Boxscore Construction Analysis

Eugene Gerden, Contributing Writer

Turkmenistan, located in Central Asia on the Caspian Sea, plans to significantly increase its presence in the global gas market. The country has the fourth-largest natural gas reserves in the world; however, to date, its presence in the global gas industry has been limited. This situation may change in the coming years, as the country has already started to create conditions for a significant increase in gas exports.

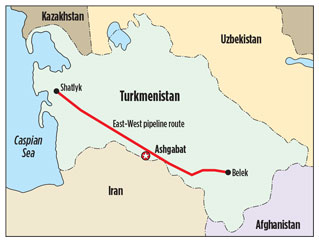

New pipelines to offer wider export reach. According to Turkmenistan’s Ministry of Oil and Mineral Resources, the country recently completed construction of the 1,000-km East-West gas pipeline (Fig. 1). The new gas pipeline connects the country’s main gas fields into a single gas transportation system and significantly increases its export capacity. In addition, it would become part of the pipeline system for deliveries of Turkmen gas to Europe. The official launch of the new East-West pipeline in December 2015 is expected to help Turkmenistan provide additional guarantees for stable exports of its gas to global markets.

|

|

Fig. 1. Turkmengaz’s East-West pipeline route from Shatlyk |

According to an official spokesperson of the Turkmen Ministry of Oil and Mineral Resources, the construction of the East-West pipeline will allow Turkmenistan to pump up to 30 Bcm of gas from the country’s largest gas fields, located in the eastern part of the country, to states bordering the Caspian Sea on the west.

According to the original plan, the new pipeline was to become part of the Nabucco project; however, due to its suspension, the Turkmen government decided to complete construction of the pipeline with its own resources.

At present, Caspian states continue development of infrastructure for exports of Caspian gas to Europe. Part of this involves the expansion of the South Caucasus gas pipeline, as well as the ongoing construction of the Trans-Anatolian Pipeline (TANAP) and the Trans-Adriatic Pipeline (TAP).

By 2020, these pipelines will be able to carry large volumes of gas, primarily from Azerbaijan and Turkmenistan, with the aim of further exports to the EU. According to recent statements by Maroš Šefčovič, vice president of the European Commission for the European Energy Union, the EU expects to receive Turkmen gas by 2019.

The EU has long planned to diversify its gas supplies and reduce its energy dependence on Russia. At present, the European Commission is considering Turkmenistan and Azerbaijan as potential partners for the launch of regular gas supplies to the EU.

According to Mikhail Korchemkin, head of research firm East European Gas Analysis, Russia has become an unreliable gas supply partner to the EU in recent years, and the management of Gazprom has threatened to significantly reduce gas exports to the EU, in favor of sending them to Asia-Pacific countries.

Prior to 1997, Russia was the only buyer of Turkmen gas, and supplies took place through the Russian Central Asia–Center (CAC) pipeline. However, several years later, the Turkmen government was able to launch the first Turkmen-Iranian pipeline, with annual gas capacity of 8 Bcmy, and, in 2010, another pipeline to Iran was established with a capacity of 12.5 Bcmy.

In 2009, Turkmenistan started sales of its gas to China, as a result of the signing of a 30-year contract for 30 Bcmy of gas through the Central Asia–China pipeline system. This system, which takes gas from Kazakhstan to China and also has a leg into Turkmenistan through Uzbekistan, was completed in 2010.

By 2030, the government of Turkmenistan plans to increase gas production to 230 Bcm. Further development of the country’s large Galkynysh gas field and planned development of another 30 gas fields, as per statements from Ashirguly Begliev, chairman of Turkmengaz, will help meet this goal.

According to plans of the Turkmen government, gas production at the Galkynysh field is expected to reach 93 Bcmy by 2016, and total gas exports from the country should reach 180 Bcm by 2018. As part of these targets, Turkmengaz has started preparations for the expansion of the D section of the Turkmenistan–China pipeline, which will raise that section’s total capacity to approximately 30 Bcmy of gas.

Analysts believe that Turkmenistan has a good chance of implementing these plans, taking into account the country’s huge gas reserves. According to data from the British consulting firm Gaffney, Cline and Associates, Turkmenistan’s total gas reserves are estimated at 27.4 Tcm.

In 2014, the total volume of natural gas produced in Turkmenistan amounted to more than 76 Bcm, of which 45 Bcm were exported abroad. China remains the main buyer of Turkmen gas; however, according to Turkmen government plans, this situation will change in the near future, amid EU attempts to significantly reduce dependence on Russian gas. In the meantime, analysts believe that Turkmen gas shipments to Europe will result in tightening market competition, although this will not be associated with any radical changes in the market.

Turkmenistan is in need of new markets for its gas. In 2015, Russia imported only 4 Bcm of Turkmen gas, and no information is available on Russia’s plan to purchase gas from Turkmenistan in 2016.

|

|

Fig. 2. The official launch of the construction of the TAPI |

Turkmenistan has now pinned its hopes on the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline, which broke ground on December 13, 2015 (Fig. 2). This pipeline would bring Turkmen gas to the vast and promising markets of Pakistan, India and Southeast Asia over the long term (Fig. 3).

|

|

Fig. 3. Planned route of the TAPI pipeline. |

However, implementation of these plans may encounter some difficulties, the most important of which is an ongoing conflict between Turkmenistan and Azerbaijan for the ownership of a number of gas fields on the Caspian shelf. The two sides continue to discuss the legal status of the Kapaz field, which is one of the largest gas fields on the Caspian shelf. Azerbaijan has already started development of the field, despite fierce protests from Turkmenistan.

Planned LNG projects will supply EU. At the same time as it aspires to boost its traditional natural gas exports, Turkmenistan hopes to increase LNG exports abroad, including to EU countries. These plans include building an LNG terminal at the Caspian Sea for transport of Turkmen LNG by sea to Lithuania and other countries.

The possibility of LNG exports from Turkmenistan has been confirmed by Algirdas Butkevičius, prime minister of Lithuania. The government of Lithuania has already conducted talks for the project with the Turkmen government. It is possible that the LNG terminal could be completed by 2018. The supplies would be sent through the territories of Azerbaijan and Georgia to the Romanian seaport of Constanta, and then transported by LNG tankers throughout Europe.

Turkmenistan already operates two LNG terminals, both of which source gas from the country’s Naip and Bagaja gas fields. In 2009, the country completed construction of the first Turkmen marine LNG terminal on the coast of the Caspian Sea at the port of Kiyanly. Its design capacity is 200 metric Mtpy of LNG, with the possibility of a significant increase over the next several years.

According to the Turkmen government’s plans, by 2030, the volume of LNG production in the country should increase by up to 3 metric MMt. This increase will be achieved through the construction of new LNG plants in other parts of the country. Implementation of these plans will take place as part of the official state program to develop the domestic oil and gas industry through 2030.

To date, among the major importers of Turkmen LNG are such countries as Iran, Afghanistan and Japan; however, the geography of supplies should significantly expand during the next several years, according to the government’s vision.

Sergey Pikin, director of the Russian Energy Development Fund, commented on Turkmenistan’s energy development plans: “Despite the fact that LNG infrastructure is more expensive than pipelines, one of the main advantages of LNG, compared to traditional gas, is the possibility of its supplies without any territorial restrictions and limitations. In the case of building necessary infrastructure, Turkmenistan will be able to supply gas to those countries that can offer higher prices for its gas, and, in particular, the EU states. The Turkmen government is aware of this and no longer plans to focus on the supplies of traditional gas to China and Russia, as it did in the past.”

While simultaneously catering to gas-hungry EU nations, Turkmenistan aims to create conditions to attract Western investors to produce gas within its territory. To date, Italy’s eni has expressed interest in developing Caspian Sea blocks. The company plans to explore the 19th and 20th blocks of the Turkmenistan shelf, with the volume of reserves pegged at more than 500 MMt of oil and 630 Bcm of natural gas. According to sources in the Turkmen government, negotiations are underway with other Western investors for the development of additional blocks. GP

|

Eugene Gerden is an international contributing writer specializing in the global oil refining and gas industry. He has been published in a number of prominent industry titles.

Comments