U.S. natural gas prices likely to remain elevated through the winter

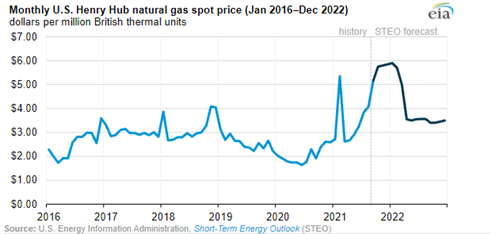

In their October Short-Term Energy Outlook (STEO), the EIA forecasted that natural gas spot prices at the U.S. benchmark Henry Hub will average $5.67/MMBtu between October and March, the highest winter price since 2007–2008. The increase in Henry Hub prices in recent months and in our forecast reflect below-average storage levels heading into the winter heating season and strong demand for U.S. LNG, even though we’ve seen relatively slow growth in U.S. natural gas production. The EIA expects Henry Hub prices will decrease after the first quarter of 2022, as production growth outpaces growth in LNG exports, and will average $4.01/MMBtu for the year.

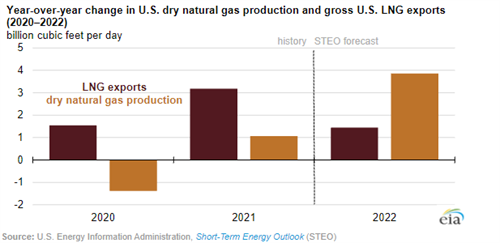

U.S. exports of LNG are establishing a record high this year, and we expect them to set a new record high next year. We expect LNG exports to average 9.7 Bft3/d) this year (3.2 Bft3/d more than the 2020 record high of 6.5 Bft3/d) and to exceed annual pipeline exports of natural gas for the first time. The year-on-year increase in LNG exports coincides with slight growth in U.S. natural gas production. The EIA expects U.S. dry natural gas production to average 92.6 Bft3/d this year, which is 1.1 Bft3/d more than in 2020 but 0.3 Bft3/d less than in 2019.

Because U.S. LNG exports have grown faster than domestic natural gas production, inventories are lower than average. As of the end of September, the EIA estimates that total U.S. natural gas inventories are 5.5% below the five-year (2016–2020) average. The EIA forecasts that U.S. inventories of natural gas will begin the winter heating season on November 1 at 3,572 Bft3/d, or 4.8% below the five-year average. Lower U.S. inventories could contribute to more natural gas price volatility, particularly if any area in the United States experiences a severe cold snap, which makes the price outlook for this winter very uncertain.

In the second quarter of 2022, the EIA forecasts decreasing Henry Hub natural gas prices as anticipated growth in domestic natural gas production begins to outpace growth in U.S. LNG exports. The EIA expects U.S. production to average 96.4 Bft3/d in 2022, or 3.9 Bft3/d more than in 2021, and U.S. LNG exports to rise by a smaller amount, 1.4 Bft3/d, during this time period. The EIA forecasts that faster growth in production will put downward pressure on natural gas prices.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments