forecast increased natural gas exports by pipeline, mainly to Mexico. In our STEO forecast, net exports of U.S. natural gas (exports minus imports) grow 6% from 2023 in 2024 to 13.6 billion cubic feet per day (Bcf/d). In 2025, net exports increase another 20% to 16.4 Bcf/d.

We forecast that U.S. LNG exports increase 2% in 2024 to average 12.2 Bcf/d. In 2025, we forecast that LNG exports grow by an additional 18% (2.1 Bcf/d). We forecast U.S. natural gas exports by pipeline to grow by 3% (0.3 Bcf/d) in 2024 and by 4% in 2025. We expect pipeline imports to decline by 0.4 Bcf/d in 2024 and then increase slightly (0.1 Bcf/d) in 2025.

In 2024–25, we forecast that existing U.S. LNG export facilities will run at similar utilization rates as in 2023. Annual maintenance typically occurs in the spring and fall, when global LNG demand is lower and temperatures are mild. In April and May 2024, we expect LNG exports to decline while two of the three trains at the Freeport LNG export facility undergo annual maintenance. Later in 2024, we expect that Plaquemines LNG Phase I and Corpus Christi Stage 3 will begin LNG production and load first cargoes by the end of the year. In 2025, the developers of Golden Pass LNG plan to place in service the first two trains of this new three-train LNG export facility.

Data source: U.S. Energy Information Administration, Short-Term Energy Outlook (STEO)

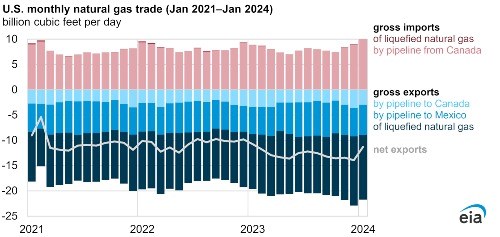

We forecast an increase in U.S. natural gas pipeline exports to Mexico as several pipelines in Mexico—Tula-Villa de Reyes, Tuxpan-Tula, and Cuxtal Phase II connecting to the Energía Mayakan pipeline on the Yucatán Peninsula—become fully operational in 2024–25. These pipelines started partial service in 2022–23 but have not been operating at full capacity. Also, flows via the Sur de Texas-Tuxpan underwater pipeline are likely to increase slightly in 2024 when it begins delivering natural gas from the United States to Mexico’s first LNG export project, Fast LNG Altamira.

U.S. natural gas pipeline imports from Canada remained relatively unchanged over the last two years (2022–23), averaging 8.1 Bcf/d. We expect pipeline imports from Canada to remain a key supply source, particularly for the U.S. Midwest region during winter months.

U.S. LNG imports, which primarily serve New England and generally peak in winter months, declined slightly in 2023, mainly because of record-warm winter weather. We expect LNG imports to average about 0.1 Bcf/d in 2024–25 and continue to serve as a marginal supply source during periods of high demand, particularly in the winter months.

Data source: U.S. Energy Information Administration, Natural Gas Monthly

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

Comments