Boxscore Construction Analysis

A. Blume,Managing Editor

Adrienne.Blume@GulfPub.com

Australia is the fourth-largest LNG exporter in the world after Qatar, Malaysia and Indonesia. At present, it has a total LNG production capacity of approximately 24 MMtpy at three projects, placing it far behind Qatar’s 77 MMtpy of capacity. However, Australia is on track to catch up with Qatar by 2018, and then to surpass Qatar in 2020, to become the world’s largest exporter, by investing over $160 B in LNG terminal construction and an additional $85 B for FLNG facilities.

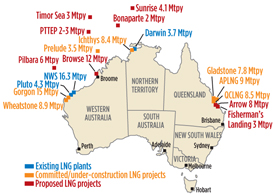

However, very high project costs and shifts in global gas trading patterns could force the delay or transformation of several of these ventures. In some cases, expansion trains may be shelved, FLNG may be considered in place of onshore LNG facilities, and proposals for new liquefaction facilities may be merged with existing developments to save costs. Fig. 1 shows Australia’s existing, under-construction and proposed LNG and FLNG projects.

|

|

Fig. 1. Existing, under-construction and planned |

Challenges to LNG success. Another development that could alter the future of some Australian LNG projects is the 30-year, $400-B agreement signed in May by Russia and China. Under the deal, Russia will send 38 Bcmd of gas via a new pipeline from Russia’s Far East region to China, starting in 2018. Japan could also benefit from these pipeline supplies.

The deal will force LNG producers around the world—including those in Australia, which are uniquely positioned to deliver large volumes of LNG to Asia-Pacific gas importers—to find more competitive LNG markets in South Korea and Japan. Ultimately, the agreement will lead to the deeper integration of global gas markets.

Additionally, surging shale gas output in North America has aligned with cost complications at Australian LNG ventures to make the Pacific projects less secure. Rising labor costs, an inflated Australian dollar and dropping gas prices elsewhere in the world have put $100 B in potential projects under threat.

Despite cost inflation for LNG projects, Royal Dutch Shell has approved the construction of the first FLNG facility off the northwest coast of Australia. The $13-B Prelude facility will export 3.5 metric MMtpy of LNG to Asian markets starting in 2016. A number of other FLNG projects are under development or planned, as shown in Fig. 1.

Labor unrest threatens setbacks. Along with rising project costs, labor disputes between LNG workers and companies are impeding progress on projects. During the summer, a dispute with labor unions in Queensland put the schedules of three LNG projects, worth more than $60 B, at risk.

A new labor agreement was signed in mid-August after Australia’s federal court granted an injunction against the Construction, Forestry, Mining and Energy Union and 72 workers. The deal temporarily eased concerns of delays to first production for the three projects. BG Group still plans to start its Queensland Curtis LNG export venture in late 2014, while Santos and ConocoPhillips expect to begin production at their LNG developments in 2015.

However, analysts warned that the new labor deal, which included a 13% wage increase but no change to the set fly-in, fly-out (FIFO) work schedule, was not likely to put an end to the unrest. Productivity could be impacted by future protests over the FIFO schedule, which requires personnel to work four weeks before flying out for one week. Workers had demanded a three-week-on, one-week-off FIFO schedule as part of the labor agreement.

The average tradesperson working and living locally in Australia made an estimated A$200,000 ($187,000) in 2013, including wages of A$160,000, daily payments and retirement fund contributions, based on figures provided by contractor Bechtel. The average laborer earned A$135,000, and made approximately A$175,000 in total compensation.

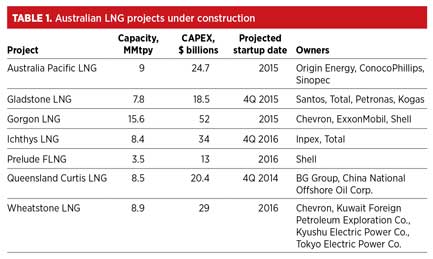

Status of ongoing projects. Seven major LNG projects (Table 1) are under construction as of August, according to the Australian Petroleum Production and Exploration Association (APPEA). Four projects will source gas from offshore Western Australia (Prelude FLNG, Gorgon LNG, Ichthys LNG and Wheatstone LNG), and three are located in Queensland (Gladstone LNG, Queensland Curtis LNG and Australia Pacific LNG).

The Queensland projects will use coalbed methane (“coal seam gas”) as feedstock. Australia is a significant producer of coal seam gas, making it the only sizable producer of unconventional gas outside of North America. These reserves could provide gas for the growing number of Australian LNG projects as the development of shale gas plays moves forward.

The remainder of the projects in Fig. 1 have the potential to evolve as costs, labor issues and global trading patterns change and grow. As the race to supply Asia-Pacific with gas continues, Australian LNG exporters will remain in competition with foreign LNG exporters—and each other—to secure buyers for their product. GP

Comments