LNG exports continue to lead growth in U.S. natural gas exports

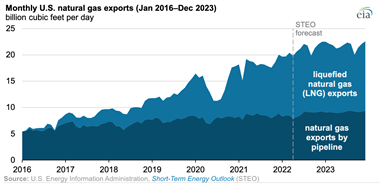

(EIA) — Since the U.S. began exporting more natural gas than it imports on an annual basis in 2017, natural gas exports both by pipeline and as LNG have grown significantly. The EIA forecasts that LNG exports will continue to lead the growth in U.S. natural gas exports and average 12.2 Bft3d in 2022. If realized, the U.S. would surpass Australia and Qatar and become the world’s top LNG exporter this year.

The EIA expects annual U.S. LNG exports to increase by 2.4 Bft3d in 2022 and 0.5 Bft3d in 2023. We forecast that natural gas exports by pipeline to Mexico and Canada will increase slightly, by 0.3 Bft3d in 2022 and by 0.4 Bft3d in 2023, primarily as a result of more exports to Mexico. The U.S. currently ranks second in the world in natural gas exports, behind Russia.

U.S. LNG exports exceeded pipeline exports of natural gas for the first time on an annual basis in 2021. Monthly LNG exports continued to set new records in 2021 and averaged 11.3 Bft3d this winter, 2.2 Bft3d more than last winter. In March 2022, U.S. LNG exports reached a new high of 11.9 Bft3d. U.S. LNG export capacity increased in 2021 with the addition of Sabine Pass Train 6 and capacity expansions at Sabine Pass and Corpus Christi LNG export terminals.

By the end of 2022, once the new Calcasieu Pass LNG export facility is placed in service, the U.S. will have more LNG export capacity than any other country in the world. The EIA expects that relatively high LNG demand in Asia and Europe will support continued U.S. LNG exports.

U.S. exports by pipeline also increased in 2021 as Mexico continued to expand its domestic pipeline network. The increase in flows via Sur de Texas-Tuxpan Pipeline and the Trans-Pecos Pipeline (part of the Wahalajara system) allowed more natural gas to flow to the Mérida markets in the Yucatán Peninsula and to power plants in the Mexico City and Guadalahara regions in central and west-central Mexico.

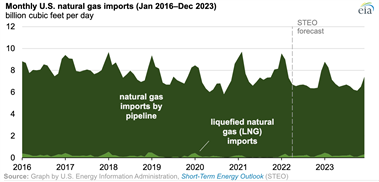

The EIA expects U.S. natural gas imports to decrease by 0.5 Bft3d in 2022 and by 0.2 Bft3d in 2023 because natural gas production from the Appalachia region will likely continue to displace imports from Canada in the midwestern states. We expect LNG imports, primarily into New England in the winter months, to remain essentially unchanged in the next two years.

Principal contributor: Victoria Zaretskaya

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments