Boxscore Construction Analysis

L. Nichols, Director, Data Division

Lee.Nichols@GulfPub.com

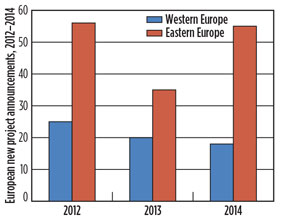

The European downstream construction sector is a tale of two cities. Western Europe’s new project announcements have fallen amid a surge of new project announcements in Eastern Europe, Russia and the Commonwealth of Independent States (CIS) (Fig. 1). In the past year alone, Eastern Europe has controlled 72% of new project announcements in Europe. This dominant market share is attributed to a surge in new project announcements in Russia, Azerbaijan, Kazakhstan, Turkmenistan and Uzbekistan.

|

|

Fig. 1. European new project announcements, |

Russia has led the way, with over $55 B in refinery modernization projects, as well as over $60 B in the buildup of its domestic LNG export capacity. Russia’s overall goal is to produce at least 40 MMtpy of LNG by 2020. This volume would raise Russia’s global LNG market share from 5% to 11% in only six years.

At the time of publication, Russia is exceeding its LNG export goals. The country has six major LNG projects representing more than 50 MMtpy of export capacity. However, this capacity figure would drop by at least 10 MMtpy if Gazprom decides to scrap its Vladivostok LNG project. The project is already delayed by one to two years, and Gazprom announced in October that it might abandon the project in lieu of building more natural gas pipeline capacity to China.

While Russia is building up its LNG export capacity to supply gas-hungry Asian markets, European countries are seeking ways to diversify their natural gas supplies away from Russia. At present, Russia supplies nearly 30% of European gas, of which nearly half is imported via pipelines crossing Ukraine.

Fears still loom that the crisis between Russia and Ukraine has the potential to shut off natural gas supplies to Western Europe. This scenario has prompted a handful of European countries to diversify their energy portfolios away from Russian supplies. Projects including Poland’s $1.2-B LNG terminal in Swinoujscie and Finland’s approval for the construction of up to three LNG terminals are part of this diversification effort.

At a time when Western Europe is diversifying its natural gas supplies, French energy company Électricité de France (EDF) is planning one of the region’s largest industrial projects. The Dunkirk LNG project (Fig. 2) is EDF’s first LNG terminal project and the second-largest industrial construction site in France.

|

|

Fig. 2. Aerial view of the Dunkirk LNG site. Photo |

As natural gas production in the North Sea decreases, the Dunkirk LNG facility will provide France with the ability to diversify its natural gas supplies away from Russia and strengthen its energy security for years to come.

Dunkirk LNG. Once completed, the Dunkirk LNG terminal will be the largest terminal in continental Europe. The $2-B terminal project is being developed by Dunkerque LNG, a subsidiary of EDF. Additional stakeholders include Fluxys Group (25%) and Total (10%). After commissioning, the project will be operated by Gazopole, which is owned by EDF and Fluxys.

EDF is one of the world’s largest utilities providers. The company is making strides in replacing oil-fired and coal-powered plants with the latest-generation gas-fired plants. The company aims to construct the terminal to improve competition in the gas supply market, increase flexibility to supply gas-fired power stations during peak winter months, and strengthen gas supplies in France and Europe.

This project is of huge importance to the European region, especially with the threat of Russian supplies being stopped due to Russia’s conflict with Ukraine. European countries’ ability to diversify their natural gas imports away from Russia with alternative gas supplies, such as LNG, allows better security in the case of natural gas supply disruptions in the future.

The terminal is being constructed in Le Clipon, near Dunkirk, France. The site was selected in 2005 due to its ability to handle the largest tanker vessels and its proximity to French and European gas networks.

In 2006, the Dunkirk Independent Port (PAD) launched a request for proposals to build an LNG terminal in the western port. In October of that year, EDF was selected by PAD to conduct a feasibility study for the project. EDF spent the next three years conducting a thorough and detailed feasibility study on the site.

In 2010, EDF and Total signed an agreement whereby Total acquired a 10% interest in the company. The agreement allowed Total to secure additional LNG regasification capacity as part of its strategy to supply markets in France and Europe. The project partners reached a decision in 2011 on the construction of the site’s infrastructure. The construction of the site is based around three main structures:

- The platform and the marine structures

- The LNG terminal

- Structures providing connections to the French and Belgian natural gas networks.

The terminal will have an annual regasification capacity of 13 Bcm and connect to the French and Belgian gas markets. With its large capacity, the terminal represents around 20% of France and Belgium’s annual natural gas consumption.

The site will also contain three LNG storage tanks with a capacity of 190 Mcm. Each storage tank will measure 50 m high and 90 m in diameter. The terminal will contain a pier capable of accommodating Q-Max tankers with a capacity of 266 Mcm. Additional facilities include:

- LNG unloading system

- Regasification unit that will extract LNG from the tanks and vaporize it by heat exchange in open-rack vaporizers that use seawater

- Seawater inlet to heat the LNG

- Natural gas connection to supply French and Belgian gas networks.

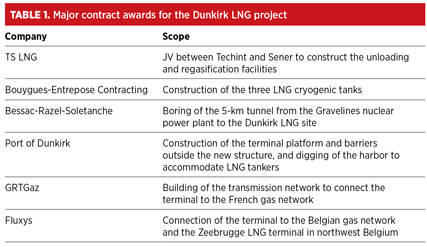

Major contract awards are listed in Table 1.

Joséphine la Peule. The project will also include the construction of a 5-km tunnel from the Gravelines nuclear power plant to the LNG terminal. This tunnel will supply discharged hot water from the Gravelines plant to the terminal for regasification of the LNG.

The drilling of the tunnel is being performed by a 160-ton machine known as “Joséphine la Peule” (Fig. 3). In keeping with miner tradition, a structure used to bore a tunnel must be given a woman’s name to pay homage to Saint Barbara, the patron saint of miners. The project developers named the machine Joséphine la Peule, after the giantess of Coudekerque-Branche, the largest suburb of the city of Dunkirk.

|

|

Fig. 3. Joséphine la Peule, the 160-ton drilling machine |

Joséphine la Peule symbolizes the industrial past of Coudekerque-Branche, especially its textile industry. Women were once referred to as les peules, after the flasks filled with a refreshing herbal tea made from black currant leaves. These concoctions would be used to quench one’s thirst while working in intense heat. By naming the drilling machine after the giantess of Coudekerque-Branche, the project developers are upholding another tradition—that of the “Giants of the North.” The French géants, or giants, are part of French carnival and party tradition, and originally represented figures from Biblical stories.

The Joséphine la Peule machine began drilling in the second half of 2013. Mechanical problems halted drilling in July 2014, delaying completion of the tunnel to August 2015. Once completed, 5% to 6% of discharged hot water from the Gravelines nuclear power plant will flow through a 3-m-diameter pipe, located under Dunkirk’s western outer harbor, to the Dunkirk LNG terminal. Water flow rates will depend primarily on gravity.

Operations. The Dunkirk LNG project developers expect to begin operations in late 2015. The terminal work will require nearly 1,200 workers between 2012 and 2015. The completion of the LNG terminal will not only provide natural gas for two markets; it will also provide energy security for years to come. The LNG terminal will also allow EDF to supply its customers with dual energy offerings (electricity and gas) and optimize supplies to its gas-fired power stations.

Once operational, the facility will be the largest regasification facility in continental Europe and has the potential to produce LNG bunkering fuel for marine vessels traveling across the North Sea. GP

Comments