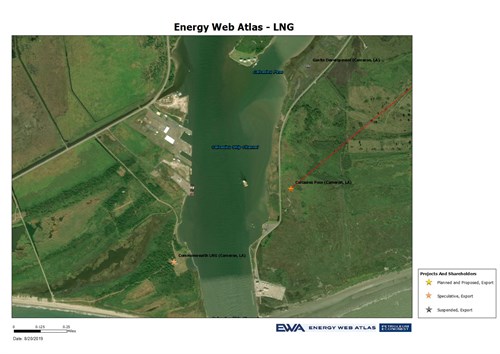

Venture Global announces FID, financial close for Calcasieu Pass LNG

Arlington, Virginia – Venture Global LNG, Inc announced the final investment decision (FID) and closing of the project financing for the company’s Calcasieu Pass LNG facility and associated TransCameron pipeline in Cameron Parish, Louisiana.

|

| Source: EWA |

The proceeds of the debt and equity financing fully fund the balance of the construction and commissioning of Calcasieu Pass. Full site construction has been underway since February 2019, and the project is expected to reach its Commercial Operations Date (COD) in 2022.

Stonepeak Infrastructure Partners provided a $1.3 billion equity investment for the project. The lender group for the company’s $5.8 billion construction financing includes the world’s leading Asian, European and North American project finance banks.

The lenders who provided funding at closing are Banco Santander, S.A, Bank of America, N.A., Goldman Sachs Bank USA, Industrial & Commercial Bank of China Limited, ING Capital LLC, JPMorgan Chase Bank, N.A., Mizuho Bank, Ltd., Morgan Stanley Senior Funding, Inc., Natixis, Nomura Securities International, Inc., Royal Bank of Canada, Sumitomo Mitsui Banking Corporation, and The Bank of Nova Scotia.

“Our goal has always been to lower the cost of electricity by delivering clean, low-cost LNG to the world," Venture Global LNG Co-CEOs Mike Sabel and Bob Pender jointly stated. "The closing of our financing is the culmination of years of hard work, and we want to sincerely thank our Venture Global team, our construction partners, our foundation customers, our lenders and advisors, Cameron Parish and our local partners in Louisiana.”

Calcasieu Pass has received all necessary permits, including FERC authorization and Non-FTA export authorization from the U.S. Department of Energy.

The project has 20-year LNG sale and purchase agreements with Shell, BP, Edison S.p.A., Galp, Repsol and PGNiG. Venture Global LNG is also developing the 20 MTPA Plaquemines LNG project and the 20 MTPA Delta LNG project, both in Plaquemines Parish, Louisiana.

Morgan Stanley served as financial advisor to Venture Global for the transaction. Latham & Watkins LLP served as counsel to Venture Global and Skadden, Arps, Slate, Meagher & Flom LLP served as counsel to the lenders.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments