Global oil and gas pipeline sector delaying project FIDs

The global oil and gas pipeline sector has been facing several headwinds in the form of a fall in oil and gas prices, demand destruction, and a weak global economic outlook on the back of COVID-19 outbreak.

Consequently, delaying financial investment decisions (FIDs), slashing capital expenditure and stalling projects have become the norm for several pipeline operators to conserve cash and sustain the COVID-19 crisis. While these approaches may offer temporary relief, the global oil and gas pipeline sector might be better off looking for new opportunities and regularly reviewing strategies to stay prepared for future disasters, says GlobalData, a leading data and analytics company.

Haseeb Ahmed, Oil and Gas Analyst at GlobalData, comments: “One of the primary measures that a majority of pipeline operators have adopted to contain the losses is to delay FIDs of upcoming projects. For example, Phillips 66 Partners, one of the joint developers of Ace pipeline, postponed FID on this project, which is likely to delay project start by a couple of years, and Enbridge has postponed the FID of its Rio Bravo Pipeline project by a year.”

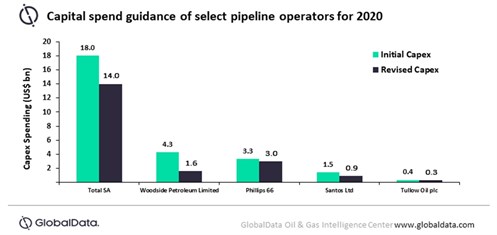

Global pipeline companies are also reducing capex. According to company announcements, Woodside Petroleum Limited has announced cutting its capex by almost two thirds (62%) for the year 2020, while Santos Ltd announced reducing its capex by nearly 37%.

Since fuel consumption has taken a huge hit due to the lacklustre performance of the transportation and tourism sectors, pipeline companies are forced to come up with conservative strategies such as reducing capex or delaying FIDs to plug the losses incurred. However, with the recurring nature of pandemic, pipeline operators globally might encounter an uphill task to fully recover from its devastating impacts.

Ahmed concludes: “The immediate strategic responses by these companies may suffice to minimize financial burden in the near future, however, for sustainability, diversification may be the key for risk mitigation. Also, focusing more on revenue generating streams by augmenting operational efficiency using breakthrough technologies such as data analytics might help companies during times of crisis.”

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments