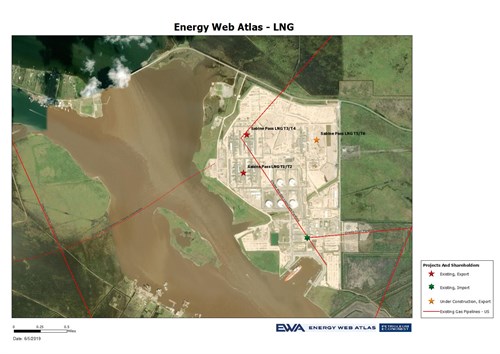

Cheniere to build Louisiana Sabine Pass 6 LNG export train

U.S. liquefied natural gas (LNG) company Cheniere Energy Inc said it will build the sixth liquefaction train at its Sabine Pass LNG export terminal in Louisiana.

|

| Source: EWA |

Cheniere also said it expects to make a positive final investment decision as early as 2020 to add additional capacity in a third stage at its Corpus Christi LNG export terminal in Texas.

Natural gas use is growing rapidly around the world as countries, like China, seek to wean their industrial and power sectors off dirtier coal. Cheniere is the biggest supplier of U.S. LNG and also the biggest buyer of gas in the country.

Cheniere said it gave Bechtel, the lead contractor building its LNG terminals, notice to proceed with construction of Sabine 6. Cheniere has said it has a $2.5 billion contract with Bechtel to build Sabine 6 and expects the unit to enter service in 2023.

To fund a portion of Sabine 6 and a third LNG berth at the plant, Cheniere said its Cheniere Energy Partners LP subsidiary entered into 5-year, $1.5 billion senior secured credit facilities with 29 banks and financial institutions.

Cheniere said it boosted the run-rate production guidance of its liquefaction trains to 4.7–5.0 million tonnes per annum (MTPA) of LNG, up from 4.4-4.9 MTPA. That is equivalent to around 0.7 billion cubic feet per day (bcfd) of natural gas.

One billion cubic feet of gas can supply about five million U.S. homes for a day.

Cheniere said it agreed to buy about 140,000 million British thermal units (mmBtu) of gas from U.S. exploration and production company Apache Corp for about 15 years for the Corpus Christi expansion. That is equivalent to about 0.85 MTPA. The cost of the gas will be indexed to global LNG prices.

Cheniere is developing the third stage at Corpus Christie to include up to seven 0.2-bcfd liquefaction trains. The company said it expects to receive all remaining necessary regulatory approvals for the project by the end of 2019.

Apache said the Cheniere agreement is part of its long-term strategy to access new markets for gas produced at its Alpine High play in the Permian Basin.

The Permian in West Texas and eastern New Mexico is the biggest U.S. shale oil basin. Since much of that oil comes out of the ground with associated gas, it is also the nation’s second-biggest shale gas formation.

Reporting by Scott DiSavino Editing by Paul Simao Editing by Paul Simao

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments