Opportunities and challenges for small-scale LNG commercialization

R. S. Bhullar, Fluor Corp., Aliso Viejo, California

The rapid development of the unconventional gas supply chain in North America could have a game-changing impact on large-scale and mega-gas processing/liquefaction facilities. However, there are relatively fewer risks and, therefore, greater opportunities associated with the development of small-scale gas processing and LNG facilities and infrastructure.

Issues related to large global hydrocarbon development are different from those related to small-scale gas processing facilities. Gas is anticipated to be the leading fuel of choice in the future and will play a key development role in Asian and Latin American economies. New development drivers and regulations provide great opportunities for small-scale and mid-scale gas and LNG projects, without regard to supply and demand dynamics. A comprehensive review of the developing trends and opportunities related to small-scale gas processing and LNG is offered here.

New opportunities are discussed, including traditional power and fuel replacement, marine bunkering, environmental drivers and regulations, feedstock and petrochemicals, and infrastructure opportunities, along with challenges that small-scale project developers may face. Understanding the issues, drivers, economics and challenges is vital to the economic leverage and future success of these projects.

Large-scale projects are capital-intensive and extremely risky, and they use complex technologies and equipment. Additionally, they face a constantly changing regulatory environment. Presented here are simpler technologies and infrastructures, quick deployment options, smaller sizes for projects and more targeted approaches for reducing risk and bringing these projects online with relatively smaller capital requirements.

Evolving LNG supply/demand picture. Natural gas will be a leading fuel of choice going forward, and LNG will be a significant component of this gas supply chain. However, the industry faces significant challenges.

Shale gas supply development and the US transition from a net importer to a net exporter of energy have created a permanent, game-changing market shift. Mega-projects were planned and completed by overambitious producing nations like Australia to meet the gas needs of the US, which never materialized. At present, an excess of LNG supply exists on the order of

100 metric MMtpy. This excess has created unutilized capacities and a large imbalance in the supply chain that will grow as more projects come online.

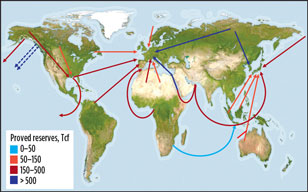

This excess gas supply is shaping the emerging picture of global LNG supply and trade, as shown in Fig. 1. In the US and Canada, several LNG receiving and regasification terminals were built and never utilized or brought onstream. Some of these terminals are being converted to liquefaction facilities for LNG export. Much of the North American gas is being exported to Japan, Korea, Latin America and Europe. This growth is being further facilitated by the opening of a parallel Panama Canal branch, which will lower shipping costs to Asia.

|

|

Fig. 1. Global trade flows for LNG, 2015. |

China, on the other hand, is playing a relatively small role in the global LNG picture. The country is developing pipeline infrastructure to import Russian gas, while making significant strides in small-scale LNG and gas supply infrastructure. North American gas supplies would have a relatively small impact on the European market, which is well supplied with gas by pipelines and other infrastructure, with supply arrangements already locked in by long-term sales and purchase agreements (SPAs) from customers in the Middle East and North Africa.

The biggest challenge to the gas processing/LNG industry going forward is North American gas supply—specifically, low-cost shale gas production. At the time of publication, the cost of shale gas at Henry Hub was in the range of $2/MMBtu to $2.50/MMBtu, and is expected to hover in that price range for the foreseeable future. If the cost of liquefaction is added to this price, along with the costs of pipeline and marine transportation, then the gas can be supplied to Asian-Pacific countries for less than $6/MMBtu.

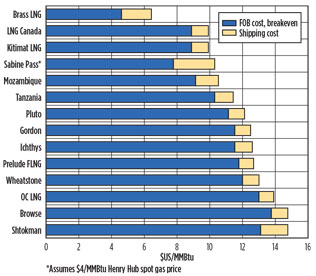

These low costs could damage the economics of LNG projects in Australia that are completed or waiting to be brought onstream. For many Australian and other higher-priced LNG projects, the breakeven cost is $11/MMBtu–$14/MMBtu. Fig. 2 shows the breakeven costs for typical projects from a study by Deutsch Bank. These costs can make participating in the LNG/gas processing industry very challenging for the players involved and for future players waiting to join the club.

|

|

Fig. 2. Breakeven costs for typical LNG projects. |

For future projects, the same approaches as those taken in the past will not work. New strategies must be developed and followed. The merits of small-scale to mid-scale LNG projects are discussed here, although some of these concepts can be applied to larger projects when they again become economical.

Completely integrated LNG/gas supply chain. Mega-projects are out of favor at present, and it is inconceivable that new projects would be financed and executed in a similar manner as the traditional SPA-based projects. A lack of financing due to the uncertainty of the long-term SPAs greatly complicates these project developments.

The structures of the new projects would need to be completely different, from a cost-and-supply point of view. Standalone mega-liquefaction projects with breakeven costs upwards of $12/MMBtu–$14/MMBtu are not feasible at present. The new bar for future projects is much lower—around $4/MMBtu–$6/MMBtu.

The structures of the new projects must include the total integration of the downstream supply side into the upstream supply side. Cost distribution, financial risks and rewards must be shared with all of the stakeholders and beneficiaries in the supply and distribution chain for projects to move forward.

Reducing capital costs of projects. For new projects to be realized, the overall capital cost of the entire project must be addressed, first and foremost. Several considerations and factors should be kept in mind:

- Formation of alliances and partnerships

- Risk-sharing from “cradle to grave”

- Addition of modular capacity as needed or as justified

- Next-generation modularization to reduce cost and schedule

- Standardization of design

- Minimization of cost on high-cost items

- Minimization of time to market

- Use of prefabricated equipment like tanks and compressors, rather than custom-designed, field-fabricated equipment.

Project financing will need to be much broader and more complex, with larger alliances and partnerships to share the risks and rewards of these projects going forward.

The time has come to take a serious look at the rapidly escalating construction costs of large-scale projects in the industry. One potential idea is to execute project construction differently to increase cost control availability. Significant advances have been made to reduce construction costs with the next generation of modularization. The new techniques being developed lower construction costs by 30% and reduce schedule by 25%, resulting in quick payout and cost savings.

Everything must be challenged, starting from codes and standards to the way things are built—for example, the use of expensive pipe racks; the optimum use of proper materials; and even sparing philosophy, reliability and availability.

Project developers have more flexibility in small-scale and mid-scale LNG facilities due to the smaller sizes of these projects. The highest-cost items for most LNG projects are:

- Storage tanks

- Jetties

- Marine facilities

- Boiloff gas (BOG) handling units

- LNG vaporization

- Infrastructure, including pipe racks.

For small-scale LNG facilities, tremendous opportunities exist to reduce costs in these critical areas. Unlike the custom, stickbuilt, large-capacity storage tanks for mega-size LNG projects, the small-scale facilities can use prefabricated tanks. They can also utilize pressurized storage, whereas large, conventional LNG terminals must use atmospheric storage. New technologies, such as pressurized storage tanks, are available off-the-shelf from multiple suppliers in increments of 1,000 m3, which are suitable for small-scale LNG.

One major advantage is BOG handling. The application of this technology in small-scale LNG has been demonstrated and proven. For small-scale LNG facilities, the generated BOG is put directly into the gas pipeline or into power generation to supplement utilities. For most small-scale LNG plants, the BOG handling cost can be significantly reduced by allowing the pressure to increase in the storage tanks. Then, the high-pressure gas can be put into the pipeline or burned for auxiliary power generation.

Unlike conventional facilities, LNG vaporization for small-scale LNG can be simply executed with an atmospheric vaporizer using ambient air. This technology has been available in nitrogen facilities for many years.

Drivers for small-scale LNG. The drivers for small-scale LNG are many and depend largely on geographic location. For Asia and most of the undeveloped parts of Latin America, the biggest need is for power to fuel economic growth. Unlike North America or Europe, which have mature and developed gas markets, these developing regions do not need natural gas in its gaseous form; they need electric power to sustain their developing standards of living. Some communities are using small, diesel-based generation, with the obvious negative impact of environmental pollution (unless they use expensive low-sulfur diesel).

Most developing regions need less than 50 MW of power generation, with occasional required capacities of between 100 MW and 150 MW. Small-scale LNG is perfectly suited for such an application. The author has designed modularized LNG facilities for small-scale power generation in a cost-competitive way that can be brought online relatively quickly, unlike conventional facilities. The overall cost and complexity must be balanced with the costs and time needed for turnaround.

One of the biggest drivers in Europe and North America is diesel replacement, for which natural gas is well suited. The EU has the major initiative of sulfur emission control areas (SECAs), and the US has a parallel program. Both initiatives include a large push for small-scale LNG facilities. Although diesel prices are somewhat low at present due to the glut of oil being processed, the natural gas option will be cheaper and better in the long run.

Bunker oil has traditionally been used as marine transport fuel. The EU and US emissions initiatives mandate the replacement of bunker fuel with natural gas to reduce pollution caused by marine vessels. This replacement is a crucial milestone for the industry and has sparked the development of LNG engines for marine, truck, bus and rail transport across the world. Engines are already available for commercial use. A large market also exists to convert diesel generator sets into dual-fuel sets using LNG as an alternative fuel. Furthermore, new crude supply tankers, cruise ships and passenger ferries are being built to run on LNG.

As these initiatives are realized, opportunities for infrastructure development are emerging. These opportunities include small LNG terminals that can be supplied by smaller marine vessels, trucks or trains. For domestic gas use, small-capacity ISO containers are already available that can be trucked to remote locations, as seen in Northern Europe.

In the US, small-scale industries for LNG distribution from micro-LNG plants are developing. In these projects, a small-scale or micro-LNG producer draws feed gas from a gas pipeline grid, liquefies the gas in a small liquefaction plant, and then trucks the produced LNG fuel to local harbors, such as Los Angeles or Long Beach in California, where new environmental initiatives are being enforced. These small-scale LNG plants can even supply fuel for small trucking or bus fleets.

Takeaway. Although the future for standalone mega-projects is on shaky ground, tremendous opportunities for growth exist in small-scale and mid-scale LNG. These opportunities may come from monetizing small pockets of stranded gas, growing power and transportation fuel needs, tightening marine fuel regulations, the replacement of diesel with gas, and a host of other infrastructure and supply chain opportunities.

Additionally, the opening of the second lane of the Panama Canal will further reduce the timeline of LNG delivery to customers and shipping costs to smaller Asian countries. For serious investors, the opportunities for small-to-mid-scale LNG are wide-ranging and varied, and limited only by the imagination. GP

|

Romel S. Bhullar is a senior technical director and a senior fellow with Fluor Corp.’s office in Aliso Viejo, California. As part of the energy and chemicals group, he has over 35 years of experience in conceptual development, feedstock, engineering and construction, commissioning and startup, gas processing, liquefaction and regasification, pipelines and infrastructure for both onshore and offshore gas projects. His main focus is solving complex issues related to technical processes, process control, safety, process integration, process automation systems and subsystems, control rooms and other enterprise integration functions. Mr. Bhullar has executed multiple large- and mega-sized upstream and downstream projects for national and multinational energy companies. At present, he is working as a technical advisor on Fluor’s team for Asia’s newest LNG trading terminal in Singapore, operated by SLNG. Mr. Bhullar has authored several dozen articles in the areas of advanced process control, process safety, process automation and integration in major national and international professional magazines. He has also presented at major technical conferences, including Hydrocarbon Processing’s International Refining and Petrochemical Conference (IRPC), and conducted training and technical workshops around the world.

Comments