Methanol economy gains ground with technology, market developments

A. ABAZAJIAN, Advisian, Houston, Texas

The Nobel Prize winner in chemistry, Dr. George Olah, and co-authors published a book in 2006 titled Beyond Oil and Gas: The Methanol Economy.1 In it, the authors suggested a future economy in which methanol (Fig. 1) replaces crude-oil-based fossil fuels as a means of energy storage, transportation fuel, and raw material for a wide variety of hydrocarbon-based products.

|

|

Fig. 1. Methanol ball-and-stick model. |

Versatility, reactivity and relatively low cost of production of methanol lay in the basis of this concept. Methanol can be made from a number of carbon-containing materials, both fossil (natural gas, crude oil or coal) and renewable (biomass, municipal waste and even CO2). A number of competing synthesis routes can be used in manufacturing methanol: catalytic or thermal oxidation to syngas followed by hydrogenation, halogenation followed by hydrolysis, or biochemical conversion. Like gasoline and middle distillates, methanol is a liquid and is carried by pipeline, rail, truck, barge and oceangoing vessel.

Many products can be made from methanol. It has a high enough octane number to be substituted directly for gasoline or to be blended into gasoline. It can also be chemically converted into gasoline, ethanol, and substitutes of liquefied petroleum gas (LPG) and diesel; olefins and polyolefins; ethylene glycol, acetic acid, formaldehyde and their many polymeric derivatives.

The authors underlined the greenhouse gas (GHG) benefit of methanol as part of “CO2 looping”: it can be burned to CO2 to recover internal energy and subsequently remade again from CO2. This part of the methanol economy concept requires a contribution of a large amount of energy from non-polluting sources in a process that has not been demonstrated on a commercial scale. A small pilot plant (1.6 Mtpy) in Iceland uses non-polluting geothermal energy to make methanol from CO2 that is harvested from industrial emissions.

While “CO2 looping” may be in its infancy, it is clear that the rate of conversion of a number of carbon-containing feedstocks to methanol—and subsequent conversion to various products that substitute crude oil—is growing.

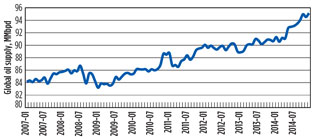

Demand substitution. A longer-term view shows that, although the global economy grew at an average rate of 3.05%2 since the last recession in 2009, global oil production grew at only 1.7%3 (Fig. 2).

|

|

Fig. 2. World oil supply, 2007–2014. |

Undoubtedly, the increasing transportation fuel efficiency is responsible for part of the discrepancy between the global gross domestic product (GDP) growth and global oil production growth:

- Higher fuel efficiency of the newer automobiles brought about by recently higher fuel prices and corporate average fuel efficiency (CAFE) mandates

- Gasoline/electrical and diesel/electrical hybrids (plug-in hybrids are basically dual-fuel vehicles, directly consuming gasoline and consuming coal or natural gas indirectly, via the electrical grid)

- Use of hydraulic hybrids

- Use of gasoline- or diesel-powered public transportation

- Carpooling, and many others.

It is also becoming clear that some of the lower growth of consumption and production of oil is due to the substitution of oil4 with other hydrocarbon and energy sources. Examples of this phenomenon are many and varied:

- Fully electric automobiles, which are fueled (indirectly, via the electrical grid) by a local blend of power generation fuels; usually some combination of coal, natural gas, nuclear, wind, solar and hydroelectric

- Plug-in hybrids partially fueled by the local electrical grid

- Electrically powered light-rail and high-speed trains, also fueled by the electrical grid

- Compressed natural gas (CNG) refuse truck and bus fleets

- The use of bioethanol (corn- or sugar-cane-based) in gasoline blends

- First-generation (methyl ester) and second-generation (hydroprocessed) biodiesel from vegetable oil or animal fat

- Replacement of home heating oil furnaces with wood pellet furnaces

- Replacement of smaller diesel generators with natural-gas-fired generators (large generators converted a long time ago)

- Walking or riding a bicycle to work (muscle power).

Substitution is also occurring on the industrial front:

- Due to the low cost of natural gas and NGL, most US ethylene producers have switched to ethane and LPG feedstocks from naphtha feedstocks, thereby substituting a crude-oil-derived product with a natural-gas-derived product

- A significant amount of propylene production in China, the US and Russia is now via dehydrogenation of propane distilled from NGL, substituting propylene from naphtha cracking

- Petroleum wax is being substituted by soy-derived wax and Fischer-Tropsch wax (derived from natural gas or coal)

- Synthetic base oils made either by hydrocracking of Fischer-Tropsch wax (Group III) or by oligomerization of ethylene (Group IV) are substituting Group I and II base oils refined from oil.

Substitution by methanol. Over the last 10 years, methanol has become a notable substitute for oil and coal. Its consumption has increased from approximately 35 metric MMtpy in 2004 to approximately 64 metric MMtpy in 2014.5 Of the 64 metric MMt of consumption in that year, approximately 60% was in chemical applications.

The chemical applications of methanol are not substituting oil- or coal-based products. These applications tend to grow with the increased use of polymers in the general economy. Approximately 40% of the methanol consumption is in oil-substitute applications. In addition, approximately 5 MMt5, 6 of captive methanol production from coal in China typically is not considered part of the methanol market, but it also substitutes for oil.

The prime alternative of producing ethylene and propylene in the Far East is by cracking naphtha, a product of oil refining. This methanol is converted into olefins via methanol-to-olefins (MTO) or into gasoline via methanol-to-gasoline (MTG) onsite. Another 4.9 MMt of methanol capacity were in the late stages of construction or in startup in 2015.

Assuming a 70% coal-to-olefins (CTO) capacity utilization rate and correcting for the oxygen content of methanol, methanol substitution of crude oil is approximately equal to 0.35 MMbpd, or 0.4% of the total crude oil demand. If one is to make the broad assumption that the difference between GDP growth and crude oil demand growth is due to efficiency improvements and substitution, then methanol substitution is responsible for approximately 30% of the total 1.3% efficiency/substitution effect.

Some of the methanol substitutes are so-called “drop-in” substitutes. These are chemically similar enough that they involve no changes to the product distribution infrastructure. Other methanol-based substitutes are chemically dissimilar functional substitutes that require the adaptation of distribution and utilization systems.

A number of processes to convert methanol into substitute products have been developed and commercialized. Other processes exist, but they have not yet been used in oil substitution applications, or they must be modified to fit it. Still others are under development.

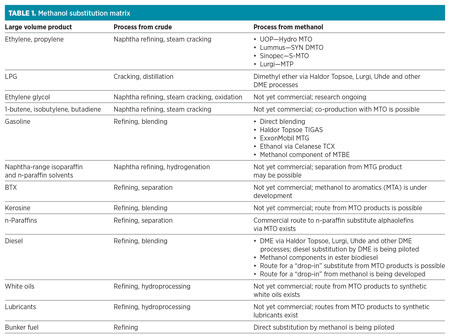

As shown in Table 1, some large-scale products from crude are either available as “drop-in” or functional substitutes from methanol. For other products, routes are available or are being developed. While some of these routes may turn out to be uncompetitive with refining routes, others may succeed.

|

A large number of substitution projects are in the works:5

- 10 merchant MTO plants totaling 12.3 MMt of methanol are under construction in China.

- Europe already allows up to 3% methanol in gasoline, but present blending levels are lower and may increase if blending is attractive on a volume or energy basis.

- Seven countries are piloting methanol blending programs: Australia, Israel, Azerbaijan, Uzbekistan, Libya, Iran and Denmark.

- North America and Europe are introducing tighter sulfur emissions in marine fuel. Both regulations and the high cost of marine fuel are driving substitution to LNG and methanol bunkering. One ferry in Europe is being converted to methanol. Methanex’s subsidiary Waterfront has ordered seven methanol transportation vessels fueled by methanol.5

- BASF is considering a methanol-to-propylene complex in the US.7

- Several MTG projects have been announced; some are in design.

Globally, the volume of methanol used for crude oil substitution is estimated to increase from approximately 32 MMt to 39 MMt by 2018, or a growth of 21% from the 2015 level. However, these growth estimates do not take into account the recent oil price decline.

Oil price decline. In 2015, the price of West Texas Intermediate (WTI) dropped to the level last seen briefly in the “great recession” year of 2009 and before that, in 2005, on constant-dollar basis. The short-term decline in oil prices in 2009 did not appear to have significantly impacted oil substitution rates. Therefore, it would be reasonable to expect that if the current oil price decline is short-lived, then the substitution rates may continue as before. However, if the low price of oil persists, it would be reasonable to expect that the substitution rate will decline.

The products refined from oil and their derivatives listed in the methanol substitution applications in Table 1 have become less expensive. This lowers the prices of the substitute products, which, in turn, lowers the expected returns from new projects. Volumes should also decline, as some producers will elect not to sell at the lower prices.

With the sustained lower oil prices, the Chinese methanol blending program may slow down. The experimental blending programs in other countries may lose momentum or be completed without being followed by a full national rollout. How much these programs will be impacted depends on the local prices for methanol vs. gasoline.

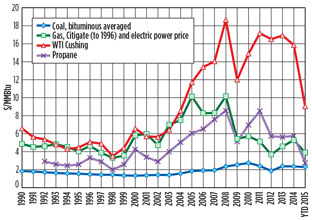

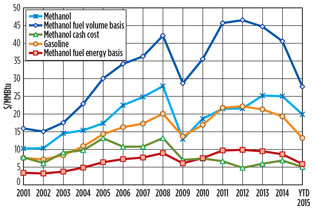

The rate of substitution of oil with methanol is sustained to some level by the continued low prices of natural gas in some regions, especially North America. Fig. 3 shows that year-to-date 2015 prices of WTI crude oil in North America are still considerably higher than natural gas prices on an energy basis. Therefore, the driving force for substitution of oil-based products with natural-gas-based products, including methanol made from natural gas, is still present, although it is much lower than before.

|

|

Fig. 3. Past feedstock prices, constant 2014 dollars. |

Fig. 4 illustrates recent methanol and gasoline prices in terms of estimated prices on an energy basis. US prices are used for all products for illustration purposes. Chinese wholesale prices may differ, which may affect some of the conclusions drawn here. Also, Methanex list prices for methanol are used without a discount. According to some sources,5 most methanol in China is blended into gasoline in small percentages and is sold on a volume basis. That would represent the best energy value outlet for methanol (see “Methanol fuel volume basis” curve in Fig. 4), including at the lower oil-derivative gasoline prices.

|

|

Fig. 4. Primary products prices in terms of price for energy |

However, that pricing method does not represent the best deal for the consumer, since methanol’s higher heating value is approximately 45% of the higher heating value of average gasoline. Methanol does have a relatively high octane number, which may help avoid some of the other blending expenses. This blending practice should continue, despite the lower oil prices, until the Chinese consumer objects.

The “Methanol fuel energy basis” curve in Fig. 4 represents the theoretical pricing for the energy delivered by the blended methanol. Prior to 2010, when the oil prices recovered from the “great recession” values and gas prices declined due to the “shale gas revolution,” the prices for methanol made from US natural gas blended into gasoline returned lower than the cash cost of methanol (see “Methanol cash cost” curve in Fig. 4); therefore, this practice did not make sense.

However, even with the recent oil price decline, energy-based prices for methanol made from US natural gas are higher than the cash cost of production; therefore, the practice may make sense for disposal of incremental methanol production. This may be the situation in China for high methanol blends, where the loss of driving range and power is noticeable and blend prices must be discounted.

Interestingly, from 2009 to mid-2013, the market prices of gasoline and methanol as reflected on an energy basis (curves “Methanol” and “Gasoline” in Fig. 4) were approximately the same, signifying that methanol could have been sold into gasoline blending at the same value it was sold into the chemical markets, provided that the fuel blenders did not demand an energy discount.

In addition to the purely economic considerations, methanol substitution has a number of non-economic drivers. For example, methanol substitution of crude oil is supported by the Chinese government’s reported desire to reduce its dependence on imported oil. In the recent past and in some cases even now, this consideration was justified in economic terms as well as strategic terms. If the lower oil prices persist, it will be more difficult to justify economically.

The marine fuel bunkering regulations represent a driver that is only somewhat elastic with respect to oil prices and will continue to present a driving force for substitution. However, if the lower oil prices persist, this conversion too may slow down, as the operators may seek ways to comply with the regulations without expensive engine conversions.

If the present levels of oil and gas prices persist, then methanol substitution of oil-derived products will find a new equilibrium level balanced between economic and non-economic considerations. The chemical applications of methanol will continue to grow proportionately with GDP in mature markets and higher than GDP in emerging markets, where the polymer market penetration rate is generally higher than GDP.

Takeaway. Methanol has been proposed as a possible substitute for oil as an energy carrier and as a feedstock for hydrocarbon products. During the last decade, high oil prices have caused a certain amount of substitution of oil by other sources of energy and other hydrocarbon sources. Methanol and its derivatives have been one of these sources. So far, it appears that methanol has substituted approximately 0.4% of global crude oil use.

The substitution of oil by methanol is continuing to develop. A number of projects around the world, most notably in China or geared toward the Chinese market, are moving forward. Technology to substitute more of the products derived from oil is continuing to be developed.

If it persists, the oil price decline that began in 2014 and is ongoing at the time of publication is likely to impact the rates of substitution and reduce the number of projects going forward. While it is difficult to estimate the impact of lower oil prices on the growth of methanol and methanol derivatives volumes, it is likely that some substitution will continue to increase at a rate driven by Chinese methanol blending practices, strategic Chinese considerations, the regulatory environment and low natural gas prices. GP

LITERATURE CITED

1Olah, G., A. Goeppert and G. K. Surya Prakash, Beyond Oil and Gas: The Methanol Economy, Wiley-VCH, 2006.

2World Bank, “GDP growth, annual %,” available at: http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG/countries/1W?display=graph

3US Energy Information Administration, “International Energy Statistics: Total Petroleum and Other Liquids Production 2014,” EIA Beta, available at: http://www.eia.gov/beta/international/rankings/#?prodact=53-1&cy=2014

4Abazajian, A., et al., “Combine gas and coal feedstocks to displace high-cost oil,” Gas Processing, September/October 2014.

5Methanex, “Investor presentation,” February 2015, available at: https://www.methanex.com/sites/default/files/investor/MEOH%20Presentation%20-%20February%202015.pdf

6Deloitte, “Chemical quarterly, China coal-to-olefins, exploring for the new Eldorado,” Deloitte, 4Q 2012, available at: http://www2.deloitte.com/content/dam/Deloitte/cn/Documents/manufacturing/deloitte-cn-mfg-chemical-quarterlyq4-en-031212.pdf

7BASF, “BASF continues to evaluate natural gas-based investment on the US Gulf Coast,” March 19, 2015, available at: https://www.basf.com/en/company/news-and-media/news-releases/2015/03/p-15-176.html

Armen Abazajian is a senior consultant with Advisian, the independent consulting business line of WorleyParsons. He has more than 25 years of experience in conceptual design, technology development, consulting and process improvement in chemicals and petrochemicals, including synthesis gas and higher olefins applications. He has authored several articles and presented at a number of industry conferences. Mr. Abazajian also has over 20 inventions, 12 of which have been patented. He is a graduate of the University of Houston in Texas.

Comments