US to drive LNG liquefaction capacity growth in North America by 2024

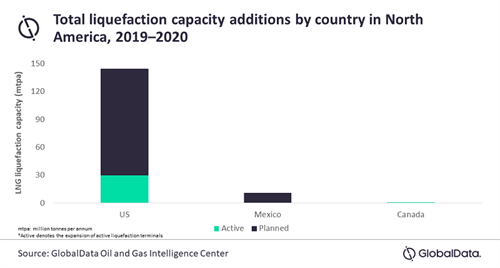

The US is expected to lead the LNG liquefaction capacity growth in North America by 2024, accounting for around 92.6% of the region’s total growth. Approximately 144.6 MMtpy is likely to be added by the US by 2024, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘LNG Liquefaction Industry Outlook in North America to 2024’, reveals that liquefaction capacity in North America is expected to increase by 156.2 MMtpy, from 69.9 MMtpy in 2020 to 205.1 MMtpy by 2024, registering an average annual growth rate (AAGR) of 26.9%. Of the total capacity additions in the region, 125.5 MMbd is expected to come from planned projects, while the remaining 30.7 MMbd is likely to come from the expansions of active/operational projects.

Adithya Rekha, Oil and Gas analyst at GlobalData, comments: “In North America, the US is likely to witness capacity additions mainly through the commencement of 11 planned and announced liquefaction terminals during 2020 and 2024. Of these, Rio Grande liquefaction terminal in Texas is one of the largest new-build projects with a capacity of 16.2 MMtpy. It aims to monetize abundant, low-cost unconventional gas in Permian Basin and Eagle Ford shale as exports.”

GlobalData expects Mexico to occupy second position in terms of liquefaction capacity additions in North America by 2024. It is expected to add around 10.9 MMtpy through four upcoming terminals by 2024. Among the upcoming terminals in Mexico, ECA Mid-Scale and Amigo Floating are the major terminals likely to add a combined liquefaction capacity of 6.4 MMtpy by 2024. The remaining additions are from the announced terminals, Sonora and Salina Cruz Floating, which are expected to start operations in 2024 and 2023, respectively.

Rekha concludes: “The expansion of the only active terminal in Canada, Tilbury, is expected to add roughly 0.7 MMtpy of liquefaction capacity in the country by 2024.”

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments