U.S. natural gas production grew by 4% in 2022

Data source: U.S. Energy Information Administration, Drilling Productivity Report, Monthly Crude Oil and Natural Gas Production Report, and Natural Gas Monthly

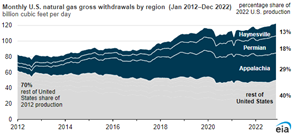

U.S. natural gas production grew by 4% (4.9 billion cubic feet per day [Bcf/d]) in 2022, averaging 119 Bcf/d. Three regions—Appalachia, Permian, and Haynesville—accounted for 60% of all U.S. production in 2022, similar to the proportion in 2021.

The most comprehensive measure of U.S. natural gas production that we collect is gross natural gas withdrawals. Our Drilling Productivity Report measures gross natural gas withdrawals in selected onshore regions.

Data source: U.S. Energy Information Administration, Drilling Productivity Report, Monthly Crude Oil and Natural Gas Production Report, and Natural Gas Monthly

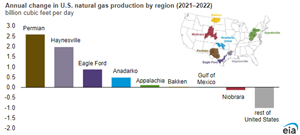

In 2022, the Appalachia region in the Northeast produced more natural gas than any other U.S. region, accounting for 29% of U.S. gross natural gas withdrawals (or 34.6 Bcf/d). Even as Appalachia remained the most prolific U.S. natural gas-producing region, its production growth has been slowing because sufficient pipeline takeaway capacity is not available to transport more natural gas. No new major pipeline capacity additions from the Northeast came online in 2022. In 2021, gross natural gas withdrawals in the Appalachia region had grown by 1.4 Bcf/d. In 2022, growth was just 0.1 Bcf/d, less than in 2020, when the COVID-19 pandemic and subsequent mitigation efforts limited production growth.

The Permian region in western Texas and New Mexico is the second-largest U.S. natural gas producing region, accounting for 18% of U.S. production. In 2022, gross natural gas withdrawals rose by 2.6 Bcf/d in the Permian, averaging 21.0 Bcf/d.

Unlike the other two regions, natural gas production growth in the Permian region is primarily the result of oil-directed drilling because of the associated gas produced during oil production. Despite lower average crude oil prices in 2022 compared with previous years, West Texas Intermediate crude oil prices remained high enough to support oil-directed drilling activity, especially in the Permian region. The average breakeven price in the Permian during 2022 ranged from $50 per barrel (b) to $54/b, according to data from a Dallas Fed Energy survey.

Gross natural gas withdrawals in the Haynesville region in Louisiana and Texas grew by 2.0 Bcf/d in 2022 to 15.3 Bcf/d, or 13% of U.S. gross natural gas withdrawals. The Haynesville region is a strategic location for operators to drill for natural gas because of its proximity to the Gulf Coast, where demand from liquefied natural gas export terminals and industrial facilities has been growing. Gross natural gas withdrawals in the Eagle Ford region in Texas rose by 0.9 Bcf/d (18%) in 2022, the first year it had increased since 2019.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

Comments