Editorial comment

A. Blume,Managing Editor

Adrienne.Blume@GulfPub.com

The US and Canada are the world’s largest shale gas producers, and growing. By 2016, shale gas is projected to make up more than half of all gas output in the two countries; by 2035, the percentage may rise to two-thirds.

But what about shale development outside of North America? Exploration efforts are rising throughout the world, although financial, geological and political roadblocks continue to challenge development.

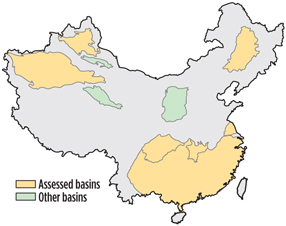

Money, geology complicate China shale. Thought to hold the largest shale gas reserves in the world of more than 30 Tcm (Fig. 1), China has spent four years of exploration and drilling for shale reserves in the hope of replicating the shale boom seen in the US. So far, one large field—Fuling, in southwestern Sichuan province—has been discovered.

|

|

Fig. 1. China shale gas and oil reserves assessment. |

Many Chinese shale plays are characterized by low organic content, which means that producers must drill more wells to equal production volumes seen in the US. Also, high exploitation costs could make development difficult. Due to these and other complications, China’s National Energy Administration has halved the country’s shale gas production goal for 2020 to 30 Bcm, from an earlier target of 60 Bcm–80 Bcm.

It may be easier for China to focus on tight gas production, in which it has drilling experience, to meet government targets for gas output. Analysts expect China’s tight gas production to reach 80 Bcm by 2020—double from estimates issued in 2013.

Europe opens up to drillers. Large-scale production of unconventional gas has not yet begun in Europe, even though the EU is the second-biggest regional gas market in the world. The UK government recently opened new areas to drilling bids for shale gas and oil, making nearly half of the country’s area available for drilling operations, following the lifting of a fracing moratorium in late 2012.

The UK is competing with Poland to lead the development of shale resources in Europe. Poland, which experienced disappointment during its initial explorations for shale gas, has drilled 63 test wells as of May, and it plans to begin commercial production from one well in 2014.

More data, analysis and forecasts of unconventional gas production in China, the UK and around the world—along with discussions of the gas processing facilities needed to monetize these resources—are available in Hydrocarbon Processing’s HPI Market Data 2015 report, published in October. GP

Comments