Gullfaks Rimfaksdalen project onstream ahead of schedule

Gullfaks Rimfaksdalen (GRD) was scheduled for startup on December 24, but the project has progressed faster and now the field is onstream, at lower costs than planned.

The project delivered is more than NOK 1 B below the estimate of the plan for development and operation (PDO), reducing costs from NOK 4.8 B to around NOK 3.7 B.

Torger Rød, senior vice president for project development in Statoil, commented, "Over time, we have focused on reducing costs and raising the profitability of our projects to ensure long-term activity and value creation on the Norwegian Continental Shelf (NCS). Based on a smart concept using standard solutions and existing infrastructure, Gullfaks Rimfaksdalen strongly proves that we are on the right track to succeed on this work."

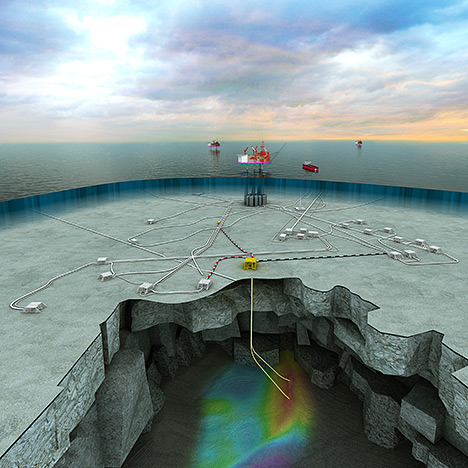

Photo courtesy of Statoil

Recoverable reserves are approximately 80 MMboe, mostly gas. The licensees are Statoil (operator) (51%), Petoro (30%) and OMV (19%).

"The volumes from Gullfaks Rimfaksdalen help us reach our ambition of maintaining production and a high activity level on the NCS beyond 2030," said Arne Sigve Nylund, executive vice president for Development and Production Norway.

"We have a well-developed infrastructure, and we will keep realizing opportunities in the North Sea. This development leads to more production, improved value creation and higher activity level on Gullfaks, and also throughout the value chain related to the field."

The Gullfaks Rimfaksdalen development consists of a standard subsea template with two simple gas production wells, and possibilities for the tie-in of two more wells. The well stream is connected to the existing pipeline leading to the Gullfaks A platform.

Gas and condensate are transported in existing pipelines to the processing plant at Kårstø, north of Stavanger, for processing. From there, the gas is exported to markets on the European continent.

Gullfaks Rimfaksdalen is one of Statoil's fast-track projects, aiming to realize resources quickly and inexpensively—for example, by using existing infrastructure while it is still available.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Mitsubishi Heavy Industries Compressor acquires Swiss rotating equipment maintenance company AST Turbo AG

- KBR awarded FEED for Coastal Bend LNG project

Comments