Gas Processing News

McDermott to design FPU for Woodside’s Scarborough

McDermott International Inc. has signed a contract with Woodside Energy Ltd. to undertake front-end engineering and design activities for a floating production unit (FPU) for the Scarborough field gas development in Western Australia.

McDermott’s center of excellence in The Hague, Netherlands will lead the study and early engineering. Upon completion, the contract includes the option to progress to an engineering, procurement, construction and installation (EPCI) contract, should the project be approved for full development by Woodside and its Scarborough JV partners.

The FPU will process natural gas, which encompasses gas separation, dehydration and compression, as well as monoethylene glycol (MEG) regeneration and water handling. The topside will be placed on a semi-submersible hull in 2,952 ft (900 m) of water depth. The FPU will be remotely operated and minimally staffed.

The Scarborough gas field is located approximately 236 mi (380 km) off the Burrup Peninsula in the Northwestern Shelf of Australia and contains 7.3 Tft3 of natural gas reserves. The development covers 12 daisy-chained subsea wells to be tied back to a semisubmersible FPU located at the Scarborough field, with onshore processing on the Burrup Peninsula.

Chevron signs new gas agreement with GS Caltex

Chevron USA Inc., a wholly owned subsidiary of Chevron Corp., has signed a sales-and-purchase agreement (SPA) with GS Caltex Corp. for the delivery of LNG to South Korea from Chevron’s global supply portfolio.

As a JV between Chevron and GS Energy, GS Caltex has signed a long-term agreement and will begin receiving LNG in October 2019. Chevron has an existing LNG SPA with GS Caltex executed in 2009.

Wison floating gas-to-methanol plant granted AIP by ABS

|

Wison Offshore and Marine (WOM) has received approval in principal (AIP) from the American Bureau of Shipping (ABS) for its latest floating natural gas-to-methanol (FGTM) facility. This facility is one of the innovative solutions that Wison has developed for the offshore gas production industry. The fully integrated gas-to-methanol system is more cost-effective for “stranded” natural gas production and can eliminate heavy upfront capital expenditure during offshore LNG production.

With the topside design being done by Wison Engineering Ltd. (WEL), the floating methanol facility features a combination of both WOM and WEL technical experience. The FGTM facility can be deployed to nearshore/offshore gas fields, with a capacity of 1.8 MMtpy of methanol. It also offers a storage capacity of up to 200,000 m3.

The launch of Wison’s FGTM design represents a successful collaboration between Wison and ABS. It also highlights the combined efforts of Wison Offshore & Marine and Wison Engineering to not only develop a new solution for the monetization of natural gas resources, but also to provide clients with an integrated engineering service.

As demand for different types of liquefied gases increases rapidly, the concept of the FGTM plant will provide a new solution for liquefied gas conversion and production to the market, ABS said.

Rimrock Energy secures acreage from Confluence Resources

Rimrock Energy Partners LLC has secured a long-term acreage dedication from Confluence Resources, an active oil and gas producer with an established lease-holding position in the northern DJ basin.

In conjunction with this acreage dedication, REP will extend its existing natural gas gathering and processing system (the Pierce System) 16 mi east to provide midstream services to Confluence. This strategic extension will position REP to provide natural gas gathering and processing services to all producers in the northern DJ Basin.

REP continues to make strides in the construction of its Pierce System, an 80-mi system that will provide its producer customers with low-pressure gathering and up to 200 MMft3d of cryogenic gas processing capacity, with access to premium residue gas and NGL markets. The Pierce System is scheduled to be in service in May 2019.

Tokyo Gas, Centrica sign SPA from Mozambique LNG

|

Tokyo Gas Co. Ltd., the largest city gas provider in Japan, and Centrica LNG Co. Ltd., a subsidiary of UK-based international energy and services company Centrica Plc, have jointly signed a binding sale-and-purchase agreement (SPA) with Mozambique LNG1 Co. Pte Ltd. for the long-term offtake of LNG. Mozambique LNG1 is the jointly owned sales entity of the Mozambique Area 1 co-venturers. The signing of the SPA follows a non-binding heads of agreement (HOA) signed in June 2018.

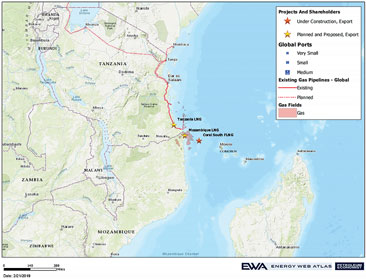

Tokyo Gas and Centrica have agreed to jointly purchase 2.6 MMtpy of LNG, to be delivered ex-ship from Mozambique LNG, from the startup of production until the early 2040s. This agreement provides the project with key foundation customers that will support the final investment decision by the Mozambique Area 1 joint venture partners, targeted for the first half of 2019. The location of the Mozambique LNG project, along with those of other proposed projects in the area, is shown in the figure.

The joint procurement approach takes full advantage of Mozambique's central location between Europe and Asia, assisting both companies to access diverse markets and proactively manage demand fluctuations across regions with different market dynamics.

It also represents the first long-term LNG procurement contract in Africa for both Tokyo Gas and Centrica in line with ongoing efforts to further diversify their respective portfolios of LNG sources. This will improve the liquidity and further develop the global LNG market.

Golden Pass FID crests second wave of US LNG

Qatar Petroleum and ExxonMobil’s early 2019 announcement that they will proceed with development of the Golden Pass LNG export project at Sabine Pass, Texas kicks off what could be a record year for LNG final investment decisions (FIDs).

Qatar Petroleum (70%) and ExxonMobil (30%) said that construction at Golden Pass will begin in 1Q 2019, with startup scheduled for 2024.

According to Wood Mackenzie, the $10-B liquefaction project, which will have the capacity to produce approximately 16 metric MMtpy of LNG, is one of the few remaining brownfield LNG development opportunities on the US Gulf Coast.

The Golden Pass regasification terminal has much of the infrastructure needed for an export project. Even if costs come in at slightly above the $10-B mark, on a dollar-per-metric-ton basis, it is still one of the lowest-cost opportunities for new, large-scale liquefaction capacity anywhere in the world.

Wood Mackenzie believes that proceeding with construction now will enable the project to lock in costs and minimize exposure to inflationary pressures before the next cycle of global LNG investment heats up. Golden Pass offers Qatar Petroleum the opportunity to optimize shipping costs, particularly into Europe and Latin America. It also helps Qatar protect its market share as it seeks to leverage its LNG assets in response to a changing market structure.

Advantages exist for ExxonMobil, too. The company is the second-largest producer of natural gas in the Lower 48 states, and Golden Pass supports additional upstream supply development; however, the project partners have not announced intentions to tie the export project directly to ExxonMobil’s upstream production.

Furthermore, the project strengthens ExxonMobil’s relationship with Qatar, a key country in its global portfolio. Through its joint investment in Golden Pass LNG, ExxonMobil will be deepening this relationship and working with Qatar Petroleum to diversify both upstream and internationally. Further upstream deals between the two are likely.

In its 4Q 2018 results, ExxonMobil said that Rovuma LNG (Area 4) in Mozambique is also on its target list for FID this year. Rovuma will share some plant and marine facilities with the adjacent Mozambique LNG1 project.

Dominion Energy to reduce methane emissions by 50%

Dominion Energy will reduce methane emissions from its natural gas infrastructure by 50% over the next decade, based on 2010 levels. The initiative will prevent more than 430,000 metric t of methane from entering the atmosphere, the equivalent of taking 2.3 MM cars off the road for a year or planting nearly 180 MM new trees.

The voluntary initiative builds on the progress Dominion Energy has made in reducing methane emissions over the last decade, which prevented more than 180,000 metric t of methane from entering the atmosphere, equivalent to taking nearly 1 MM cars off the road for a year or planting 75 MM new trees. The initiative also builds on the 50% reduction in carbon emissions that Dominion Energy has achieved across its electric fleet since 2000, and the advances it is making with renewable energy.

Methane is the primary component of natural gas, which is used to heat 118 MM US homes, generate one-third of the country’s electricity, and power manufacturing and other industries. Natural gas is transported to power plants, homes and businesses across the US through a 2.5-MM-mi national underground pipeline system.

Dominion Energy will achieve the emissions reductions in three primary ways:

- Reducing or eliminating gas venting during planned maintenance and inspections

- Replacing older equipment across its system with new, low-emissions equipment

- Expanding leak detection and repair programs across its entire system.

Over the last decade, the industry has made progress in reducing methane emissions from natural gas production and distribution systems. With the new initiative, Dominion Energy is taking a leading role in the industry by reducing methane emissions across its entire system, from production and storage to transmission and distribution.

Reducing or eliminating venting. Gas venting during planned maintenance and inspection is the largest source of methane emissions from Dominion Energy’s transmission and distribution pipeline system. To perform maintenance or inspection on pipelines and compressor stations, natural gas must sometimes be removed from the system, which was historically done by venting it to the atmosphere. A primary focus of the company’s initiative will be dramatically reducing or even eliminating venting during maintenance activities.

One example is the company’s use of zero-emissions vacuum and compression (ZEVAC) technology to capture methane before maintenance or inspection so it can be recycled for use in other parts of the system. After piloting the technology on a limited scale, Dominion Energy purchased 16 ZEVAC units from TPE Midstream for widespread use across its distribution and transmission pipeline systems.

Replacing older equipment. While gas venting is the largest source of methane emissions, other, minor sources can add up to larger volumes. Dominion Energy is focused on reducing these sources by replacing older equipment with new, low-emissions equipment.

An example is Dominion’s program to replace natural gas-powered pumps at gas-producing wells with solar-powered electric pumps, which reduces methane emissions at the facilities by more than 90%.

The company is also replacing other aging equipment across its system, including bare-steel pipe, cast-iron pipe, valves, fittings, joints and seals to reduce or eliminate these emissions sources.

Expanding leak detection and repair. Even after reducing emissions from gas venting and aging equipment, there is still more the company can do to reduce minor emissions that are often the hardest to detect because they are odorless and cannot be seen or heard.

Over the last decade, Dominion Energy has made significant progress finding small emissions sources using infrared cameras. This program will be expanded to detect and repair these minor emissions sources across every part of the company’s natural gas system, from production and storage to transmission and distribution.

Petronet signs initial deal to invest, buy LNG from Tellurian

Indian gas importer Petronet LNG has signed an initial agreement with Tellurian Inc. to invest in Tellurian’s proposed Driftwood project in Louisiana, US and buy LNG.

India is expanding its pipeline network and building new LNG import terminals to boost its use of the cleaner fuel. Indian Prime Minister Narendra Modi has set a target to raise the share of natural gas in India’s overall energy mix to 15% in the next few years from about 6.5% at present.

Tellurian is offering an equity interest in Driftwood Holdings, which comprises Tellurian’s upstream company, its pipeline and the upcoming terminal that will be able to export 27.6 metric MMtpy of LNG.

A $500-MM investment in Driftwood would give the stakeholder rights to 1 metric MMtpy of LNG over the life of the project. Tellurian hopes to begin production in 2023.

Wood, KBR win Crux FEED project offshore Australia

Wood and KBR Inc. have secured a multimillion-dollar contract to deliver integrated front-end engineering design (FEED) for Shell Australia’s Crux project. The two companies will build a not-normally-manned (NNM) platform and gas export pipeline approximately 600 km north of Broome, offshore Western Australia.

The Crux facilities will be an important source of backfill gas supply to the Shell-operated Prelude floating liquefied natural gas (FLNG) facility. The remotely operated, minimum-facilities NNM platform concept for Crux will dry the gas and export the gas/condensate to Prelude via a new, 160-km multiphase gas pipeline.

The services will be delivered over 18 mos by Wood and KBR’s engineering and project management teams in Perth, supported by Wood’s resource base in Kuala Lumpur, Malaysia. The teams will provide a single integrated FEED for the Crux topsides, jacket, export pipeline and subsea pipeline end manifold.

Wood also provides specialist consultancy services for flexible riser integrity management to the Prelude FLNG facility.

Thailand's PTT to invest up to $11 B in LNG, infrastructure

Thai energy company PTT Pcl plans to invest up to 354.7 B THB ($11.3 B) over the next 5 yr to boost its natural gas portfolio and energy infrastructure. From 2019–2023, PTT plans to invest 167.1 B THB, of which 44% will be allocated to expand its gas business and firm up infrastructure. PTT aspires to become a global LNG portfolio player.

Gas is becoming a primary energy source for Thailand because it is easier to transport, cleaner and has lower costs. PTT also set aside an additional 187.6 B THB to invest in new technologies and expand its core business should opportunities arise. Other investment areas include expansion of petrochemical capacity and its electricity business.

Bahrain to begin LNG imports in spring

Bahrain is expected to receive its first import of LNG this spring, becoming the fifth country in the Middle East to import LNG. The Bahrain LNG import terminal will have a capacity of 173,000 m3 (0.8 Bft3d) and will utilize an offshore floating storage unit (FSU) and a separate regasification platform, connected via undersea pipelines, to an onshore receiving facility at Khalifa bin Salman Port. An FSU vessel called Bahrain Spirit will serve the project under a 20-term charter.

LNG supply for the project will be procured on the global spot market to supplement existing domestic production, until new production from the recently discovered offshore Khaleej Al Bahrain 2 oil and natural gas field comes online. Although Bahrain's domestic natural gas production has increased in recent years, most of the increase is non-marketed production used for reinjection to maintain output levels at the country's aging Bahrain field, which has been producing oil and natural gas since 1932.

LNG imports will be used to meet Bahrain's growing natural gas demand, primarily from the industrial sector. Bahrain LNG will supply natural gas to two new, combined-cycle natural gas-fired power plants scheduled to be in service in 2019–2020, as well as a new refinery expected to come online by 2022. One of the natural gas-fired power plants (1.8 GW) will be used to supply electricity to an expanded aluminum smelter, which is expected to be the largest single-site smelter in the world.

In 2018, global LNG regasification capacity expanded by an estimated 3.4 Bft3d (3%) as two new countries—Bangladesh and Panama—began LNG imports, and several other countries (China, Turkey, Japan, Greece and Finland) expanded their LNG import capacity. Early in 2019, Russia and Gibraltar (an overseas territory of the UK), have become the newest LNG importers.

In 2019–2020, EIA estimates that an additional 9.6 Bft3d of LNG import capacity will be placed in service. Most of this new capacity will be located in India (2.8 Bft3d) and China (2 Bft3d), accounting for about 50% of the total global capacity additions over this period.

Further capacity expansions are expected in Jamaica, Taiwan, Thailand and South Korea, while Ghana is expected to begin LNG imports by 2020.

Azerbaijan to supply more gas to Southern Europe

Azerbaijan is an important supplier of crude oil and natural gas in the Caspian Sea region, particularly to European markets. Azerbaijan's exports of natural gas are poised to become a more significant part of the country's economy. Azerbaijan produced approximately 600 Bft3 of dry natural gas in 2017 and exported about 210 Bft3, according to the US Energy Information Administration.

Azerbaijan plans to expand its natural gas exports to Europe. EU leaders consider connecting Azerbaijan's Shah Deniz natural gas field to Southern Europe to be a step toward the strategic goal of diversifying Europe's natural gas supply. Southern and Eastern Europe, in particular, have limited supply options for natural gas because of geographic constraints and infrastructure limitations.

The Trans-Balkan pipeline, which supplies Russian natural gas to the Balkan countries and Turkey through Ukraine, is one of the region's only existing supply routes. In 2017, the Trans-Balkan pipeline transported approximately 600 Bft3 of natural gas to the EU border in Romania, according to the International Energy Agency. Although the proposed Azerbaijani volumes—about 565 Bft3—will bring a smaller amount of natural gas to Southern Europe, they could help mitigate potential natural gas supply disruptions by providing another option to satisfy regional natural gas demand.

The Shah Deniz field, which is about 40 mi southeast of Baku in the Caspian Sea, contains most of Azerbaijan's natural gas. In 2017, the field produced about 360 Bft3 of natural gas and about 19 MMbbl of condensate. The main markets for Shah Deniz gas have been Azerbaijan, Georgia, and Turkey.

In mid-2018, the field's second stage of development, Shah Deniz 2, came online and began delivering natural gas to Turkey, which EIA includes in its definition of Southern Europe. Shah Deniz 2 will also add 38 MMbbl–44 MMbbl of condensate production capacity per year.

The natural gas produced at Shah Deniz 2 will flow west through an expanded pipeline network known as the Southern Gas Corridor (SGC). Turkey started receiving Shah Deniz 2 natural gas in 2018 through the South Caucasus Pipeline Expansion (SCPX), which runs from Azerbaijan to the Georgia-Turkey border.

The 1.5-Bft3d Trans-Anatolian Natural Gas Pipeline (TANAP), which runs from the Georgia-Turkey border and is being extended to the Turkey–Greece border, was completed in June 2018 and has provided additional natural gas capacity into Southern Europe. Volumes of natural gas shipped via TANAP reached 0.1 Bft3d in 2018 and are expected to increase to 0.2 Bft3d in 2019. The Trans Adriatic Pipeline (TAP), which is slated to run from the Turkey-Greece border to Italy, is expected to be completed in 2020.

Of the expected 565 Bft3 of yearly natural gas production at Shah Deniz 2, Turkey has contracted for 211 Bft3, and European markets have contracted for the remainder. Some deliveries will go to Greece, Bulgaria, and potentially Albania, and the rest will be delivered to the Italian national transmission network before possibly flowing north to Central Europe.

Comments