Peninsular Malaysia remains over-contracted in gas through to 2023; stronger demand in East Malaysia

Commentary from Wood Mackenzie's senior analyst Edi Saputra based on the recently published Malaysia long term gas out look:

We will continue to see soft gas and LNG demand in Peninsular Malaysia over the next five years. Gas demand growth will be limited, driven by the declining gas share in power generation from 39% today to 27% in 2020, losing to generation from coal. The progress of the RAPID downstream projects in Pengerang - comprising a new gas-fired CCGT, oil refinery and downstream petrochemical complex - will help offset this decline and maintain the overall gas demand at between 2,500 mmcfd and 2,800 mmcfd within our forecast time frame.

LNG demand is expected to remain below 3 mmtpa until 2020. The recent supply upside from the North Malay basin project and MTJDA's B17, together with the increase in coal-fired generation, will result in soft LNG demand in the near term. The market will remain in an oversupply situation with uneasy competition between piped gas supply and LNG imports. Demand will still be lower than the import contract level from GLNG and Brunei LNG through to 2022. From 2023 onwards, as piped gas supply declines, LNG demand will start to surpass the existing import contracts, creating space for more LNG to supply the market.

|

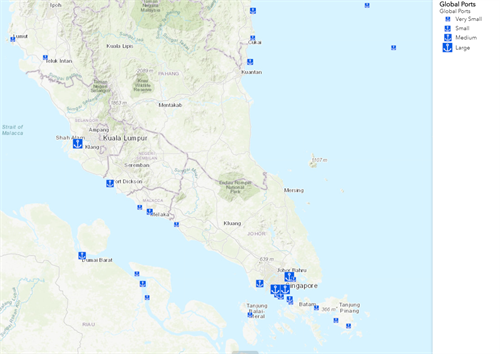

| LNG Terminals in Malaysia SOURCE: EWA |

Gas demand growth in Sabah and Sarawak looks stronger compared with that of Peninsular Malaysia. In Sabah, new industrial projects in Kimanis and Sipitang (such as SAMUR within SOGIP) have been developed, with several others in the pipeline. In Sarawak, gas demand growth will be driven more by the power generation sector. Currently, the bulk of opportunities still centre on the LNG export venture, but more gas will be needed to supply the growing local markets going forward.

Impact of Malaysia's 14th general election

Malaysia held its 14th general election on 9 May 2018, which brought a leadership change with Dr Mahathir Mohamad elected as the country's new prime minister. Mahathir's populist measures will shape the country's energy landscape in the near term. Some of his key initiatives include the scrapping of goods & services tax (GST), re-introduction of petrol subsidy for targeted segments, and better royalty payment for the oil and gas producing states such as Sabah and Sarawak. This may lead to increased royalty contribution from PETRONAS to the states related with the oil and gas extraction activities.

While there is no specific mention yet about gas pricing policy in his programme, Mahathir's stance on maintaining subsidies and reducing the cost of living may pose uncertainties to the continuity of the current gas price reform initiatives. Looking at the new policy directives for petrol sales, with subsidy re-enactment for targeted customer groups, there is a possibility for residential customers to be shielded from future price hike. For general industrial customers however, we expect the current cost pass-through mechanism to remain intact, as seen from the recent price increase. In June 2018, Gas Malaysia increased gas price for its industrial customers to RM32.69/mmbtu (US$8.2/mmbtu), which includes a surcharge of RM0.77/mmbtu owing to the higher actual costs in the previous six months.

No uptake yet on the third-party access (TPA) scheme

Malaysia implemented the third-party access (TPA) scheme in January 2017, with an expectation that this will encourage more participation in the domestic market. The market was opened up for new participants in seven different segments comprising LNG import, shipping, regasification, pipeline transportation, distribution, retail and gas utilisation.

However, the uptake has been slow so far. We have not seen any new players participating in the domestic market yet. This can be contributed to the lacklustre gas demand at the moment, particularly from the power sector which favours coal generation, and the difficulty in competing with PETRONAS as the strong incumbent in the market.

PETRONAS acquired stakes in LNG Canada

In May 2018, PETRONAS acquired 25% stake in the LNG Canada project. The project, comprising two trains with 6.5 mmtpa capacity each, aims to take the final investment decision in 2018 with possible start-up in 2023. The farm-in will provide PETRONAS with an alternative monetisation route for its 52-tcf upstream reserve in North Montney, British Columbia, following the cancellation of its Pacific North West project in July 2017. The LNG monetisation option offers better return compared with selling gas to the Canadian gas grid.

At the same time, we expect PETRONAS to remain long in its LNG position, having 14 mmtpa of uncontracted LNG through to 2030. The completion of PETRONAS FLNG 1 and Bintulu Train 9 has increased liquefaction capacity in East Malaysia from 25.5 mmtpa to 30.3 mmtpa in 2017, while domestic demand will remain below the contracted imports from Brunei LNG and GLNG in the medium term. PETRONAS' farm-in deal with LNG Canada could add another 3.25 mmtpa to this uncontracted tranche. This long position will require PETRONAS to continue its aggressive marketing strategy in placing volumes into the international markets.

Pengerang regas started operating in November 2017

PETRONAS Gas, in a joint venture with Dialog group and the Johor State, has started the operations of Malaysia's second regasification terminal in Pengerang, Johor. The 3.5-mmtpa onshore terminal, which cost RM2.7 billion (US$680 million) to build, started operating in November 2017.

The new regas terminal however, has not caused any visible increase in Peninsular Malaysia's LNG demand, as the the downstream power, refinery and petrochemical projects are not yet in place to take the gas. While six LNG cargoes have been delivered to the terminal within six months of its operations, we understand this was driven more by the technical requirement as it requires minimum turn down to operate. Deliveries into the Sungai Udang terminal in Malacca have declined during the same period as a result.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments