U.S. ethane production, consumption, and exports set new records again in 2023

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly

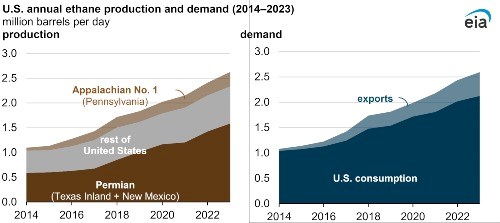

U.S. ethane production, consumption, and exports established new record highs in 2023, according to data from our Petroleum Supply Monthly. Continued growth in ethane consumption in the global petrochemical sector and rising ethane recovery associated with natural gas production drove these increases.

U.S. ethane production rose 9% to average 2.6 million barrels per day (b/d) in 2023, driven by record natural gas production. In the United States, almost all ethane is recovered at natural gas processing plants, which remove ethane and other natural gas plant liquids (NGPL) from raw natural gas. The Texas Inland and New Mexico refining districts, which span the Permian Basin, accounted for 61% of all U.S. ethane production in 2023. Production in those districts averaged 1.6 million b/d in 2023, about the same as in 2022. Production in the Appalachian No. 1 Refining District, which straddles most of the Appalachian Basin production area in Pennsylvania and West Virginia, accounted for 11% of total U.S. ethane production, also nearly the same as in 2022.

Domestic ethane consumption, measured as product supplied, rose 5% in 2023 to 2.1 million b/d. In the United States, ethane is consumed almost exclusively in the petrochemical industry as a feedstock. Two new petrochemical crackers, located in Port Arthur, Texas, and in Monaca, Pennsylvania, ramped up operations in 2023 after coming on line in late 2022. Ethane consumption in the Gulf Coast (PADD 3), where most crackers are located, increased 4% from 2022 to 2.0 million b/d. Ethane consumption on the East Coast (PADD 1) more than doubled, averaging 38,000 b/d in 2023, a 22,000 b/d increase from 2022.

U.S. ethane exports averaged a record 471,000 b/d during 2023, a 57,000-barrel increase from the previous record set the year before. Strong ethane exports were driven by growth in global petrochemical sector demand and rising tanker capacity. Low prices for U.S. ethane compared with other feedstocks globally contributed to the record exports. China imported 45% of U.S. ethane exports in 2023, followed by India (16%), Canada (14%), and Norway (10%).

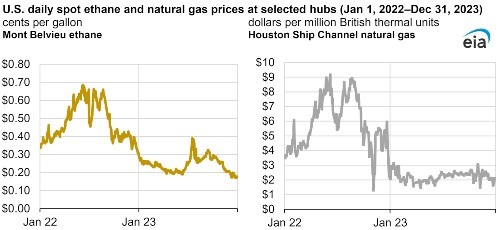

Data source: Bloomberg, L.P., and Natural Gas Intelligence

Note: The Houston Ship Channel is the closest natural gas pricing hub to the Mont Belvieu NGPL pricing hub. NGPL=natural gas plant liquids.

U.S. ethane prices at Mont Belvieu, Texas, the main pricing hub for NGPLs, were volatile throughout 2023. Ethane prices averaged under 25 cents per gallon (gal) for the year but briefly rose close to 39 cents/gal ($5.89 per million British thermal units) in mid-July. Ethane prices fell below 18 cents/gal in the last week of the year due to lower natural gas prices. When ethane prices are low relative to natural gas prices, plant operators can leave more ethane in the natural gas stream to be sold in natural gas markets.

In our March 2024 Short-Term Energy Outlook (STEO), we forecast that U.S. ethane production will rise to average 2.7 million b/d in 2024 and 2.8 million b/d in 2025. U.S. ethane consumption will rise to average 2.2 million b/d in 2024 and 2.3 million b/d in 2025, and exports will remain flat at an average of 500,000 b/d in 2024 and 490,000 b/d in 2025.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

Comments