EIA explores effects of not building future interstate natural gas pipelines

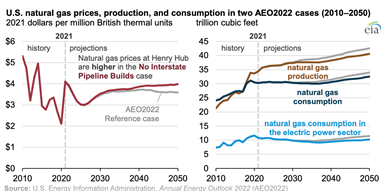

The EIA analyzes the effects on the energy market if no additional U.S. natural gas pipeline capacity is built between 2024 and 2050. In the No Interstate Natural Gas Pipeline Builds case, the EIA projects 5% less natural gas production and 4% less natural gas consumption in 2050 compared with the reference case. The EIA also projects that the Henry Hub spot price in 2050 would be 11% higher in that case than in the reference case.

Restricting U.S. interstate pipeline builds in its projection results in 7.4 Bft3d less interregional capacity in 2050 than in the reference case projection, which, for example, limits the amount of natural gas that can flow from the Appalachia production region to demand areas such as the Midwest.

The higher natural gas prices that result from capacity constraints primarily affect natural gas consumption in the U.S. electric power sector, which is more price-sensitive than the residential, commercial, and industrial sectors. In the No Interstate Natural Gas Pipeline Builds case, the EIA projects 11% less natural gas-fired generation in the U.S. during 2050 than in the reference case. Higher natural gas prices make natural gas less economical for electric power generation compared with alternative sources, such as coal or renewables.

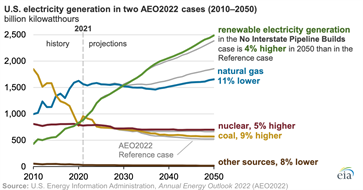

The EIA projects that natural gas’s share of U.S. electricity generation would fall from 34% in 2050 in the reference case to 31% in the No Interstate Natural Gas Pipeline Builds case. To make up for less natural gas-fired generation in the No Interstate Natural Gas Pipeline Builds case, electricity generation from renewables, coal and nuclear sources increase.

The EIA projects that restricting interstate U.S. natural gas pipeline capacity would only slightly lower energy-related CO2 emissions in the U.S. relative to the reference case. Total CO2 from all fuel sources in 2050 are 4% lower in the No Interstate Natural Gas Pipeline Builds case than in the Reference case. The relatively small effect on CO2 emissions, despite the decline in natural gas consumption and growth in electric power generation from renewable sources, is due to our forecast of increased coal-fired power generation, which would be more carbon intensive than the natural gas-fired generation it displaces.

Principal contributor: Stephen York

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments