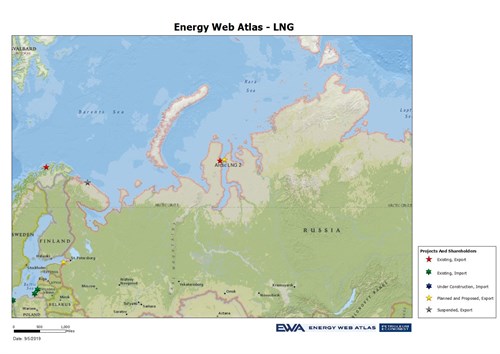

Launch of the giant Arctic LNG 2 development

Total, Novatek and the other project shareholders have approved the final investment decision (FID) for Arctic LNG 2, a major liquefied natural gas (LNG) development located on the Gydan peninsula, Russia. The project will have a production capacity of 19.8 million tons per year (Mt/y) and is expected to export its first LNG cargo by 2023, the second and third train to start up by 2024 and 2026.

Total has a direct 10% interest in Arctic LNG 2 alongside Novatek (60%), CNOOC (10%), CNPC (10%) and a Mitsui-Jogmec consortium, Japan Arctic LNG (10%). Total also owns an 11.6% indirect participation in the project through its 19.4% stake in Novatek, thus an aggregated economic interest of 21.6% in the project.

“Arctic LNG 2 will leverage the success of the Yamal LNG project and will deliver competitive LNG to the markets in four years’ time," commented Patrick Pouyanné, Chairman and CEO of Total. “Arctic LNG 2 adds to our growing portfolio of competitive LNG developments based on giant low cost resources primarily intended for the fast growing Asian markets.”

The project has very low upstream costs with the development of the giant resources from the Utrenneye onshore gas and condensate field. The installation of three concrete gravity-based structures in the Gulf of Ob on each of which will be located a 6.6 Mt/y liquefaction train will contribute to significant capex reduction (more than 30% per ton of LNG) compared to Yamal LNG. Also, the close proximity to Yamal LNG will allow Arctic LNG 2 to leverage synergies with existing infrastructure and logistics facilities.

Arctic LNG 2 production will be delivered to international markets by a fleet of ice-class LNG carriers that will be able to use the Northern Sea Route and the transshipment terminal in Kamchatka for cargoes destined for Asia and the transshipment terminal close to Murmansk for cargoes destined for Europe.

Total, Second Largest Private Global LNG Player

Total is the second-largest private global LNG player, with an overall portfolio of around 40 Mtpa by 2020 and a worldwide market share of 10%. With 22 Mt of LNG sold in 2018, the Group has solid and diversified positions across the LNG value chain. Through its stakes in liquefaction plants located in Qatar, Nigeria, Russia, Norway, Oman, Egypt, the United Arab Emirates, the United States, Australia or Angola, the Group sells LNG in all markets.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments