Woodside CEO 'OK' with LNG buyers' club, hints at more flexibility

HONG KONG (Reuters) -- Australian energy major Woodside Petroleum on Wednesday hinted it may in future be willing to allow buyers of LNG more flexibility as part of long-term contracts, saying that in time this could help create a more liquid market.

|

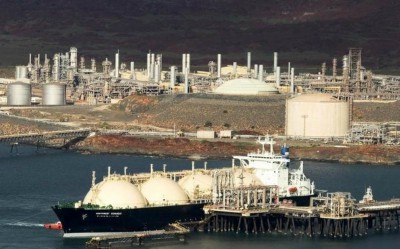

| Photo Courtesy of Reuters. |

Last week, the biggest buyers in the world's top three LNG consuming countries--Japan, South Korea and China--clubbed together to secure greater supply flexibility.

The move potentially shifts power to importers amid a growing surplus, adding pressure on producers like Woodside and peers Royal Dutch Shell, Chevron and Exxon Mobil to grant more flexible contracts.

Speaking as one of the first executives of a major LNG producer to address the buyers' alliance, Woodside's Chief Executive Peter Coleman said on Wednesday he did not see a threat from the new grouping.

"We are OK with it, we don't see a threat from it at all," he told Reuters in Hong Kong.

The main goal of the buyers' alliance--made up Japan's JERA, Korea Gas Corp (KOGAS) and China National Offshore Oil Corp (CNOOC)--is to rid themselves of long-term contracts that oblige them to take in a fixed amount of cargoes every month and which do not allow them to sell excess cargoes to third parties.

Coleman did not specifically say Woodside was willing to grant buyers more flexibility in future, but said that to "cooperate and move things around" was a sensible thing to do for the big LNG buyers.

"It actually helps create more liquidity in the market place, because you have a large volume of LNG moving through the three different market players," he said.

MORE TRADING, LESS MEGA-PROJECTS

The LNG industry is undergoing huge change as the biggest ever flood of new supply is hitting the market, with volumes coming mainly from Australia and the United States.

The oversupply resulted in a more than 70% fall in Asian spot LNG prices from their 2014 peaks to around $5.50 per MMBtu.

However, Woodside has come through the market rout in better shape than many rivals, with $2.7 B in cash and undrawn debt, and sees itself well positioned.

Woodside operates large LNG export facilities like Pluto and the North West Shelf, and is a partner in the $34 B Wheatstone project, scheduled to start up later this year. It also has plans for another project, Browse, but for which it has not yet made a final investment decision (FID).

Still, while oversupply will likely trigger more trading in LNG as producers sell uncontracted cargoes, Coleman said it made it difficult to develop large new production projects.

"The challenge today is there is not a market you can go to and develop a mega project ... The mega projects--15-20 MMt (annual capacity)--still require buyers in long-term contracts to finance," he said.

Thanks to high spot prices of up to $20 per MMBtu over past years, producers and buyers were keen to sign long-term contracts that guaranteed supplies at stable prices.

Now, with oil and gas prices much lower and abundant supplies, LNG importers are keener on freely trading LNG instead of entering fixed term deals.

"Buyers are still two years away from being able to take out (new) long-term contracts for big projects," Coleman said.

Reporting by Farah Master; Writing by Henning Gloystein; Editing by Tom Hogue

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Mitsubishi Heavy Industries Compressor acquires Swiss rotating equipment maintenance company AST Turbo AG

- KBR awarded FEED for Coastal Bend LNG project

Comments