Venture Global LNG announces additional private placement funding of $160M

Arlington, Virginia – Venture Global LNG, Inc. announced that it has raised additional private capital of approximately $160 million from large institutional investors. The company has now raised a total of $630 million to support the development of its projects.

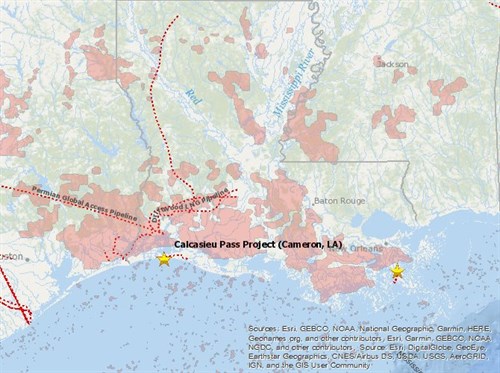

The transaction proceeds will fund Venture Global LNG’s continued development activities for its proposed LNG export facilities in Louisiana. The company is developing both the 10 MTPA Calcasieu Pass facility on the Gulf of Mexico and the 20 MTPA Plaquemines LNG facility on the Mississippi River using a highly efficient, mid-scale liquefaction technology provided by its strategic partner GE Oil & Gas, LLC, part of Baker Hughes, a GE company (BHGE).

|

| Source: EWA |

In response to the capital raise, Co-CEO Mike Sabel stated, “Both new and existing investors recognize our quality execution as we continue signing binding 20-year agreements for the purchase of LNG from our Calcasieu Pass and Plaquemines projects. Our growing list of world-class partners, which includes Shell, BP, Edison S.p.A., Galp, and PGNiG, among others, can feel confident in our ability to deliver the lowest cost LNG from North America."

Co-CEO Bob Pender added, "Following receipt of the Draft Environmental Impact Statement for our Calcasieu Pass project in June, we are preparing for our FERC authorization and the commencement of construction in early 2019. The contracting momentum for our Plaquemines project continues to grow, and we expect to announce additional milestones in the near term.”

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments