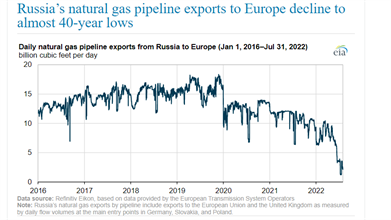

Russia’s natural gas pipeline exports to Europe decline to almost 40-yr lows

(EIA) -- Russia’s natural gas exports by pipeline to the EU and the UK declined by almost 40% during the first seven months of 2022 compared with the same period in 2021 and by almost 50% compared with the previous five-year (2017–21) average, according to data from Refinitiv Eikon. In mid-July 2022, exports declined to 1.2 Bft3d, the lowest level in nearly 40 years. Between 2016 and 2020, Russia had accounted for about one-third of the EU’s and the UK’s supply of natural gas via pipeline, according to Eurostat.

Russia exports natural gas to the EU and the UK through three major pipeline corridors, which account for approximately 16.0 Bft3d of import pipeline capacity when combined with smaller interconnections, according to data from Gazprom:

- Offshore (underwater Baltic Sea) pipeline Nord Stream 1 into Germany (at entry point Greifswald) and further to the Netherlands, France, the UK, and other European countries,

- Via Belarus to Poland (at entry point Kondratki) and Germany (at entry point Mallnow, the westernmost point of the Yamal pipeline),

- Via Ukraine to Slovakia (at entry point Velke Kapusany), where the natural gas pipeline branches out to the Czech Republic and Austria, transporting natural gas further to countries in northern and southern Europe.

Russia’s natural gas pipeline exports to the EU and the UK have been declining since 2020, initially as a result of reduced demand in Europe because of responses to the COVID-19 pandemic. In mid-2021, Russia began to limit its natural gas exports to Europe to long-term contracted volumes only and ended spot-market sales. Russia’s natural gas exports to the EU and the UK averaged 16.0 Bft3d in 2019, 12.4 Bft3d in 2020, and 10.9 Bft3d in 2021.

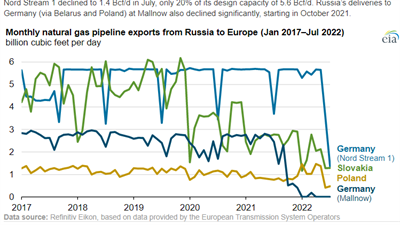

The most significant decline in Russia’s exports has been into Germany via the Nord Stream 1 pipeline. Exports on Nord Stream 1 declined to 1.4 Bft3d in July, only 20% of its design capacity of 5.6 Bft3d. Russia’s deliveries to Germany (via Belarus and Poland) at Mallnow also declined significantly, starting in October 2021.

Pipeline flows from Russia into Slovakia averaged 1.8 Bft3d so far in 2022, compared with the previous 5-yr average of 4.2 Bft3d for the same period. Pipeline flows declined, in part, because a natural gas compressor station located in Ukraine was taken offline. Russia’s natural gas deliveries into Poland and neighboring countries via Belarus averaged 0.9 Bft3d from January 2021 through April 2022, declining to 0.2 Bft3d since then.

To compensate for lower natural gas pipeline exports from Russia, the EU and the UK have been importing record-high volumes of LNG this year, particularly from the U.S.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments