Consider high-value outlets for propane and butane

A. Abazajian, Advisian, WorleyParsons Group, Houston, Texas

Shale oil and gas operations in North America generate abundant and low-cost supplies of LPG. At the same time, high production levels of shale oil and gas have created market niche opportunities for high-octane gasoline and low-temperature diesel blendstocks.

The industry has long contemplated the combinations of technologies to convert components of LPG, propane and butane into gasoline and diesel blendstocks. However, prior to the advent of high differentials between oil, gas and LPG, these combinations did not make economic sense.

These processes should be updated with advancements in the individual technologies and advancements in the process intensification, as well as adapted to the market requirements by simplifying separations. The resulting processes represent additional high-value and high-volume outlets for low-cost North American propane and butane.

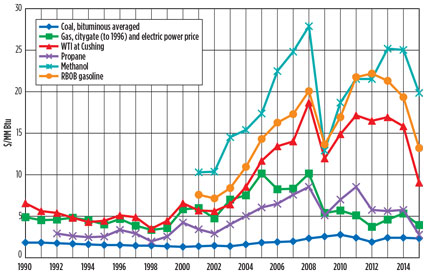

Opportunity in lower hydrocarbons. Low-cost natural gas, ethane and propane produced from shale gas operations represent a field of opportunity for the US petrochemical industry. Prior to the 2014/2015 oil price decline, petrochemical margins in the US were very high. High rates of “wet” shale gas production in the US kept NGL plentiful and, therefore, low-priced. The low-priced ethane and LPG fractions of NGL displaced expensive naphtha as a feedstock to ethylene crackers (Fig. 1).

|

|

Fig. 1. Past feedstock prices, in constant 2014 dollars. |

On the product side, US NGL-based ethylene and its derivatives competed on the global market against naphtha-based ethylene derivatives, benefiting from a high price differential between raw materials and products.

The fall of oil prices in 2014/2015 resulted in lower naphtha prices and, therefore, lower prices of naphtha-based petrochemical derivatives. While this lowered margins for NGL-based petrochemicals, it also exerted even more downward price pressure on NGL feedstocks, which are still being produced at high rates to provide cashflows for shale gas producers hit by oil and gas price declines.

A number of projects, including some first-of-a-kind projects in North America, emerged to take advantage of low-cost NGL feedstocks:

- Export of ethane1 to Europe and, reportedly, even to the Middle East

- Increased exports of LPG2

- Propane dehydrogenation3 units to produce high-purity propylene for polypropylene

- Power generation using ethane.1

However, each of the first three opportunities is limited because the final product market is limited. For example, export of ethane to Europe is limited by the availability of liquefaction terminals, ethane carriers, regasification terminals and crackers that are conveniently located on the water and are able to cost-effectively convert to ethane feed.

LPG exports are limited by the size of LPG export markets (typically much smaller than gasoline and diesel markets), as well as by logistical considerations.

Propane dehydrogenation (PDH) to polymer-grade propylene is typically limited to those facilities located near propylene pipelines. Propane dehydrogenation integrated with a polypropylene plant is not limited to the propylene pipeline network, but it is limited by the growth rate of the polypropylene market. The propylene and polypropylene markets also have a number of other constraints—for example, the supply/demand profile of these commodities; some control of the market by the licensors of the technology, most of whom are also producers of these products; and other structural barriers.

The power market is very large; however, it values ethane only slightly higher than natural gas due to its higher heating value. This scenario does not return much value to a product that is relatively expensive to separate from natural gas. Also, although LPG is used as emergency or startup fuel in some industrial or power applications, values in the power market in general are too low for the long-term use of LPG fuel.

Propane and butanes, sometimes in mixtures with olefins, are produced as byproducts in refineries. A number of refining processes—for example, fluidized catalytic crackers (FCC), cokers and visbreakers—produce such streams. Typically, these offgases are collected and fed into the refinery fuel gas system. Since natural gas and LPG have such a low price in North America, refinery fuel gas has similarly low energy value.

Upgrading the value of the refinery fuel gas streams also represents an opportunity. Since these streams often have a high olefins content, chemical upgrading of these streams is somewhat easier than upgrading the NGL-derived lower hydrocarbons. As with NGL-derived lower hydrocarbons, dehydrogenation can be used to convert the remaining lower paraffins in the streams. In addition, the upgrading units for the refinery fuel gas can benefit from lower brownfield capital costs, thereby capitalizing on available utilities and possibly spare equipment.

Low-cost propane and butane present an opportunity, which must be matched with a product having enough margin to cover operating costs and provide sufficient return on capital investment. In a low-oil-price environment, not as many product opportunities can provide adequate margins. However, some market-specific opportunities exist that were brought about by the shale phenomenon.

Refining of light paraffinic shale oil does not yield as much high-octane aromatic and naphthenic compounds as the heavier imported crudes. Therefore, a shortage of high-octane gasoline blendstock exists, created by the increased processing of light paraffinic shale oil that now constitutes a significant portion of the crude feed slate of US refineries. Switching of the cracking plants to ethane and LPG feedstocks reduced the availability of butylenes for alkylation and, therefore, the availability of octane4 from alkylate. These factors have combined to create a global octane deficit, as reflected by the higher prices of high-octane blendstock, such as MTBE.

Another likely market opportunity is the production of high-grade, low-sulfur winter or arctic diesel with excellent cold properties, as well as jet fuel blendstock. For the last 20 years, the global consumption of diesel and jet fuel5 has grown faster than the consumption of gasoline. In some regions of the world—for example, in Europe—the growth rate has outstripped the capacity of the region’s refineries to produce it. For a number of years, US refiners shipped diesel to Europe in exchange for gasoline. Even so, due to continued growth in diesel demand, in 2015 diesel fuel shortages have been reported in the UK, the US Midwest, West Africa and India.

Meanwhile, the production of typically low volumes of low-temperature diesel and jet fuel necessitates relatively short refinery runs involving lower throughput, higher cracking severity and the generation of increased amounts of low-value lower hydrocarbon byproducts, such as propane and butane. The specific production of high-grade, low-sulfur, low-temperature winter diesel and jet fuel blendstocks6 could alleviate diesel shortages overall by freeing up refinery capacity to produce wider-boiling-range and lower-cost summer diesel.

Other possible markets are chemical intermediates and industrial lubricant basestocks. Although these markets are not large, they are high-value and can represent incremental revenue to the first few plants that are built.

Given the limitations of the existing markets for North American propane and butane supplies, an opportunity exists for additional high-volume and high-value outlets for the oversupplied North American LPG market. High-octane gasoline, low-temperature middle distillate blendstocks, chemical intermediates and industrial lubricants may present such outlets.

Enabling technologies. The technology to convert propane and butane to derivatives—for example, the dehydrogenation of propane to propylene, of isobutane to isobutylene and of n-butane to butadiene—is well known and widely practiced commercially. A number of technology companies offer dehydrogenation technology for license.

However, the dehydrogenation of propane and isobutane to make high-purity, polymer-grade propylene and isobutylene, respectively, involves a very expensive product purification facility. The costs for this type of facility are high both in terms of capital and operating expenditures.

Furthermore, a polymer-grade propylene production facility must be located next to a polypropylene plant or a polymer-grade propylene pipeline. This is because the transportation of polymer-grade propylene in tank trucks or tank cars significantly increases the cost of the product.

Once the olefin is made via on-purpose dehydrogenation, or via a refining cracking process, then well-known olefin conversion technologies can be used to add value. Oligomerization over solid phosphoric acid is well known for oligomerizing primarily FCC olefins to gasoline blendstocks. At one time, this technology was widely practiced in refineries and steam cracking plants to make polymer gasoline. More recently, most refineries have switched to alkylation as a more cost-effective process. Alkylation of C4 olefin/isoparaffin streams produces branched higher paraffins in the gasoline range. Although this product has a high octane value, it is not useful as a chemical intermediate or as a kerosine/diesel blendstock. Still, in some cases, alkylation may be an option for large, standalone LPG-to-alkylate units.

The oligomerization technology has been improved, with a number of Ziegler, zeolite and modified zeolite technologies7 emerging to enhance olefin conversion rates and to reduce capital investment and catalyst costs.

Some of the technologies using zeolite catalysts cause cyclization of the intermediate higher olefin oligomers and hydrogen transfer, resulting in the formation of cycloparaffins, cycloolefins and substituted aromatic compounds. Such processes have the capability to make high-octane gasoline blendstocks as well as low-temperature diesel additives.

A number of commercial facilities exist to convert lower olefins, which are sometimes mixed with lower paraffins, to olefin oligomers used as chemical intermediates—for example, propylene trimer and propylene tetramer. Propylene trimer and propylene tetramer are used to make alkyl phenols and alkyl benzene. Both are used in detergent formulations. Typically, these facilities are standalone plants that use relatively high-cost chemical-grade propylene and isobutylene as feedstocks.

Another application where lower olefins are converted to high-value oligomers is when isobutylene, either pure or in a mixture with isobutane, is oligomerized or polymerized to polyisobutylene (PIB). Some of these facilities use isobutane/isobutylene mixtures from dehydrogenation as feedstocks.

In the 1980s and 1990s, a number of theoretical works were published describing integrated processes for the conversion of wet natural gas8 or LPG9 to gasoline blendstocks,10 as well as middle distillate fuels and even lubricants. However, prior to the recent North American oil, gas and LPG price scenario, the margin between the lower hydrocarbon feedstocks and gasoline and diesel blendstocks was not sufficient to justify high operating costs and high capital investment of these facilities (Fig. 1).

Certainly, margins during 2012–2014 appeared to be high enough for most projects. Even margins seen after the 2014/2015 price decline may be high enough for advantaged projects, especially if specifically targeted technical advancements are applied to the enabling technologies. Renewed interest is seen in considering a combination of olefin generation and olefin conversion technologies.

Enabling processes. Enabling technologies of conversion of propane and butane into olefins and subsequent olefin conversion to high octane or low-temperature diesel products can be combined into efficient and cost-effective processes.

The process of propane dehydrogenation into polymer-grade propylene or polypropylene involves a capital-intensive and energy-intensive purification section. Polymer-grade propylene or polypropylene is a sufficiently high-priced product to compensate for the cost of the purification. High-octane or low-temperature blendstocks are typically high-volume, but lower-priced products. Taking into account the lower margins, the cost of the processes to make the blendstocks can be reduced by decreasing the cost of the separation section through process simplification or process intensification.

One possible way to improve the economic attractiveness of these processes is to feed a mixed olefin/paraffin stream exiting dehydrogenation or another olefin generation reaction to the olefin conversion reactor without separation. The expensive cryogenic separation of close boiling point components, such as propane and propylene, to very low levels can be avoided. Once the olefin is converted to an oligomer, a cycloolefin, a cycloparaffin or an aromatic, it can be separated from the precursor paraffin relatively easily and inexpensively.

|

|

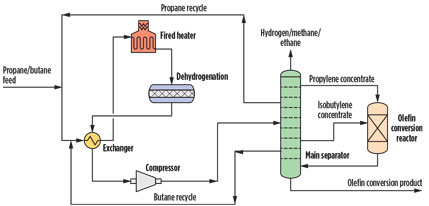

Fig. 2. A process to convert propane and butane to high-value products. |

The capital cost of the enabling processes can be reduced further by process intensification. One such patent-pending process integrates the separate distillation steps of the combined dehydrogenation and olefin conversion process. The intensified distillation process takes advantage of the lower volatility of the products of the olefin conversion by incorporating the olefin conversion reactor into the distillation scheme in a “side-reactor” concept in which the olefin conversion reactor is closely integrated into the distillation scheme. The olefin species are concentrated in a sidestream from the distillation column, which is sent directly to the reactor while the reaction product is introduced back into the distillation column for separation.

In one possible version of the process, lower alkanes such as propane and isobutene are sent to a dehydrogenation reactor. The effluent of the dehydrogenation reactor, containing propylene, propane, isobutylene and isobutene, is exchanged with the feed to preheat it and sent to the main separator. Light byproducts of dehydrogenation, including hydrogen, methane, ethylene and ethane are removed overhead. The propylene concentrate is removed via an upper sidestream and sent to the olefin conversion reactor. The propane concentrate is removed next and sent back to dehydrogenation; the isobutylene concentrate is taken off in a sidestream and is also sent to the olefin conversion reactor, potentially in a different feed point; and isobutane is removed in yet another sidestream and recycled to dehydrogenation.

The hot crude product from the olefin conversion reactor is sent to the lower section of the main separator, where propane and isobutane are concentrated and where unreacted propylene and isobutylene are recovered with the respective concentrate sidestreams. The heat generated by the exothermic olefin conversion reaction is used to reduce the reboil requirements of the column. Olefin conversion products, such as oligomers, cycloolefins, substituted aromatics and others are recovered as a product in the bottoms of the column.

In another possible version of the process, the lighter streams containing lower olefins such as propylene, isobutylene, 2-butene, 1-butene, butadiene and various isomers of pentenes and hexenes from fluid catalytic cracking (FCC), coking, visbreaking, hydrocracking and steam cracking are sent to the main separator, where the olefins are concentrated in one or more sidestreams and are sent to the olefins conversion reactor. The outlet of the olefins conversion reactor is sent back to the main separator where the heavier products are separated in the column bottoms.

The olefin conversion product can be further separated into different cuts for various applications in the same or an additional distillation column. Depending on the degree of olefin conversion and the balance of the competing oligomerization and cyclization reactions, the entire product, or a cut of it, can be used as a low-pour-point winter diesel blendstock.

Depending on which olefin conversion technology is applied and the conversion product characteristics, it is possible that the final product may need to be hydrogenated for the fuel and lubricant applications. Alternatively, the olefinic product, or specific cuts of the olefinic product, can be used as petrochemical intermediates, in which case hydrogenation will not be required. Also, a number of high-value lubricant applications exist where some level of olefins or aromatics in the product is an advantage. The possible chemical intermediate and lubricant applications are:

- C5–C10 carbon numbers: feedstock for plasticizer alcohols, eventually used in compounds used to make PVC more malleable

- C7–C11 carbon numbers: feedstock for alkyl phenol, a detergent intermediate

- C11–C13 carbon numbers: feedstock for alkyl phenols for eventual use in lubricant additives

- C10–C14 carbon numbers: branched alkyl benzene, used as a detergent intermediate and a refrigeration lubricant.

- C14+ carbon numbers: feedstocks for heavy benzene alkylates, eventually used as lubricant additives.

- C14+ carbon numbers: synthetic drilling fluid basestocks and additives.

Compared to the fuel additive markets, the markets for the chemical intermediates and lubricants are not large, but these applications are typically higher-value and can add incremental revenue to the first movers in this area.

Takeaway. Abundant supplies of low-cost propane and butane from shale gas operations in North America represent an opportunity for extension into new market niches, which have appeared partly as a result of the shale gas phenomenon. It appears that high-octane gasoline blendstock and low-temperature diesel blendstock market niches represent such opportunities.

To take advantage of these opportunities, long-contemplated olefin generation and olefin conversion technology combinations should be reviewed and adapted to developing technology advancements and market demands. Simplification of the intermediate and product separations to take advantage of the large boiling point differences between the olefin conversion products and unconverted monomers is one such technique. Another may be process intensification in reactions and separations. GP

Literature cited

1Glasser, S., “Excess US ethane could prompt startup in exports,” Breaking Energy, http://breakingenergy.com/2015/09/03/excess-u-s-ethane-could-prompt-startup-in-exports/

2US Energy Information Administration, “US exports of propane and propylene,” https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MPREXUS2&f=M

3ICIS News, “US Dow completes PDH unit in Texas”, November 20, 2015, http://www.icis.com/resources/news/2015/11/20/9946072/us-dow-completes-pdh-unit-in-texas/

4Platts, “MTBE factor spikes higher on export demand, octane shortage,” November 5, 2015, http://www.platts.com/latest-news/petrochemicals/london/mtbe-factor-spikes-higher-on-export-demand-octane-26923539

5Axens, “Gasoline and diesel imbalances in the Atlantic basin,” http://www.axens.net/document/11/gasoline-and-diesel...part-1/english.html

6US Patent 8328883 B2 to Chevron, “Distillate fuel compositions,” https://patents.google.com/patent/US8328883B2/en

7Li, X. and X. Jiang, “Propylene oligomerization to produce diesel fuel on Zr-ZSM-5 catalyst,” Chemistry and Technology of Fuels and Oils, May 2013, Vol. 49, Iss. 2.

8US 4413153 A to Mobil Oil, “Integrated process for making transportation fuels and lubes from wet natural gas,” 1983, http://www.google.com/patents/US4413153

9US 4542247 A to Mobil Oil, “Conversion of LPG hydrocarbons to distillate fuels or lubes using integration of LPG dehydrogenation and MOGDL,” 1985, http://www.google.com/patents/US4542247

10US 4393259 A to UOP, “Process for conversion of propane or butane to gasoline,” http://www.google.com/patents/US4393259

Armen Abazajian is a senior consultant with Advisian, the independent consulting business line of WorleyParsons. He has over 25 years of experience in conceptual design, technology development, consulting and process improvement in chemicals and petrochemicals. Mr. Abazajian has authored a number of articles and presented at a number of industry conferences. He also has over 20 inventions to his name, 12 of which have been patented. He is a graduate of the University of Houston in Texas.

Comments