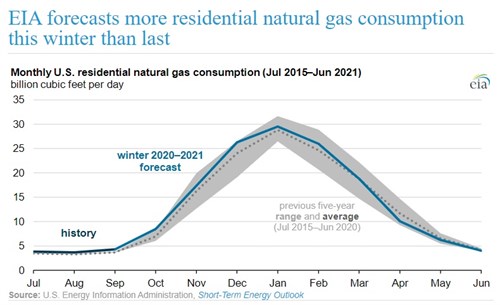

EIA forecasts more residential natural gas consumption this winter than last

In the October 2020 Short-Term Energy Outlook, the U.S. Energy Information Administration (EIA) forecasts that residential natural gas consumption for the 2020–21 winter season (October–March) will average 21.1 billion cubic feet per day (Bcf/d), 5% more than last winter. EIA expects more residential natural gas consumption because of forecasts for colder temperatures this winter and changes in consumer behavior.

Based on a colder weather forecast from the National Oceanic and Atmospheric Administration (NOAA), EIA expects the 2020–21 winter to average 602 heating degree days (HDDs), which is nearly equal to the average of the previous 10 winters and 5% more HDDs than last winter. Population-weighted HDDs measure temperature deviations from 65 degrees Fahrenheit and are used to estimate demand for heating fuels.

Changes in consumer behavior in reaction to the COVID-19 pandemic will also contribute to more residential consumption of natural gas this winter. EIA expects work-from-home and virtual schooling policies to affect winter residential consumption because, with more people at home during the day, residential space heating demand will increase compared with last winter.

Nearly half of all U.S. homes are primarily heated with natural gas. As forecast in EIA’s Winter Fuels Outlook, the average retail price of residential natural gas this winter for homes that primarily use natural gas for heating will average $9.55 per thousand cubic feet (Mcf), down 2% from $9.73/Mcf last winter. The lower average residential price of natural gas reflects generally lower natural gas spot prices in 2020.

Despite lower natural gas prices, EIA forecasts more residential natural gas consumption will lead to an increase in household expenditures for homes that primarily heat with natural gas as greater consumption per household more than offsets lower natural gas prices. EIA forecasts average household expenditures for these homes will rise to $572 this winter, an increase of $32 (6%) compared with last winter.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments