EWAnalysis

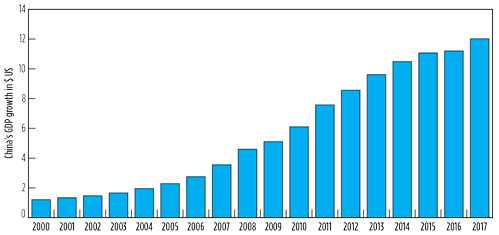

Since market reforms first started in 1978, China has shifted from a centrally planned economy to a market-based economy, experiencing rapid economic and social development. At more than $12 T, China’s economy is the world’s second largest. The country has witnessed substantial GDP growth over the past several decades. Since 2000, China’s GDP has surged from approximately $1.2 T to more than $12 T, according to the International Monetary Fund (IMF) and the World Bank (Fig. 1).

|

|

Fig. 1. Growth in China’s GDP, in billions of US dollars. Source: IMF and World Bank. |

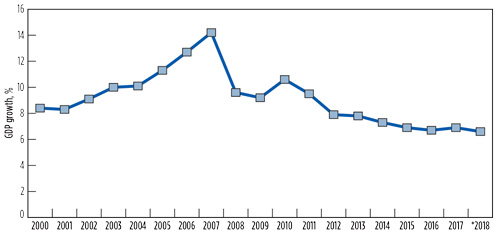

The country witnessed its largest GDP growth from 2003–2008. During this time frame, China’s GDP increased between 10%/yr and 14.2%/yr. Although the nation’s GDP growth has slowed, it remains healthy at approximately 6.6%/yr, and has maintained a steady 6.6% growth rate through 1Q/2Q 2018 (Fig. 2). This economic growth is responsible for lifting more than 800 MM people out of poverty, and has boosted the growth of the country’s middle class. In turn, China has witnessed a surge in demand for many goods and services, especially hydrocarbon-based products such as natural gas, transportation fuels and petrochemicals.

|

|

Fig. 2. Percentage growth in China’s GDP, 2000–2018. Source: IMF. |

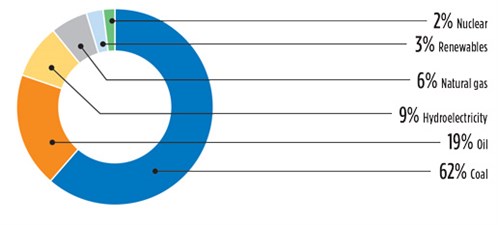

The Chinese economy is also undergoing a structural shift. Due to excessive air pollution in major industrial cities, China has instituted an initiative to replace coal-fired power generation with natural gas-fired power generation. At present, natural gas makes up approximately 6% of the country’s total energy mix (Fig. 3). However, according to China’s gas-to-power plan, natural gas market share in the country’s total energy mix will increase to 10% by 2020 and to 15% by 2030.

|

|

Fig. 3. China’s total energy mix. Source: China National Bureau of Statistics. |

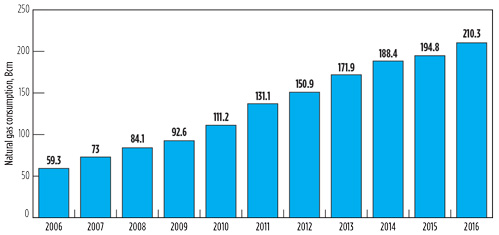

The country has already witnessed a surge in natural gas consumption over the past decade. According to BP’s Statistical Review of World Energy 2017, China’s natural gas consumption has increased from 59 Bm3y in 2006 to more than 210 Bm3y in 2016 (Fig. 4). Within the same timeframe, China has invested heavily to boost natural gas production. From 2006–2016, the country’s domestic natural gas production has increased from 60.6 Bm3y to more than 138 Bm3y (Fig. 5).

|

|

Fig. 4. China’s domestic natural gas consumption in Bm3y, 2006–2016. Source: BP. |

|

|

Fig. 5. China’s domestic natural gas production in Bm3y, 2006–2016. Source: BP. |

Although China’s domestic natural gas production has more than doubled over the past decade, production cannot keep pace with demand. As of 2016, the gap between natural gas supply and demand was nearly 72 Bm3y. With new initiatives to substantially expand the use of natural gas in power generation, China will see a spike in additional gas demand over the next several years. The pressing question is: From where will new natural gas supplies come? The country is pursuing several options to help satisfy demand: increasing shale gas production, building additional pipelines and boosting LNG regasification and import terminal infrastructure. This discussion focuses primarily on the construction of natural gas pipeline and LNG import infrastructure.

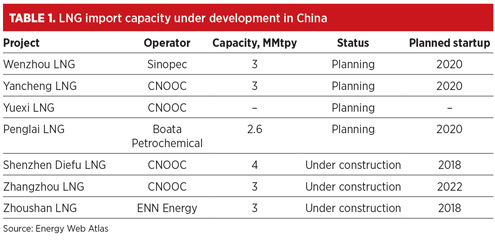

The rise of LNG. According to Energy Web Atlas, China has 18 LNG import terminals in operation, with a total installed domestic capacity of nearly 60 MMtpy. In 2017, China surpassed South Korea as the second-largest LNG importer when it received nearly 38 MMt of LNG. This represented a year-over-year increase of approximately 42%. At the time of this publication, Energy Web Atlas is tracking seven additional LNG import terminal projects that will add nearly 19 MMtpy of capacity by the early 2020s (Table 1).

|

However, China is expected to add even more LNG import capacity by the mid-2020s. During the 2018 World Gas Conference, Yalan Li, Chairperson of the Board of Directors for Beijing Gas Group Co., announced that seven of the country’s 18 LNG import terminals are being expanded, along with the construction of 11 new receiving terminals. As previously mentioned, EWA is tracking eight of the 11 new projects, with the additional three still being researched to confirm validity. China aims to boost its natural gas consumption to 400 Bm3y by the mid-2020s, making it the second-largest natural gas consumer in the world.

The viability of China’s natural gas plans depends heavily on the construction of additional storage and infrastructure. According to Ms. Li, natural gas storage capacity in China accounts for only 3% of yearly gas consumption. Also, some in the Chinese government view natural gas as more of a “transition fuel,” and place heavier emphasis on renewable fuels. Furthermore, since China has such a large coal supply, some say that coal use should be expanded to make use of China’s domestic resources instead of importing gas from foreign nations. To overcome these restrictive views and make natural gas a major fuel, Ms. Li named several important initiatives for Chinese energy companies and policy makers:

- Enhance exploration and production of resources

- Invest in digitalization and major technology breakthroughs

- Advocate for natural gas use for its abundance, low emissions and high efficiency

- Consider the advantages of imported gas, rather than emphasizing only domestic energy resources.

She noted that China’s top priority is security of energy supply. To that end, the country plans to increase domestic production first, and import more gas—in both the form of pipeline gas and LNG—second.

Although the country plans to boost domestic shale gas production, it will not be able to keep pace with natural gas demand. Even with additional supplies of piped natural gas, China will have to increase LNG imports to satisfy surging natural gas demand. According to several industry forecasts, China could overtake Japan as the world’s largest LNG importer. This trend is being exacerbated by Japan’s move toward using more renewable fuels for power generation, along with the restart of several nuclear plants, which will ultimately reduce the need for additional LNG imports.

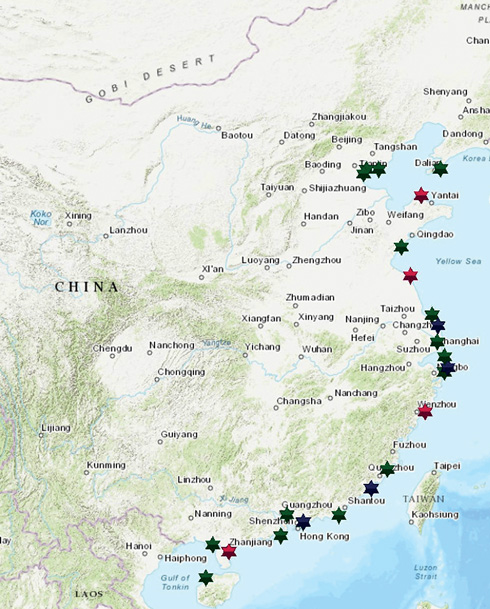

The locations of China’s operational LNG terminals, as well as those under development, are shown in Fig. 6.

|

|

Fig. 6. View of China’s LNG import infrastructure, along with LNG import terminal projects |

According to the International Gas Union’s World LNG Report 2017, the Asia-Pacific region imported more than 211 MMt of LNG in 2017, which represented nearly 73% of LNG trade. With 83.5 MMtpy, Japan remained the world’s largest importer. Although Japanese LNG imports dominate global LNG trade—the country’s imported LNG represents nearly 29% of LNG trade—China is gaining momentum. The Chinese government is looking to use natural gas in several ways; the primary goal is to replace coal-fired power generation with natural gas.

The imported natural gas will provide millions of households with an additional energy source for heating. However, the country will need to invest heavily in additional natural gas infrastructure to provide this resource to those that need it. These investments include the construction of pipeline networks to connect households to the national gas distribution system.

As shown in Fig. 6, the country’s LNG infrastructure is located where natural gas demand is highest. Construction of natural gas pipelines to these cities is economically unprofitable, which makes additional LNG imports crucial for the country. China will begin to see additional piped natural gas imports flow into the country—primarily through the construction of Russia’s Power of Siberia pipeline—which will help supplement the country’s LNG import volumes.

China witnessed the startup of two LNG import terminals in 2017. These two facilities were China National Offshore Oil Corp.’s (CNOOC’s) 2-MMtpy Yuedong LNG terminal and Guanghui Energy’s 600-Mtpy Qidong terminal. In 1Q 2018, Sinopec’s Tianjin LNG terminal received its first LNG shipment. The 3-MMtpy Tianjin terminal is one of four LNG import terminals that are scheduled to become operational this year. According to EWA and GIIGNL analysis, these LNG startups include:

- ENN’s 3-MMtpy Zhoushan LNG terminal

- Chaozhou Huafeng’s 3-MMtpy LNG conversion terminal—the project includes the conversion of an LPG plant into an LNG import terminal

- CNOOC’s 4-MMtpy Shenzhen Diefu LNG terminal.

In June, two additional major Chinese LNG projects were announced. CNOOC announced it will begin construction of six new storage tanks at its Tianjin terminal. Each tank will have a storage capacity of 220 Mm3. The additional storage is needed to satisfy natural gas demand in northern China, which is increasing at a substantial pace. According to a June Reuters industry report, the Tianjin terminal is expected to more than double its total capacity of 3.21 MMtpy in 2018 to approximately 7.25 MMtpy by 2030.

CNOOC also announced it is close to gaining approval from China’s National Development and Reform Commission (NDRC) to begin construction on a new LNG import terminal in Yancheng. The 3-MMtpy facility, located approximately 200 mi north of Shanghai, will include the import terminal, storage tanks and a 158-km pipeline to ship the majority of the LNG to Huainan City in the Anhui province. The project will be built by CNOOC Jiangsu Natural Gas, a JV between CNOOC Gas and Power and Huainan Mineral Resources Mining. Once approved by the NDRC, the facility will begin building the terminal. Operations are likely to commence in the early to mid-2020s.

Natural gas pipeline: A supplement to LNG imports. China plans to supplement its LNG imports with piped natural gas from other nations, including Russia. One of the most prominent pipeline projects is Russia’s Power of Siberia pipeline (Fig. 7). The project, being developed by Gazprom, will transport natural gas from Russia’s Irkutsk and Yakutia gas production centers to demand centers in Russia’s Far East and China via the eastern route. Once operational, the Power of Siberia pipeline will have a total capacity of 38 Bm3y.

|

|

Fig. 7. Gazprom is building the Power of Siberia pipeline to provide natural gas to demand centers in Russia’s Far East region, as well as to China. Photo courtesty of Gazprom. |

In mid-2014, Gazprom and China National Petroleum Corp. (CNPC) signed a sales and purchase agreement where Gazprom would supply CNPC with 38 Bm3y of natural gas for a term of 30 yr. Gazprom expects to start deliveries by the end of 2019. Although the eastern route of the pipeline will provide China with an additional 38 Bm3y of natural gas supplies, it still will not be enough to satisfy domestic demand. Even at full utilization, the pipeline would only cover a little over half of the gap between natural gas supply and demand. With the forecast increase in domestic natural gas consumption, China will need to rely on additional LNG imports to satisfy demand.

As shown in Fig. 8, China has an extensive pipeline network. Several pipeline projects are under development in the country, including a proposed pipeline to connect China’s coastal LNG facilities. According to Energy Web Atlas, this project is still under consideration, and no final investment decision has been announced.

|

|

Fig. 8. Operational and proposed pipeline infrastructure, along with LNG import terminals, |

Takeaway. As China turns its efforts toward reducing air pollution, the country’s demand for natural gas is forecast to substantially increase in the future. Although the nation plans to develop additional natural gas pipelines, China will need to boost its LNG import infrastructure to satisfy demand. With nearly 20 MMtpy of capacity under construction, the country is investing heavily to increase LNG import capacity. This additional capacity will help ensure that the country is able to meet its ambition of boosting natural gas in its total energy mix. GP

Comments